EDURAN NAVIGATOR

Quarterly Market Review with an Outlook.

Zurich, 3th July 2020

“Black & White”. Equity markets have recovered from their lows with vigour, while the interest rates curve as well as most economists suggest only sparse growth for the foreseeable future.

Market Review

After the “Corona fright” in the first quarter, a marked recovery began in the major deterioration (derivatives markets) at the end of March. The recovery in the second quarter appears just as irrational to market actors as the emotional markets that presented themselves during the correction. State interventionism on an unprecedented scale, together with rebounding central bank balance sheets, gave the markets initial support. It is a support, however, which could become a burden on growth over time. Our free market system (capitalism) is increasingly caught in the claws of the state – and will consequently be less free. Sooner or later we will learn to live with the Coronavirus. The tendency, however, toward expanding administration and paying accordingly for this with compulsory levies, reduces capital–by definition scarce and not infinitely available–which is needed for the next boost in innovation and resulting growth.

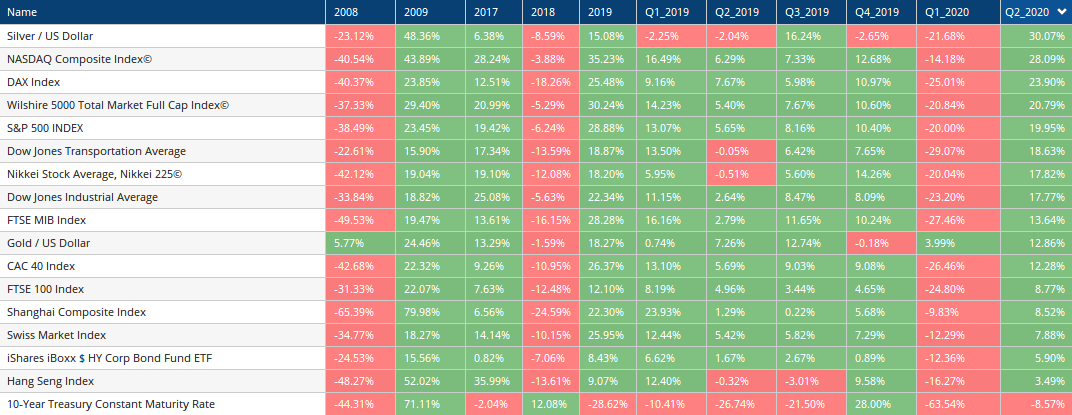

The stock markets all experienced a strong recovery in the second quarter, interest rates have come under pressure as a result of central bank measures and the demand shock (bond prices have risen accordingly).

Risk assets such as stock experienced a strong recovery in the second quarter.

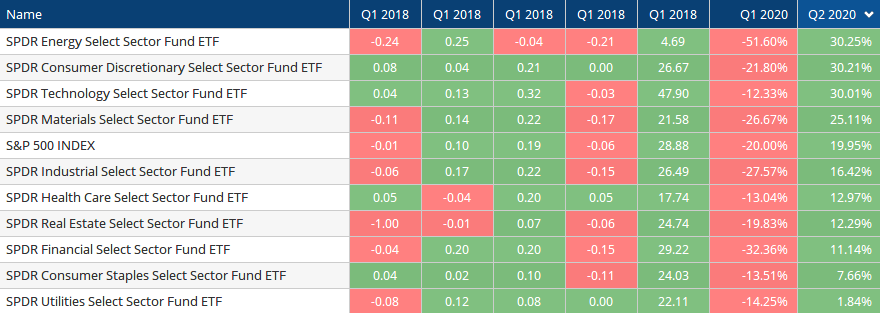

In terms of individual sectors, technology stocks in particular benefited. There is no stopping – everything seems to be going digital! Looking back in history, such a phenomenon is nothing new. Again and again, when there is an innovation boost – as is currently happening – there is a race on relatively scarce capacities: everyone has to or would like to be there sooner or later in order to remain competitive. After the boom comes the bust, the crash. Nevertheless, technology titles are in focus and have reached new highs – Corona crisis or not.

The energy sector has recovered from an unprecedented plight. With the expiry of futures in April, the oil price (WTI) fell below zero, more exactly to USD -37.63 (April 20, 2020). The price is currently back at USD 39.95. This unprecedented price movement was due to a peculiarity of the American oil market: tanker unloading and pipelines come together at the Permian Basin and, due to the corona situation, there was a lack of oil and only a limited amount of extracted oil could be rerouted into warehouses or tankers due to this single, and therefore scarce, port of call. What remained were the investors or general holders of futures contracts, who could not receive any physical oil and could therefore only sell the contracts.

Generally speaking, most sectors are still below pre-“Corona correction” levels. However, investors who kept their nerve during this emotional period and at least did not sell could at least pocket their dividends and, thanks to the recovery, catch up relatively close to old highs.

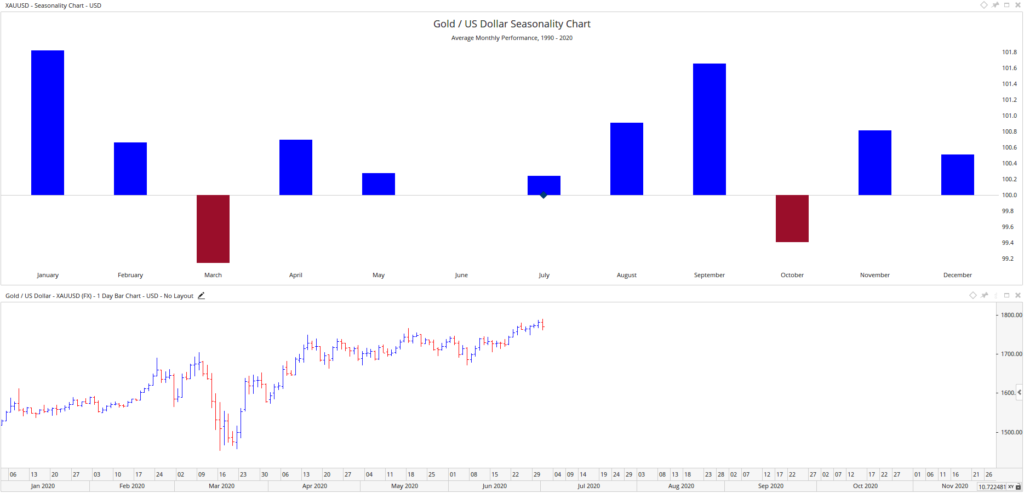

Precious metals and above all gold experienced increased demand in the first quarter. In the second quarter, the demand for this precious metal increased due to uncertain times – the shock is deep, and the chirps of the gold bugs can be heard far and wide. Not that there is no point in holding gold. Gold has its justification in every portfolio – by which we mean, those who already have it should only buy when there is weakness and should currently favour gold mining shares.

In summary, the second quarter was an adjustment of the emotionally driven correction from the first quarter. The markets are – as we will see in more detail in the section on market technology – on the way to a new balance.

Interest Rates & Capital Markets

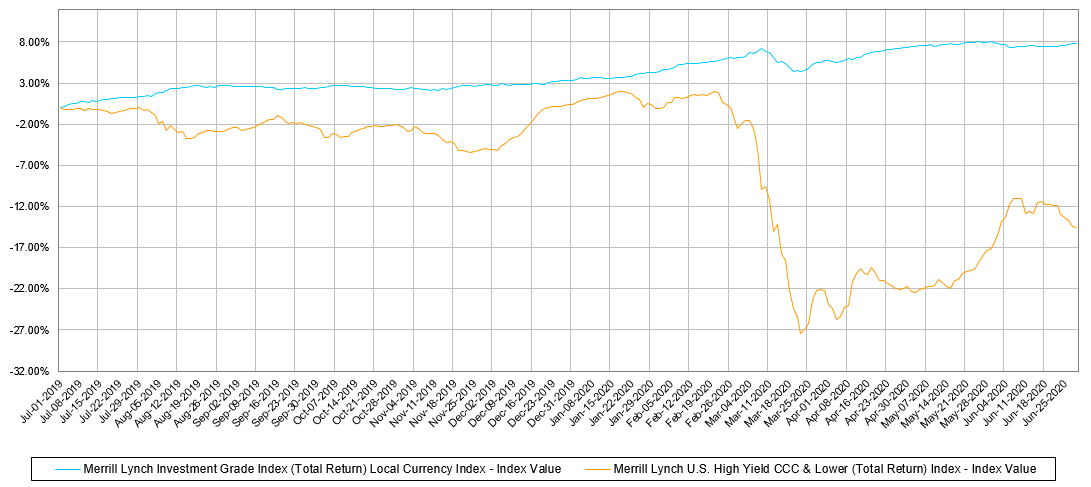

Interest came under pressure once again. As with every crisis in the recent past, central banks are helping by providing sufficient liquidity, i.e. lower key interest rates and other measures to promote their targets in order to prevent even greater distortions. Recently, funds from Treasuries have been added, where governments have given direct loans or made direct payments (and some have given guarantees). As usual, the crisis led to a flight to safe investments, such as US government bonds. Inferior quality bonds suffered similarly to the stock markets – and recovered similarly.

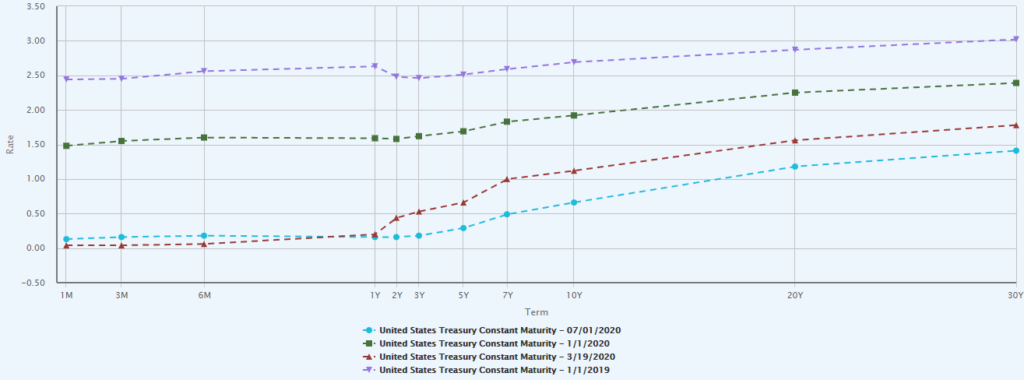

The yield curve has become somewhat steeper at – as described above – a generally lower level. With the easing in the second quarter, the curve flattened somewhat compared to the stock market low of March 19.

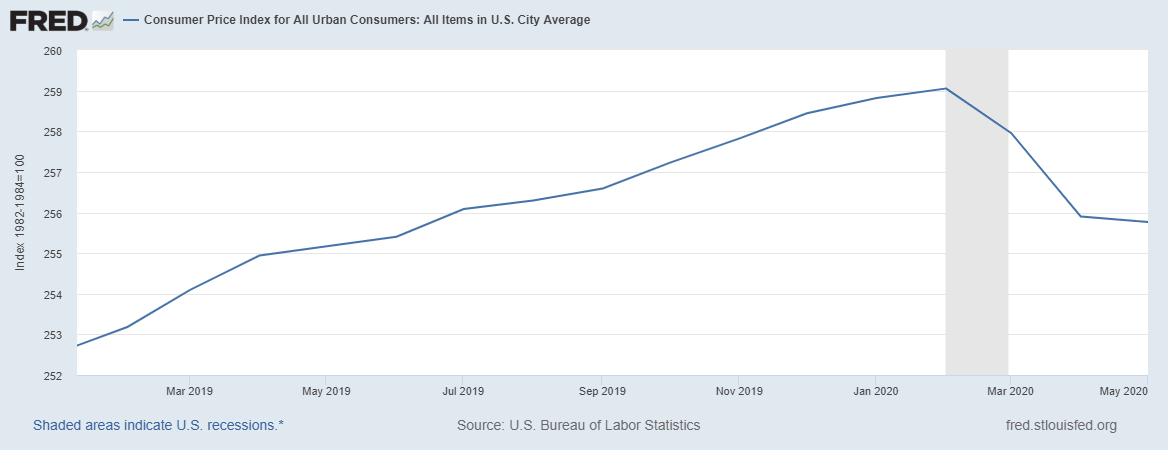

Deflationary tendencies can be seen, although the market economists and augurs are arguing here. Inflation or deflation will probably remain the decisive topic for the foreseeable future.

As a result, the USD has become more expensive against many currencies (excluding CHF), especially against emerging countries. As the world’s currency with the largest and most liquid capital market, the USD has also benefited from the return of capital through President Trump’s tax cuts. This development has a number of negative economic consequences, especially for emerging countries (often with debts demarcated in USD).

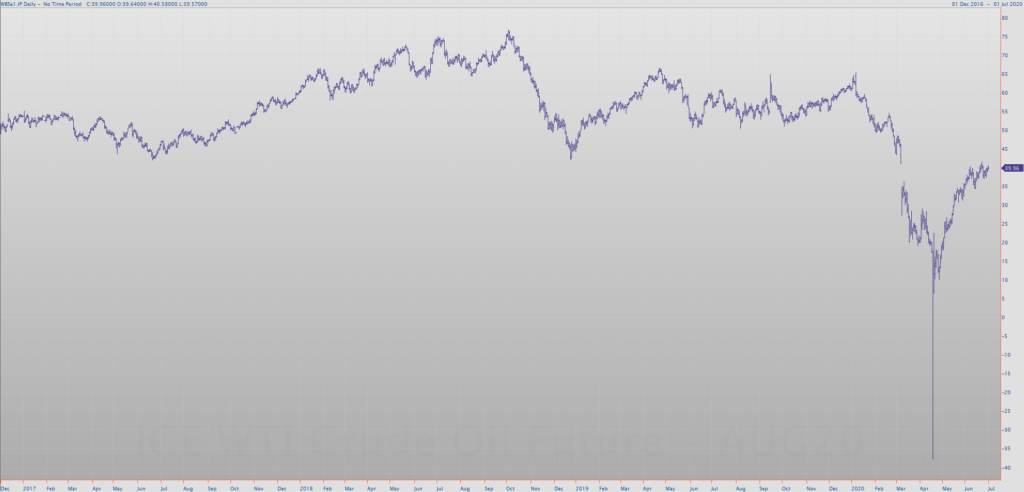

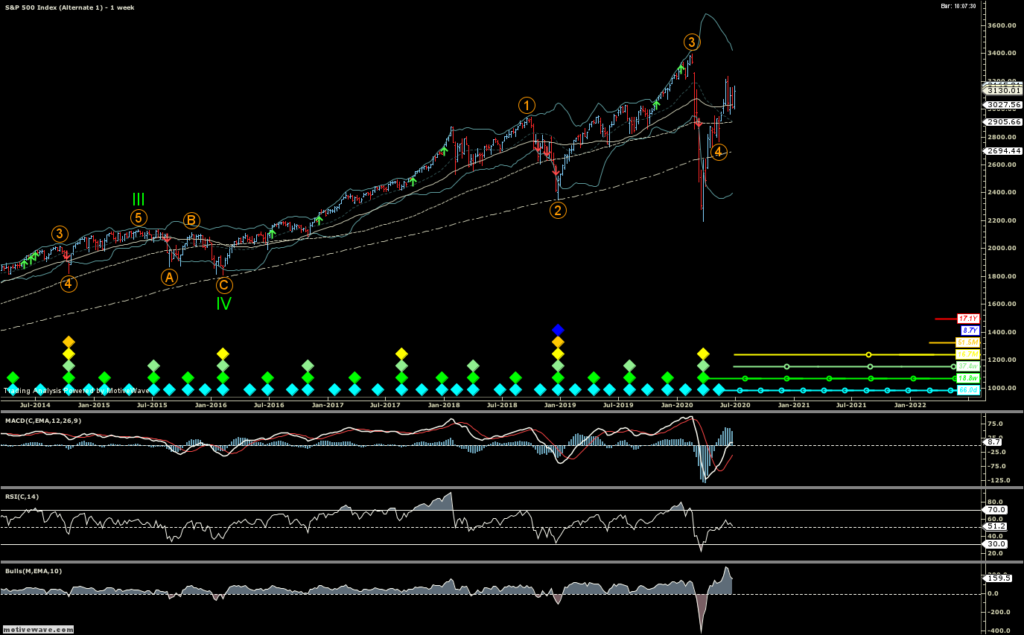

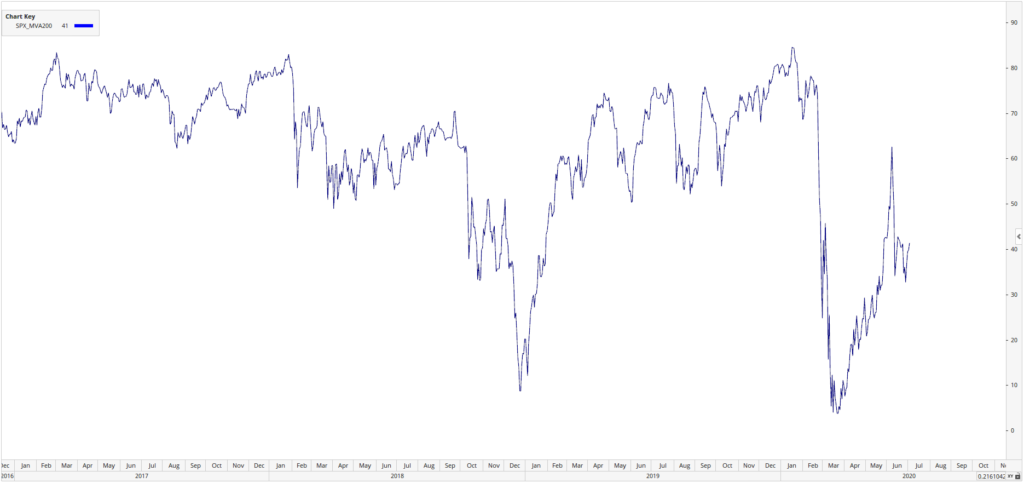

Market Technicals

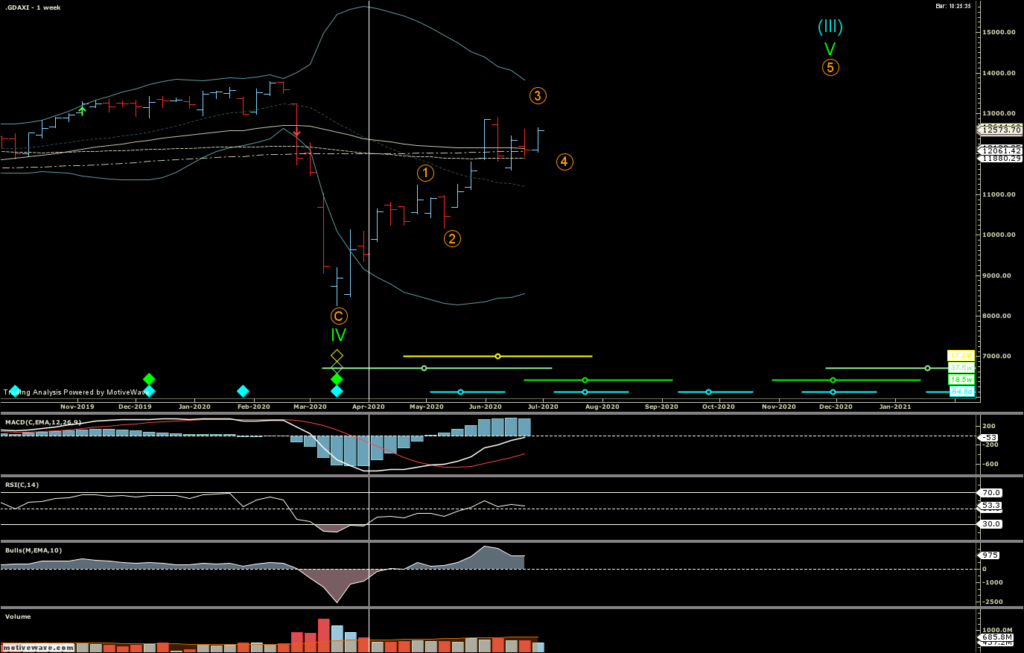

In the second quarter, stock markets continued their recovery phase and, in the meantime, made up about 4/5 of their losses (MSCI World Index). The prices of technology stocks and thus of the Nasdaq are already higher than before the Corona crisis. With new cases flaring up again in June and weak consumer numbers, the markets generally came under some pressure again, but the temporary upward trend is still intact.

This upward trend appears to be more advanced in the USA than, for example, in Europe, in which the expansion should still be in the strongest phase from a technical point of view, i.e. has a relative catch-up potential.

There is talk of a W- or a V-shaped recovery or even an L-shaped collapse like the one in 1929 (with the recession turning into a depression). The charts currently still show an upward trend that remains intact over the longer term. Again, if things don’t improve one way or the other of course pressure on prices will continue a continued bear market could take place.

In recent years, the rally has been carried mainly by a couple (if not a few) stocks. This recovery since the Corona crash still leaves small cap stocks behind. The big ones are a given, one could say – and growth stocks such as the technology stocks above all.

Outlook

Black or white, positive or negative, these are roughly the current opinions regarding markets’ further development. So-called bulls and bears are known to shape pricing on the stock exchanges, but with economists’ gloomy outlook and the still powerful rally that we have recently seen on the stock exchanges, this constellation currently appears to be particularly pronounced. The current constellation can thus make sense. Markets have done their job of finding the right price fairly well: the virus has brought the economy to a halt, with significant losses in earnings as a direct result. Interest comes under pressure due to the excess capacity and partly due to the demand shock. Deflationary tendencies are emerging. The stock markets were nevertheless able to make up for the immediate price setbacks, anticipating that in the future, due to an investment emergency, more would have to be paid for a unit of future earnings.

“There is nothing as devastating as rational investment behaviour in an irrational world.” – Maynard Keynes

Yours sincerely,

EDURAN AG

Thomas Dubach

Leave a Reply