EDURAN NAVIGATOR

Quarterly Market Review with an Outlook.

Zurich, 7th April 2020

“Bear attack”. Markets have suffered a heavy blow. Powerful stimulus is on the way and supposed to avoid a deep recession or worse. Bottom line there will be even higher levels of debt, low interest rates and weak growth.

Market Review

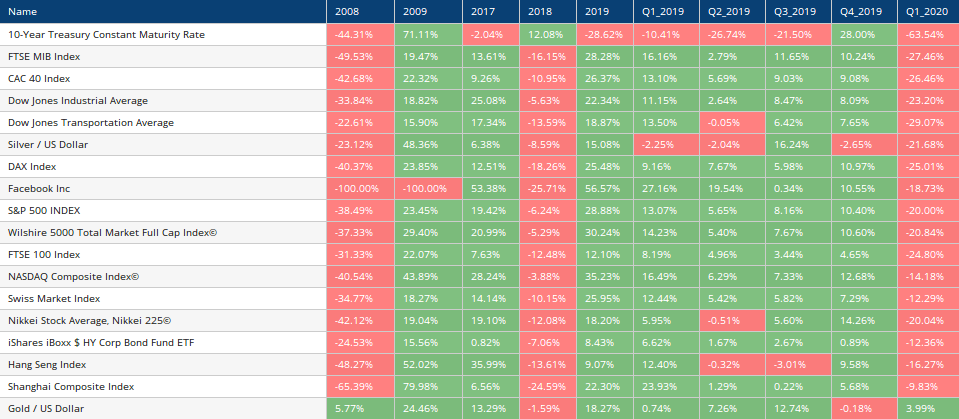

One topic that dominated the first quarter: Covid-19 or the corona-virus. However, the year got off to a good start and the markets were on their way to being not exactely inexpensive from a value perspective. As we noted in the Q4 2019 Navigator, the growth in earnings had slowed and on the flip side valuation have gone up. In other words, returns were coming at an increasingly greater cost. The virus had been in the news for some time, but most – including ourselves – didn’t really start to pay attention to it until mid-February. That said, the bear attack still came as a surprise when it effectivel took place and hit many hard. As the virus spread and the infection curve steepened, the markets reacted with panic. The shutdown of the economy ordered by the authorities has increased the misery to a new level. Not only the coronavirus, but also the relatively expensive markets as well the market structure post the great financial crisis (gfc) in 2008/09 contributed to the heavy correction. While there have been high volumes, liquidity has become increasingly stretched out in recent years as a result of the slightly changed market structure: An increasing amount of money is managed via structures such as ETFs, also there are fewer large proprietary trading books at banks that can act in an anti-cyclical manner, i.e. buying assets when end clients give in a/o lose their nerve.

Equity markets collapsed all at once, interest rates reached new record lows and the mark-ups for corporate bonds, especially those with weaker balance sheets, rose to levels last seen in the 2008/2009 gfc. After those who were quick or the ones who had weaker hands reduced their positions, we saw also forced selling of leveraged investments around 13 and 16 March.

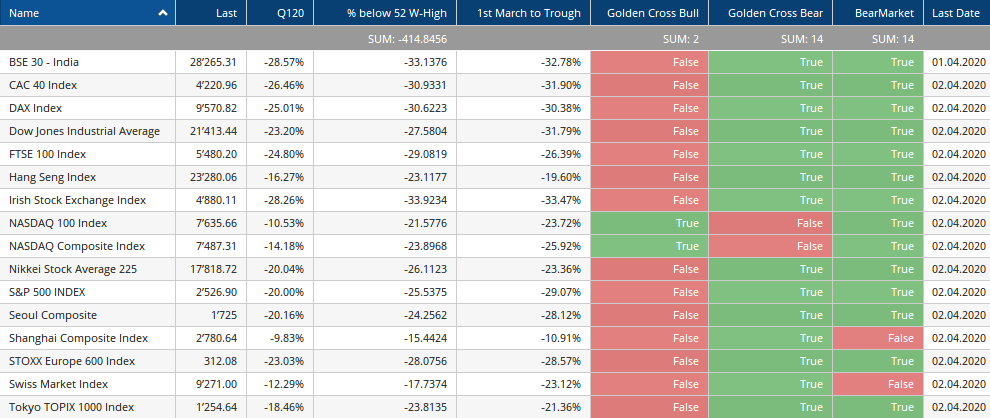

The losses measured from the start of the month of March to the troughs mark the provisional height of the panic sales (in mid-March). Most markets are now in bear territory.

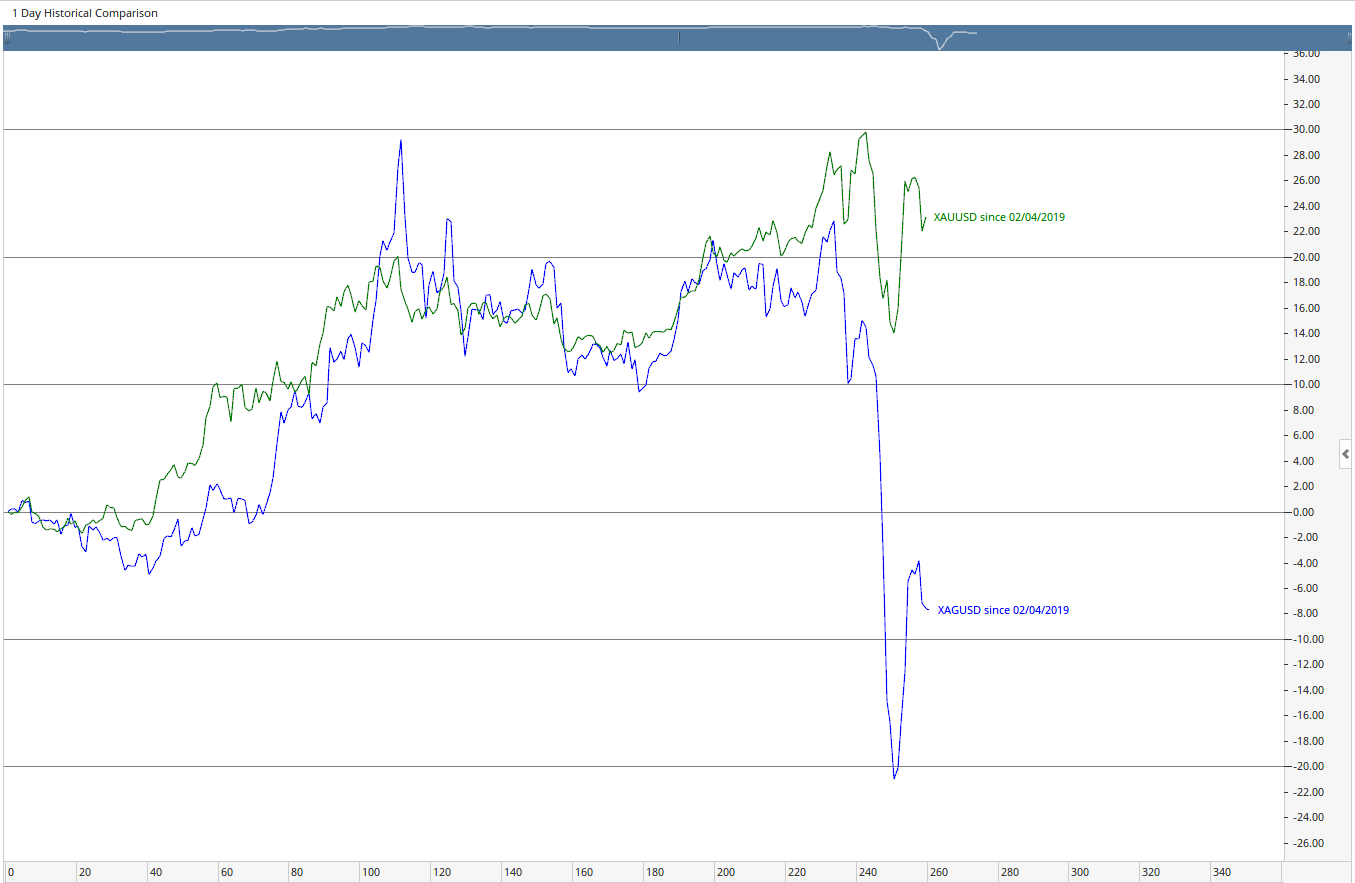

Even gold, which had reached a record high, has retreated, as has silver. In the case of gold it is likely that leveraged investments liquidated (and maybe some central banks or other pools made cash?). Silver is likely to also have been impacted by the decline in industrial activity.

As if the coronavirus crisis weren’t enough, there was also a dispute between Saudi Arabia and Russia regarding oil output and oil prices. This resulted in a supply shock due to ramped up capacity and output, which pushed down prices. The restrictions on outdoor activities and the shut-down of the economy in an attempt to fight the virus dampened demand big time in addition (up to 1/3 of demand globally we hear!). Strategic oil reserves stepped into this breach and topped up their supplies. Typically there has been a negative correlation between the price of oil and this stockpiling. It apparently works in the long-term (see graph below) as well as in the short-term. Furthermore, the USA will likely put pressure on the Saudis to stabilise prices (as has happened in the past, when President Ronald Reagan worked with the Saudis to lower oil prices and put pressure on the Soviet Union – this time, of course, the USA wants to see higher prices). The US oil industry in the fracking segment is deemed to lose money at less than USD 40 per barrel, making a substantial number of bankruptcies unavoidable. The Saudis themselves can extract oil cheaply, but they need an estimated price of USD 60 per barrel in order to keep their state order going (more in the range of USD 80 for running deficit neutral). The only one benefiting may be Russia, which – decoupled as it is from the US dollar post heavy sanctions – is relatively self-sufficient and, with its large reserves of gold, is looking to profit from the wobbly Western economy over the mid or longer term. On the whole, it is likely that the current dislocations will also result in some geopolitical turbulence as well (including Iran which suffers from both, oil prices and US-sanctions).

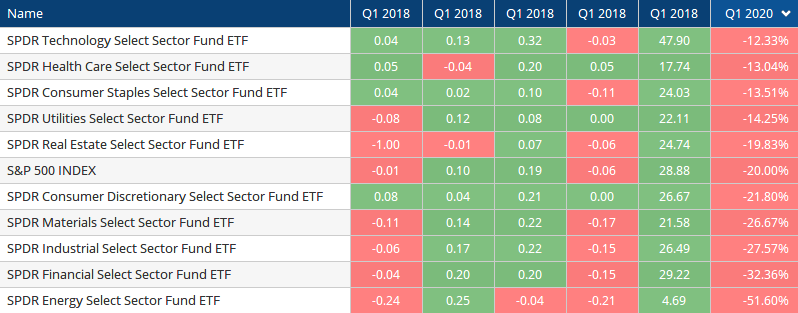

Looking at sectors, there are no surprises to be reported. The energy sector has suffered the most and incurred most dramatic losses. Within the S&P 500 Index, 4 out of 11 sectors have posted higher earnings than compared to one year ago. Utilities have grown 2.5% over the turn of a year whereas the energy sector has by 1/3 lower earnings on average to report. On a single stock level at the lows – and for some still at current levels – valuations have been truly cheap. Most markets show a 10x handle of price/revenues at sell-off-bottoms, a level which many have come close this time too. Or one could take out the whole EBIT for this year and it still looks cheap. The big question of course is: how deep will the recession be – will the stimulus help to restart engines just in time again?

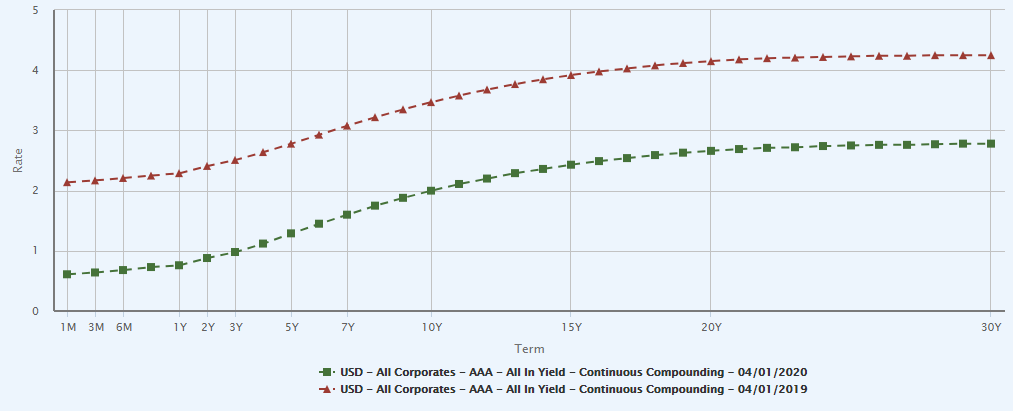

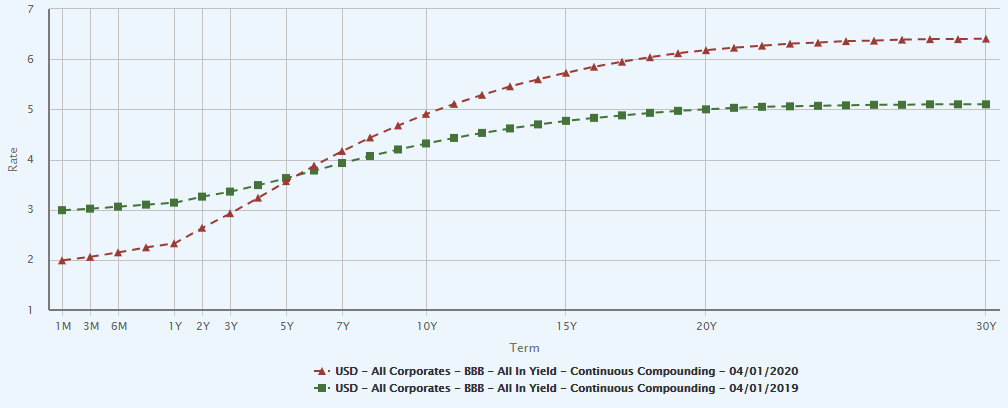

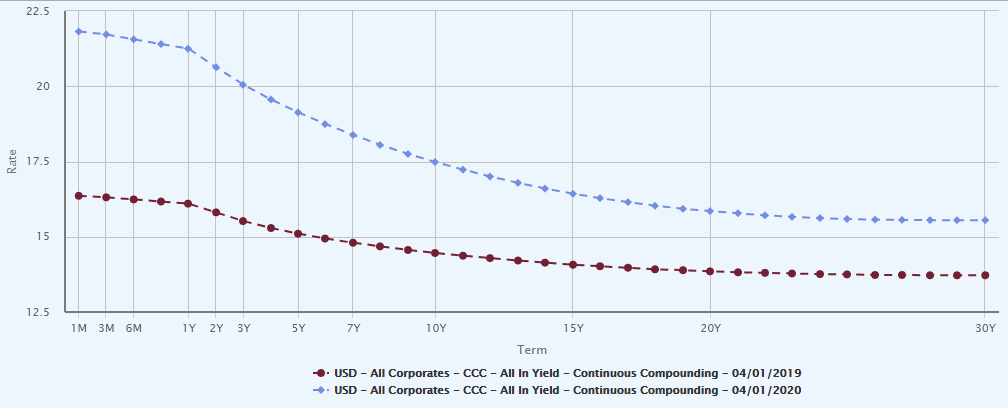

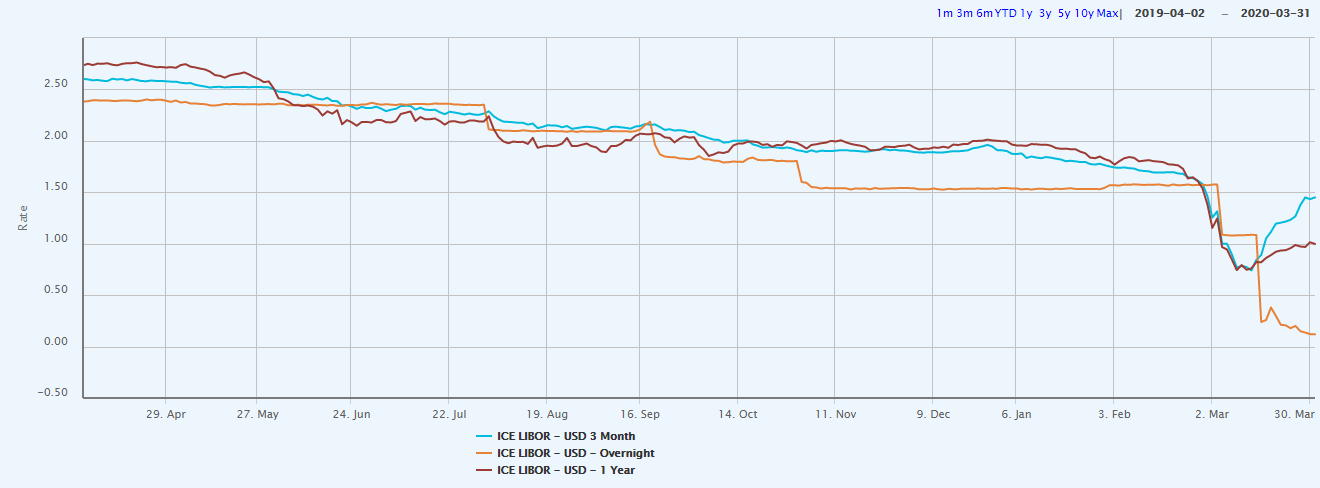

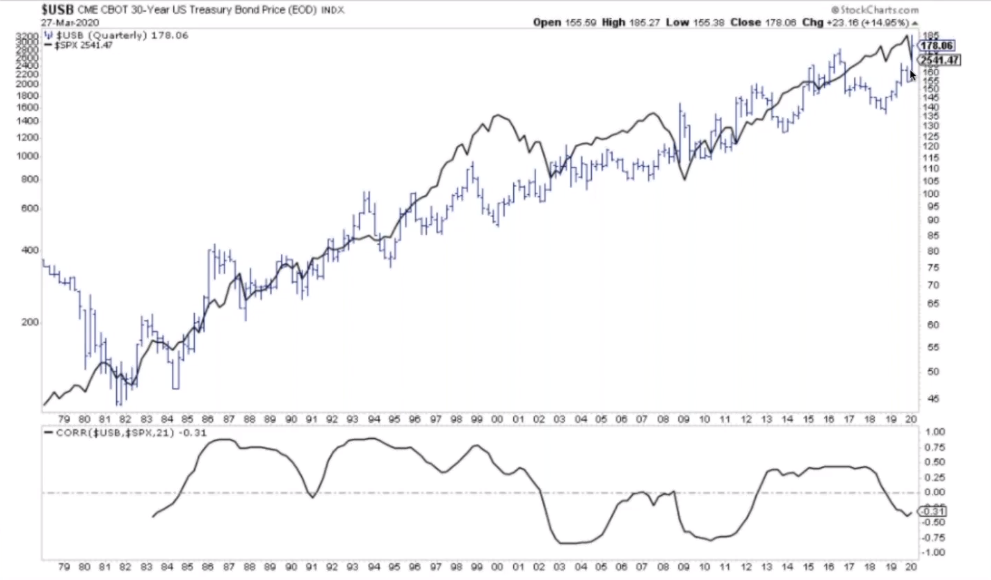

Yields

The coronavirus also resulted in a flight to safe havens. Yields on government bonds have fallen to record lows – due to its sheer size and thus its global importance, US government bonds are the main market to watch. Operating in crisis mode, the Fed flooded the markets again, with a massive monetary stimulus of around USD 4 trillion (about one-fifth of US gross domestic product it this means anything in terms of comparison). The US dollar has seen increasing demand in the US itself, causing some scarcity in the euro-dollar sector and forcing emerging markets to act (because of debt denominated in US dollars). The spectre of a deep recession has caused credit spreads to expand. Corporate bonds with a low rating have posted losses. In the investment grade segment (BBB and higher), there will likely be rating downgrades, which, for technical reasons, makes sharp price reactions (downward) likely. The number of bankruptcies will increase.

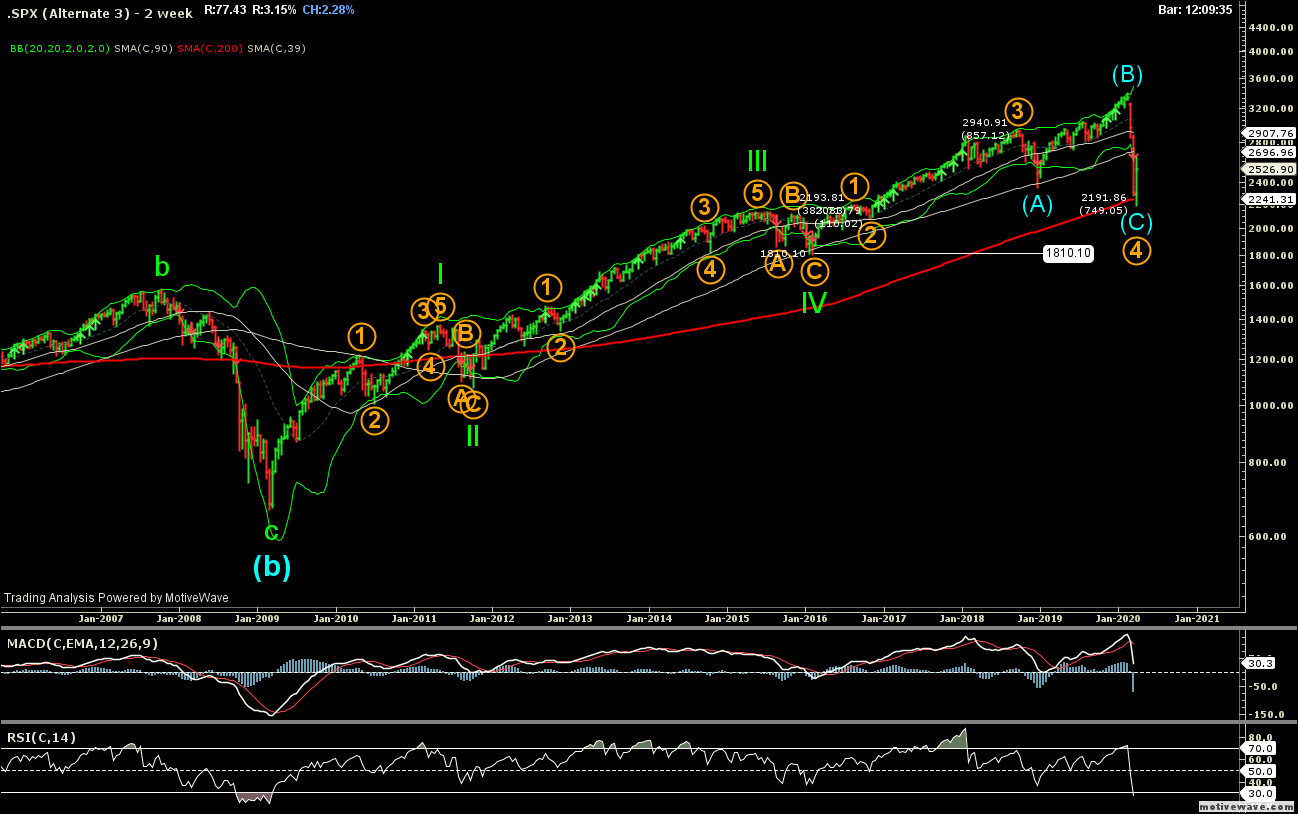

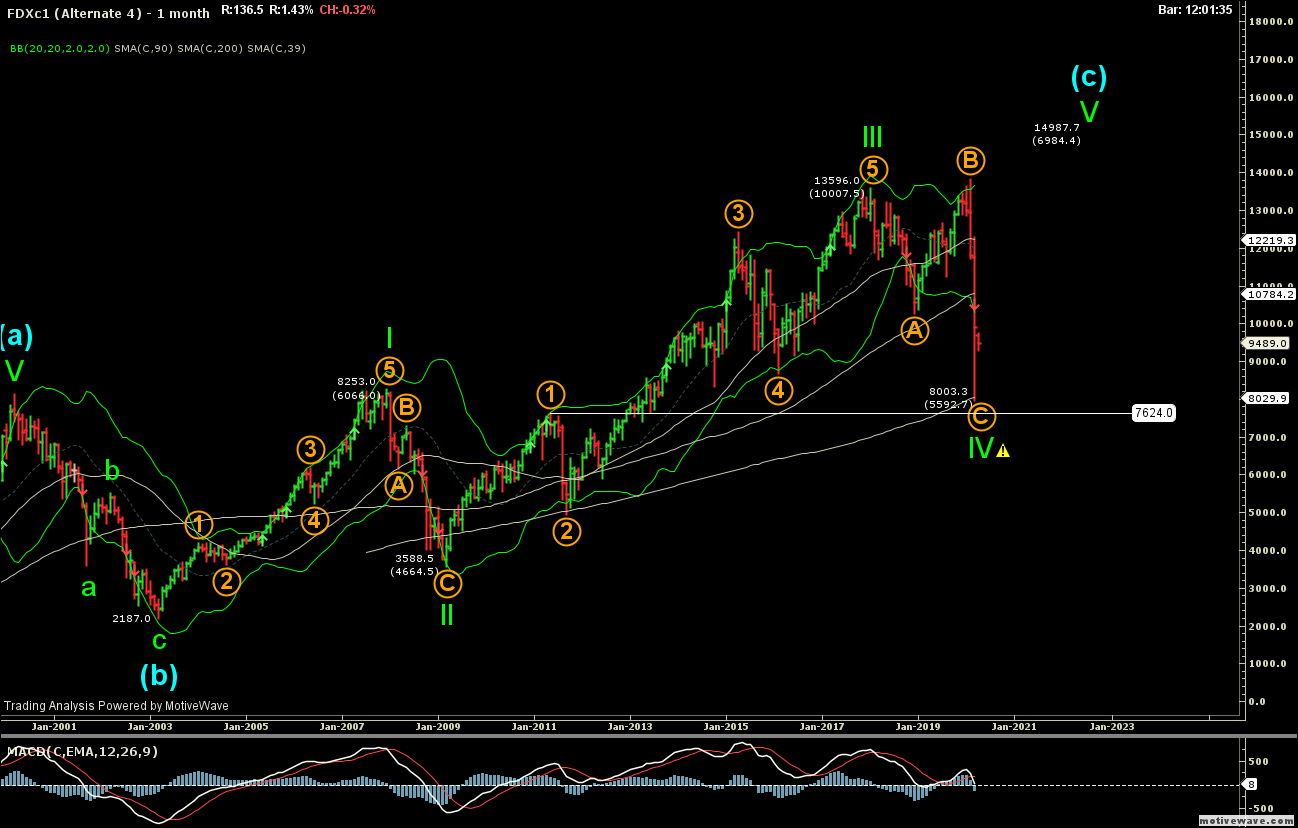

Market Technicals

Things are somewhat rocky from a technical perspective. This is especially true in the shorter term; in the longer term, the upward trend appears to be intact. The sell-off at the beginning of March leading to the lows in the second and third weeks of March represents a continuation of the correction that started in the final quarter of 2018. There were increasing signs over the course of 2019 of a resumption of the upward trend, although some indicators suggested that caution was still required.

A recovery began at the end of this first quarter, more or less the same week when options and futures expired. We believe the markets could easily once again test the bottom (worst case go below which would end the bull trend). What happens next depends greatly on the course of the pandemic and thus the economic measures implemented by governments. If the lockdown lasts for an extended period of time in one sort or the other, hence slowing down the economy, markets will be facing headwinds. If the economy is reopened and picks up at least somewhat, we may already have seen the lows.

There is talk of a W- or a V-shaped recovery or even an L-shaped collapse like the one in 1929 (with the recession turning into a depression). The charts currently still show an upward trend that remains intact over the longer term. Again, if things don’t improve one way or the other of course pressure on prices will continue a continued bear market could take place.

Economists compare the situation today with the crash of 1929 or – less headline-grabbing – with the correction in 1987. The current correction appears to be most similar to the one in 1987 in terms of duration and scope of losses. The recovery immediately following the correction was 40% in 1987 (measured in terms of the change from the previous high to the low). In 1929, the initial collapse with a recovery of around 40% took about a month and a half. But there was another upward trend in 1987, while there was worse yet to come in 1929.

In addition to interest rates, which remain low, fiscal stimulus is increasingly being used as well, which is causing a flood of additional money into the markets. Because of the correlation between interest rates and the valuation of shares, this may provide additional support for the markets. Interest rates are near or at zero, and the question is how long this situation can continue. If the government provides additional MMT/fiscal policy, this additional money may stimulate the markets once more.

Outlook

Everyone is talking about the coronavirus, but the actual damage to the economy and society will only be felt indirectly and over the longer term. The health aspect, with the tragic consequences of the deaths and serious illnesses caused by Covid-19, will hopefully soon take a turn for the better. The market has reacted and taken account of one possible outcome, the one that seems most likely at present, with the drop in prices that has occurred. Investors with a longer-term view may take advantage of such weak phases to make selective purchases. If the shutdown lasts for an extended period of time, however, the correction will continue. The current drawdown may have priced in a closure of the economy lasting one to two months, including aid measures, i.e. stimulus. We are already seeing an environment with lower interest rates again, and the alternatives for investments with a positive return will be even fewer and farther between than before the current crisis. As a result, money will increasingly be pushed into risk assets such as equities. Unlike before the crisis, however, the quality of the investment will play an even greater role in the future.

The measures that have been taken will make the state even more powerful and curtail freedoms. As during the 2008/2009 financial crisis when the state rescued banks and then implemented new and costly regulations, politicians may want to have a say this time around as well. There are also massive costs in the form of debt or advance payments, which will have to be paid by taxpayers or premium payers. There is a lack of money in other places, including for investments. In addition, there is a prevailing sense in society of a “full cover mentality” when the state supports companies (apart from certain bridge loans). Competitors with fuller coffers could have prevailed and secured margins. If we do not turn away from this policy, growth may become more modest, as was the case over the past ten years. This, in turn, does not promote long-term stability, and the fragmentation of society, which will result in political dislocations, may also intensify as a result.

Diversification and quality stocks are also available in the current environment. After all, if savings continue to earn little or no interest and social benefits are potentially being reduced over time, then there will be even more demand for good investments.

“The stock market is a device to transfer money from the impatient to the patient.” Warren Buffett

Yours sincerely,

EDURAN AG

Thomas Dubach

Leave a Reply