EDURAN NAVIGATOR

Quarterly Market Review with an Outlook.

Zurich, 7th January 2020

“Once upon a time”. The final quarter finished what the first quarter started – a stock market’s fairy tale. Investors appear to have forgotten fears of a potential recession and other dangers to end the multiple year bull-market.

Market Review

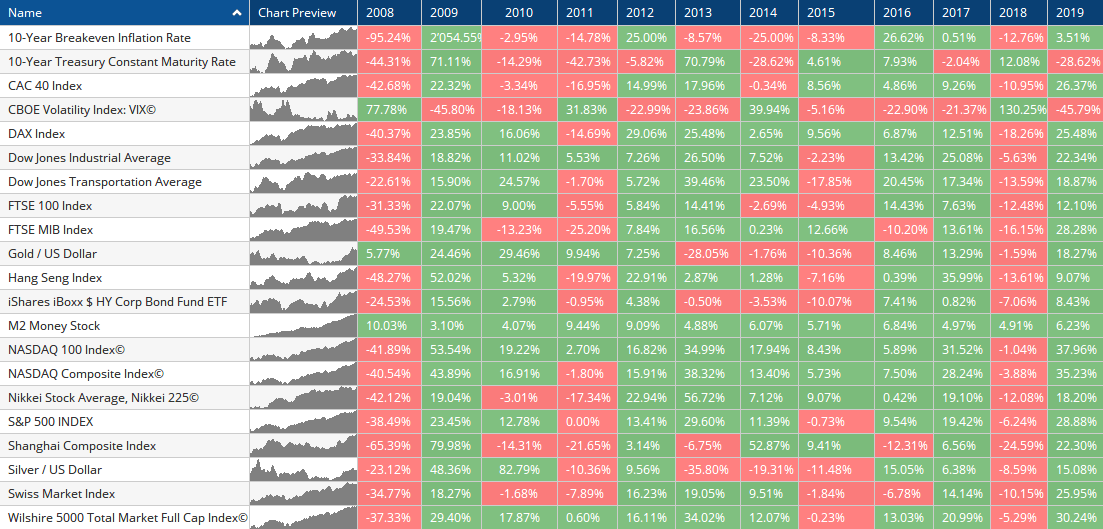

The year ended the way it begun and bottom line it resulted in a record year performance for 2019. Investors had a harsh reality check at the end of 2018, as liquidity drained and market forecasters issued dire warnings that the economy was teetering. There was no magic hand to wave, except in the form of central bankers, who slackened monetary policy. The US Fed broke from its course of normalising interest rates and resumed its policy of lower rates, a policy that other key central bankers are still maintaining. This alone led to a spectacular first quarter. After a dull summer in terms of performance with fears of a coming soon recession, the fourth quarter brought another releive. For some stock markets, such as the Swiss Market Index, 2019 was the most successful year of the decade. In addition to lower interest rates, gold had a good year as well, rallying in the closing week.

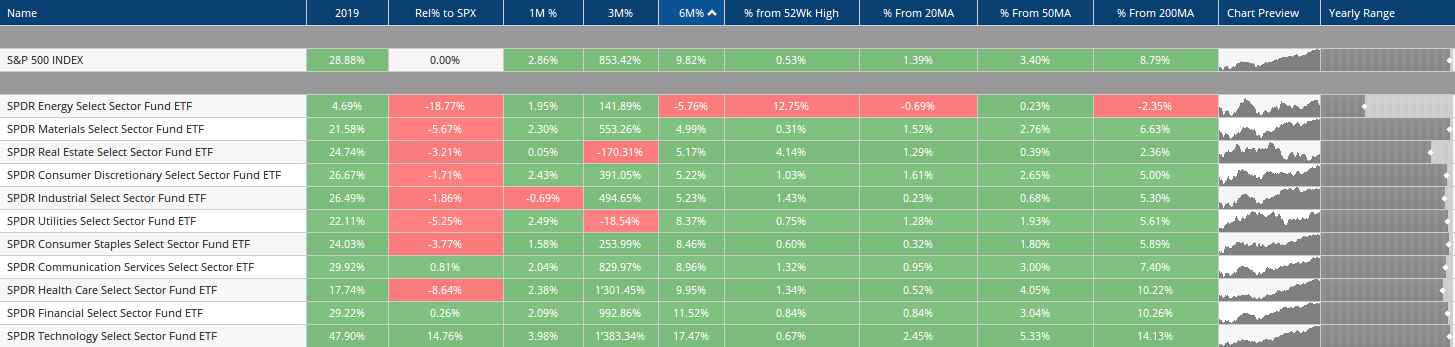

Markets over the course of Q4 2019

Investors are also aware that the world is changing. The world’s realignment process continued in 2019. The USA, the world’s super power, has faced challenges from a growing Asia, led by China, which continues to see its strength rise. The world and its globalized economy is facing headwinds and value chains may be reorganised in the future, with a regional alignment resulting in a tripolar world (comprised of the Americas, Asia, Europe and/or Russia). From a geopolitical perspective, also regional powers, such as Russia, Turkey and Iran, are more self-confident and are gaining in influence.

Stock markets are, of course, not isolated from the trends described above, but investors have paid little attention as yet to the impending risks. For the time being the decisive factor for the development of prices continues to be predominantly interest rates – and only after but increasingly of importance the shape of the economy. After initial fears of a recession surfacedcompanies seemed able to maintain their profits and even in some cases achieve growth. A number of economic indicators – mainly industrial– continued to point to a gloomy outlook. China, previously a growth engine, has weakend a bit, while the USA, following President Trump’s tax reform, appears to be on an upward trend and additional amounts of capital are supposed to flow back into the U.S. in the near term.

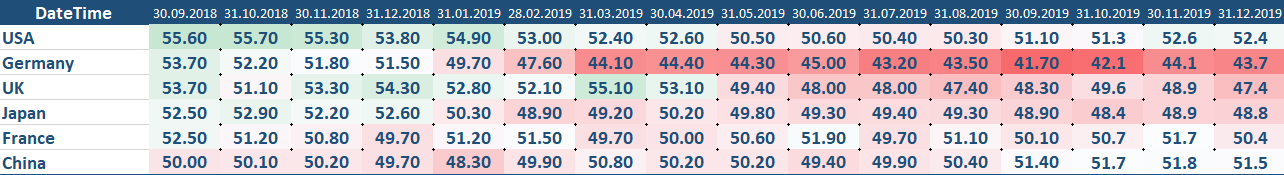

The purchasing managers index (PMI) has deteriorated in recent months and is now in or near recession territory or only moderately expansive for certain regions. For large stretches of the second and third quarters this indicator was even worse. The first signs of a recovery appeared at the end of summer, just in time before the start of the fourth quarter: The trade dispute between the USA and China may ease soon – even if there is no agreement of any real substance. In addition, consumption, which is so important for Western economies, still appears to be immune and is not showing any weaknesses. And this despite an ailing industrial sector, where a shorter working week has been introduced at some companies and some there have been staff cuts (e.g. in the German automotive industry).

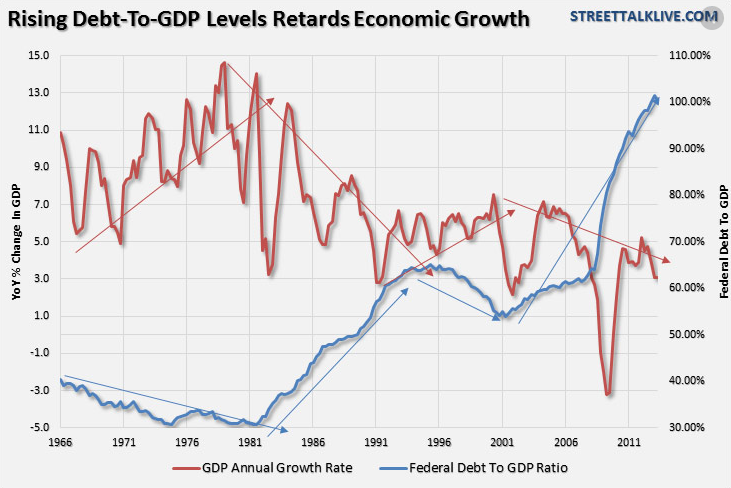

Seeing central banks as wizards who aim at controlling the economy at their will but in fact more of this have boosted stock markets and other assets depending on the financial industry. So far inflation does not look set to be an issue for the foreseeable future. This is supposed to change one day, as history tells us. However, the point in time is too early to tell (and at least for us to forecast). On top of financial stimulus, governments are looking into additional expenditures, fiscal stimulus, as the OECD is writing about for years now. This during times where debt, especially in the public sector, has increased and reached new highs, growing faster than GDP.

US federal debt growht vs GDP growth

Market Insight

Capital flowed back into stock markets. The lows reached following the correction in the fourth quarter of 2018 meant investors were able to realise dream returns last year. The valuation difference between the end of Q3 2018 and Q3 2019 or from summer to summer is less than half the calendar year performance, and, at around 10%, is still good, but closer to the long-term average for good years on the stock markets.

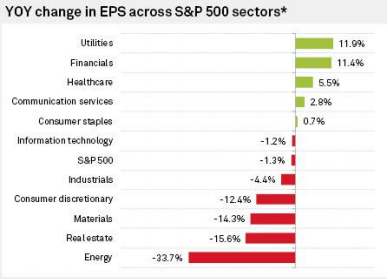

In particular, the year-end rally was led by technology stocks. The main driver was a shift from a cautious, more defensive stance to a “risk-on” view. Some companies reported earnings in December and of the few that did, most provided a positive surprise (within the S&P 500, all four exceeded expectations, with results on average 1.8% better than the estimates).

Lately, however, years of margin expansions through cost savings and stock buybacks to create higher profits per share have been replaced with an expansion of valuations. According to the latest S&P 500 figures (which are estimates) over the course of the year, earnings per share grew by around 0.8%, less than the official inflation rate. As a result, the dividend yield fell from 2.1% to 1.75%.

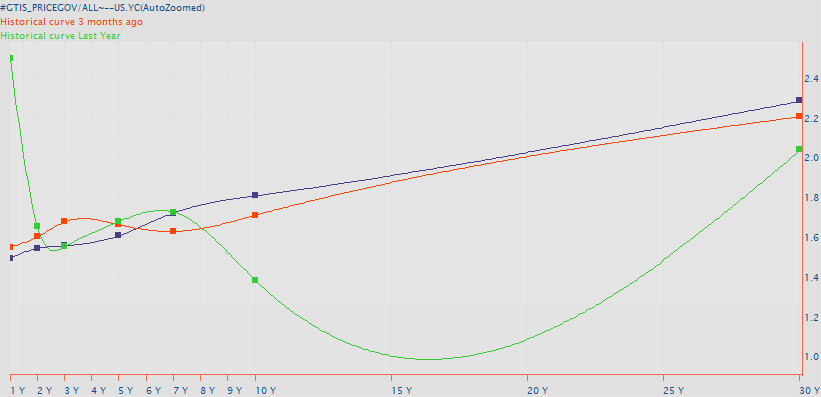

Uncertainty regarding the trade dispute has made companies somewhat reluctant to make investments. There is also a crisis in the automotive industry, which is being felt more keenly in Germany and is now affecting the order books of many Swiss suppliers as well. Following the pricing malaise in recent years, there is now some renewed hope for banks: The yield curve is getting somewhat steeper and there is hope that they will adapt to the changing environment so they can achieve growth again.

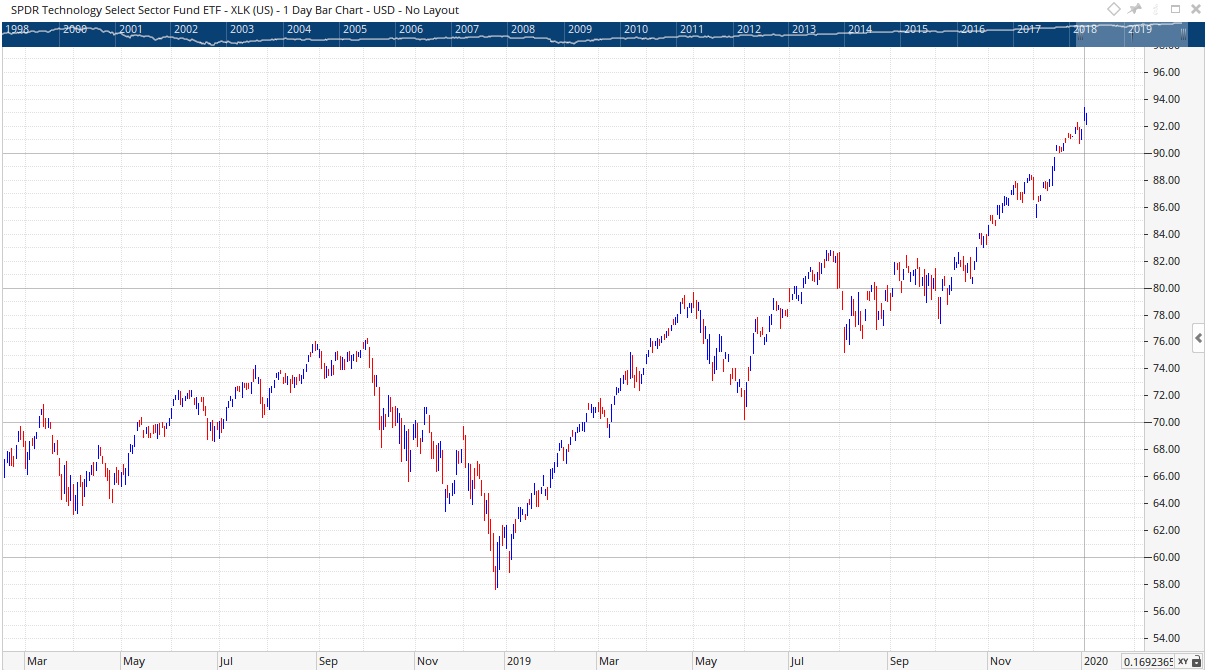

Broken down by sector, the tech-heavy Nasdaq saw its strongest increase for the year as a whole since 2017, rising by +36% (the SPDR Technology rose even more, at around 48%).

Sector-Indices (SPDR-ETF)

Apple was a driving force, rising by around 86% for the year (with an increase of about 31% in the fourth quarter)! And it did so with a market capitalisation at year-end of USD 1.3 trillion! (The total valuation of the US stock market is around USD 30 trillion.)

In general, growth stocks are a step ahead. In addition to the technology sector mentioned above, which saw substantial growth again, just like in the first quarter of 2019, the healthcare sector also rose significantly. Following a period of consolidation during the summer months, the industrial sector gained ground as well.

Technology-Sector

Industry-Sector

The energy sector is lagging behind and is being almost ignored by investors. We have a close eye on this sector and see potential in some stocks here. Along with the multi-year cyclical nature of this business, the green wave of climate change has meant that there is little new investment (or simply less investment) in certain areas, including fossil fuels. As a result, a supply shock could one of these days lead to higher prices. This plus favourable valuations appears to make it a good investment.

Energy-Sector

Yields

As in previous years, interest rates continue to be a key factor for stock markets. Looking at the overall situation, there is not much to report: Since the financial crisis in 2008/2009, central banks have kept interest rates low. Initially they did so to bail out the economy, and then they did so because companies were unable to extricate themselves from emergency or first-aid mode. We provided regular updates on this topic in our Navigator reports over the past several quarters and attempted to show the resulting practical constraints. After it seemed in 2017/2018 that the era of loose monetary policy was finally about to come to an end, we are now back in familiar territory and there is a looming threat of an increase in the new decade: in addition to low interest rates, state debt could rise to boost economic growth (fiscal stimulus). However, a new trend is becoming apparent: longer-term yields (e.g. on 10-year US Treasuries) have risen since last summer, as if the market no longer believed in the strategy of low interest rates and sees more risks in them than good – and the limit has been revised downward. A paradigm shift in perspective appears to be in the offing. This could lead to a general rise in risk premiums.

US-yield curve (actual, 3 mths ago, one year ago)

The inflation outlook could play a certain role here, with inflation-indexed bonds (here, 10-year US government bonds) appearing to have to stabilised since August.

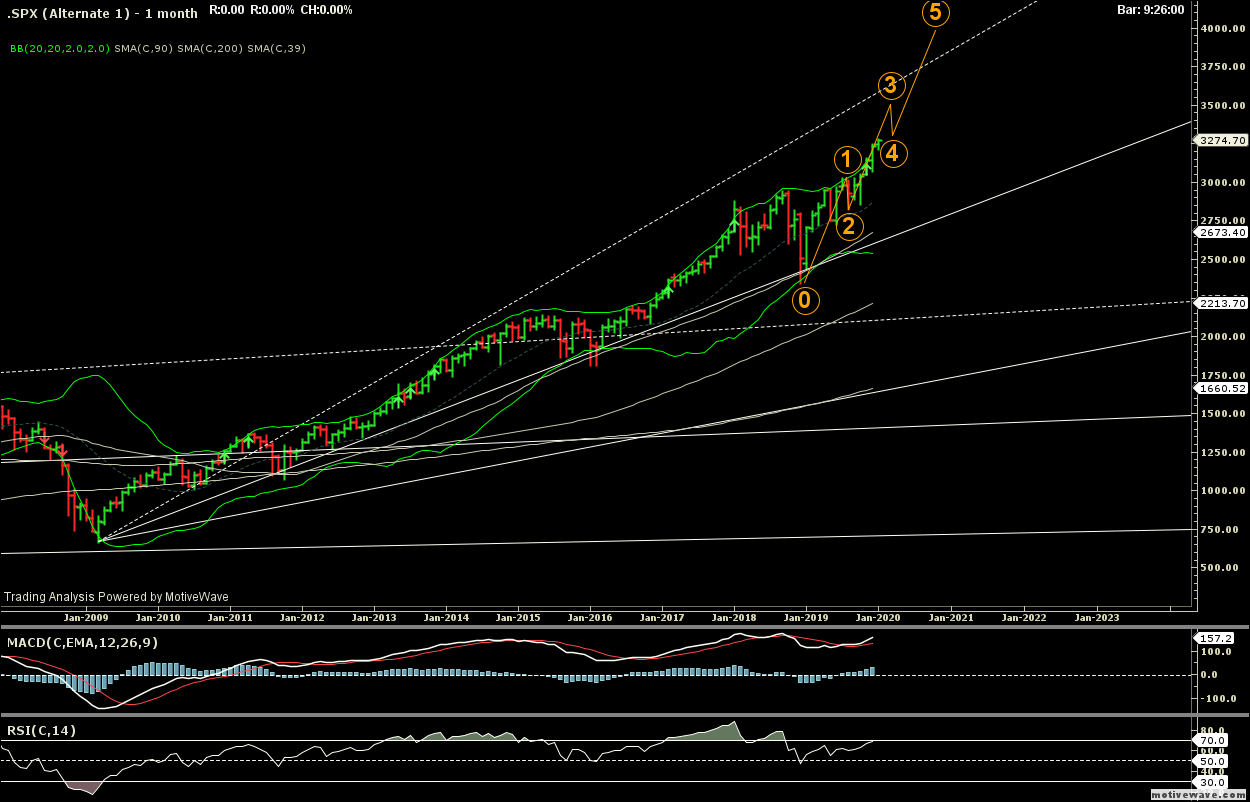

Technical Market Analysis / Charts

From a technical perspective, the markets remain in their long-term upward trend – although there are some indications that the bull run may be in its final stages. The breadth of the bull market declined steadily over the months since last summer, but this metric has improved since October. The vast majority of stocks are no longer at correction levels and are now increasingly rising in step with the large, index-driving stocks.

S&P 500 monthly chart

Although a look at the number of countries that have reached new 52-week highs (in terms of market capitalisation) shows that only about 20% of the 70 countries observed have reached new record levels, this figure is rising sharply, which points to the significance of this criterion. Viewed from this perspective, the bull market may have caught on, and another upward movement is possible.

DAX monthly chart

However, other long-term indicators – viewed from a historical perspective – point to a bull market in its advanced stages. The ratio of total market capitalisation as measured in terms of the Wilshire 5000 Index (market capitalisation) to the gross domestic product of the USA shows that stock markets have reached record high valuations (30 trillion vs. about 22 trillion).

Market Capitalization vs GDP USA

It is doubtful that valuations will continue to rise over the long term. A price-earnings ratio plus inflation of 20 will only be exceeded in the short term (Rule of 20). Lately, earnings growth has been outpaced by an expansion of valuations. Without additional earnings growth valuations will likely experience a correction.

Outlook

The new year also marked the start of a new decade. The defining characteristic of stock markets during the teens was interventionism by central banks. This is likely to not go away very quickly. More than that in the new decade governments are likely to intervene additionally via fiscal stimulus as well. The OECD has long preached the virtues of debt that was intended to spur growth. And countries such as Switzerland with a decreased share of debt via the GDP are likely to come under pressure from this angle. In her address to the EU Parliament, new ECB president Christine Lagarde noted that she views green bonds favourably so central banks could even be supportive to colors of politics. Investors do not seem greatly concerned that the price finding mechanism continues to be mislead. Mainstream views are increasingly changing towards the belief in the omnipotence of central banks which is becoming more popular. Economic growth including control over inflation can therefore be controlled almost at will, according to this view (Modern Money Theory, MMT).

Looking at the calendar, stock markets could be more volatile as early as first quarter of 2020. Brexit is planned for the end of January. The USA is also in an election year, and populism will likely be buoyant (on both the left and the right). Valuations are fairly high and thus so are the heights from which they can fall. It is an environment in which corrections are entirely possible as well as rich valuations will sustain. With interest rates stay low or in negative territory funds are likely to continue to flow into stock markets and other risk securities. As a result valuations remain relatively high but given the lack of growth risk premia is likely to increase over time.

We hope you have a good start to the new year!

Yours sincerely,

EDURAN AG

Thomas Dubach

Leave a Reply