EDURAN NAVIGATOR

Quarterly Market Review with an Outlook.

Zurich, 4th January 2021

“Stumbling blocks”. It was a difficult year, and judging by the signs of the times, things are not set to get any easier, at least not in the medium term. This does not mean that the stock market cannot remain a success story. Imbalances are emerging within society, debt burdens are mounting, and policymakers and central banks alike are doing everything in their power to keep the wheels of the economy in motion. Low interest rates are forcing an increasing volume of capital into high-risk investments. The markets are developing a momentum of their own which could one day encounter a stumbling block that will turn it in the opposite direction.

Market Review

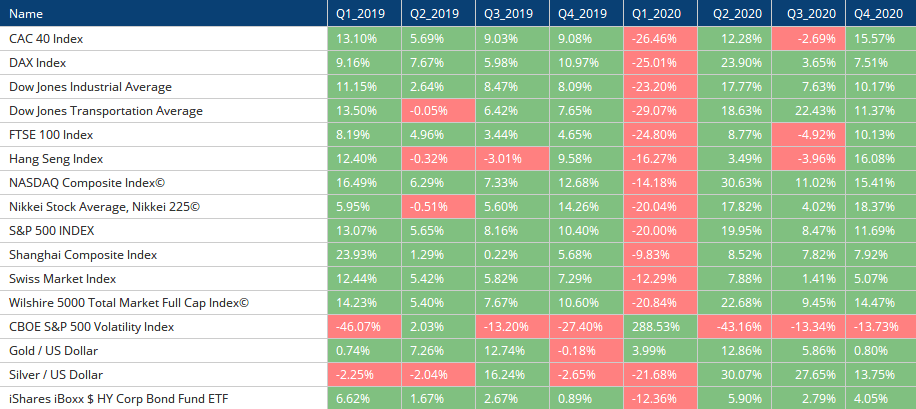

The fourth quarter saw a continuation of the recovery that emerged in March after the lows triggered by the COVID-19 crisis. Following a period of consolidation in the late summer, a mood of optimism emerged on the markets again – one that was not so very different to that seen in the first quarter before the March correction.

2020 was anything but an easy year, and the stock markets did not escape this development unscathed either. When the economy comes to a standstill, the usual order of things goes out of the window. In order to prevent insolvencies on a massive scale, the state makes funds available to prop the corporate sector up. This approach makes sense when the aim is to tide the economy over in an emergency situation, especially one created at the instigation of the state. If the aid is used to keep economic booms alive and kicking artificially, or if it extends over a prolonged period (nationalization of the private sector), this is likely to have a negative impact on future growth.

All of these factors took the wind out of the stock market sails only briefly; the race for returns very quickly resumed, fueled by the additional capital available and by debt.

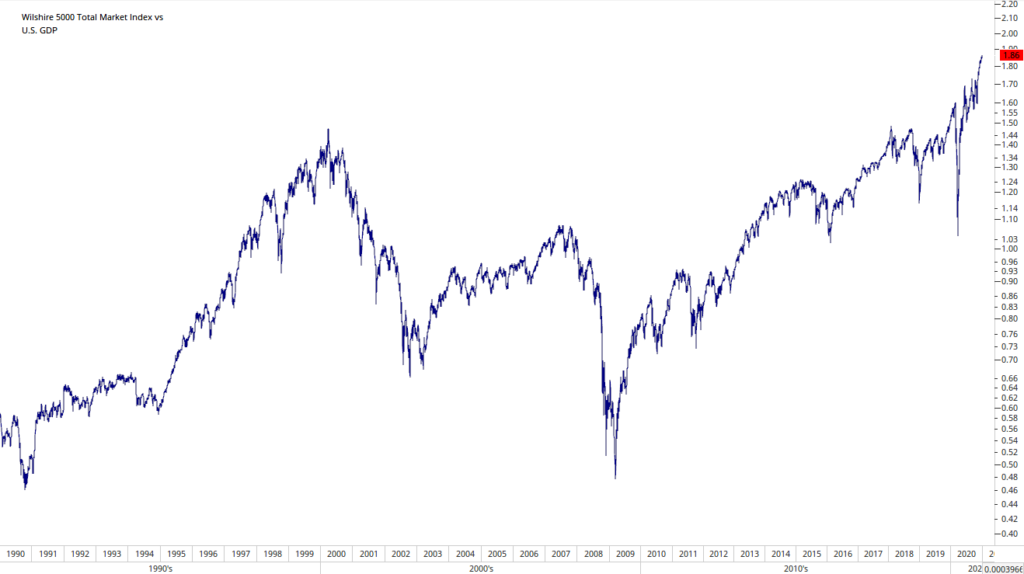

Yet again, stoic calm paid off – buy & hold, the mantra of “whatever you do, don’t lose your nerve”, was the recipe for success. Rebalancing positions at the right time can be worthwhile, but the ability to identify the right time is key. The markets are currently on an upward trajectory that has been ongoing for 10 years now. The question is when the tide will turn. To express the current situation in the simplest terms possible, it could well be sufficient to look at the ratio of total market capitalization (as measured by the Wilshire 5000 Total Market Index) to US gross national product. It turns out that, based on this ratio, the markets are more expensive than ever before. This is aggravated by the fact that US economic growth has been lagging behind debt growth in recent years.

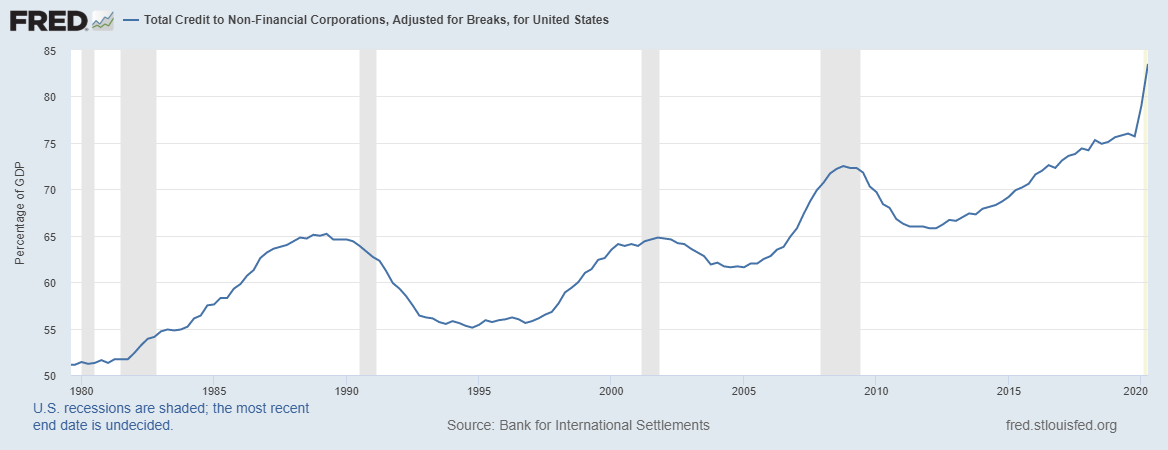

The high valuations do not, however, comes as the best news. Debt has also increased again, even though it was already at what was, for some, a terrifyingly high level ten years ago.

One aspect that appears to be new, however, is the increasingly common conviction that none of this is really a problem and that the current situation can merrily continue. Sooner or later, interest rates will start to edge up, either because the velocity of money (inflation) increases or quite simply because investors want more generous compensation after suffering losses. As interest rates rise, some of the hot air inside those inflated valuations will start to escape, and corrections will be on the agenda.

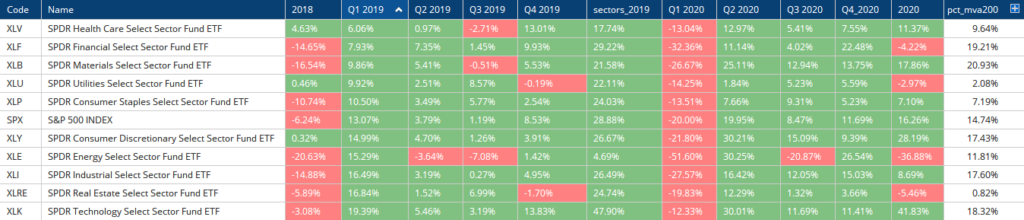

Stock Market

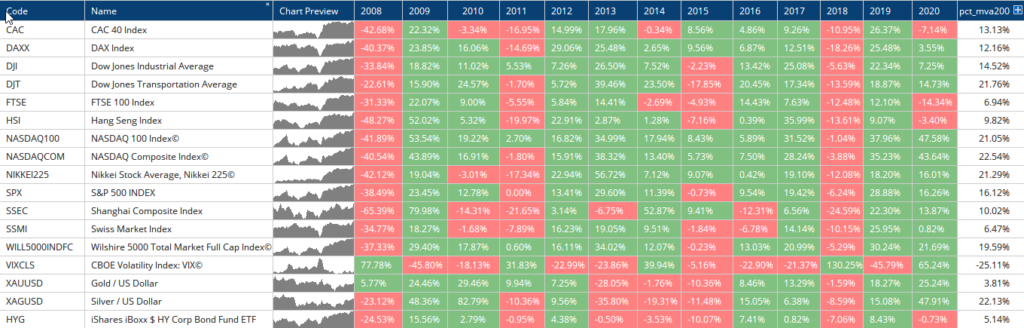

At the end of the day, 2020 was not a bad year for the stock market. For some markets, it was actually a very good year. Generally speaking, the stock market seems to have already dismissed the virus. Or rather: the virus does not seem to be as relevant as a factor as central bank policy, perhaps. Just as they were a year ago, the markets would seem to be in optimistic spirits again (for more information, please refer to the section on technical market data.

Following a consolidation pause, this mood of optimism had returned by the fourth quarter of last year at the latest. Investors who had reduced their positions during the correction phase in the first quarter and who were not confident enough about the situation over the summer months finally mustered up the courage to invest again. The vaccine approvals were reason enough for some investors to start buying again. Market prices had already risen beforehand and – with demand looking more buoyant again – set out on a year-end rally. The last three months of 2020 proved to be the strongest quarter witnessed over the last two years for the Nikkei or the Hang Seng, for example.

As far as the individual sectors are concerned, the financial sector experienced a strong closing quarter. As one of the sectors that has been lagging behind the market as a whole for years now, buying interest made a return as the debate on a possible rise in inflation – and, as a result, steepening yield curves – started to emerge.

The energy sector, too, made significant gains again in the final quarter of the year, although it was unable to recoup the losses incurred in the first quarter in the course of the year. The outlook remains relatively rosy, at least in the short to medium term. The strongest growth witnessed over the year was within the technology sector.

A mixture of factors affecting the real economy (lockdown/working from home) and the ongoing supply of cheap money mean that growth stocks are in vogue. The markets appear to be developing a momentum of their own in that strong price performance is, in turn, attracting new investments. Passive investing is also contributing to this trend.

Interest Rates & Capital Markets

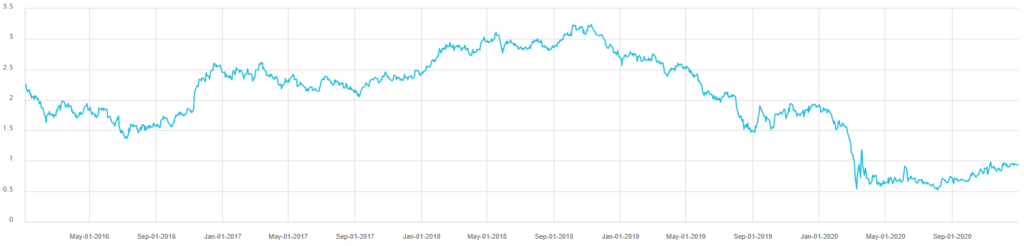

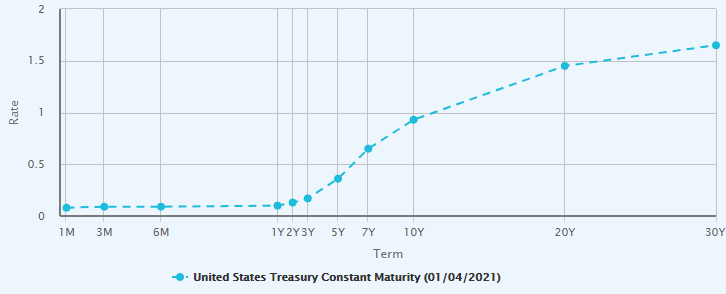

Interest rates were able to recover somewhat after hitting all-time lows. The yield on 10-year US Treasuries rose to just shy of 1%, up from lows of just over half a percent.

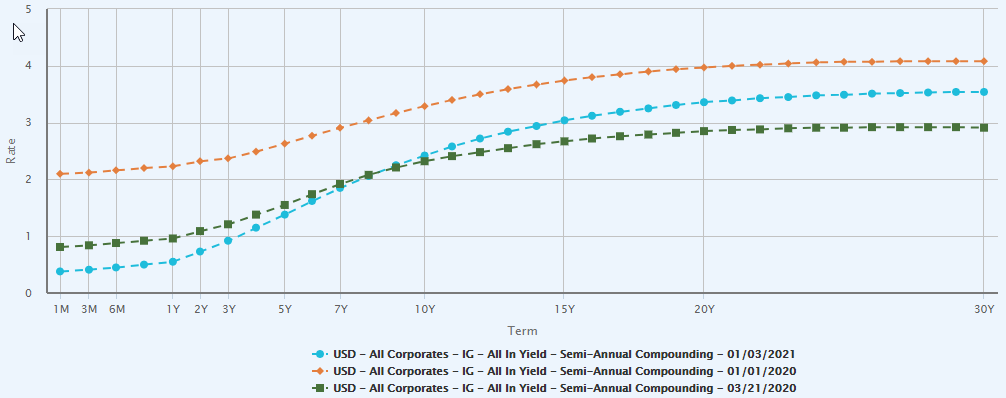

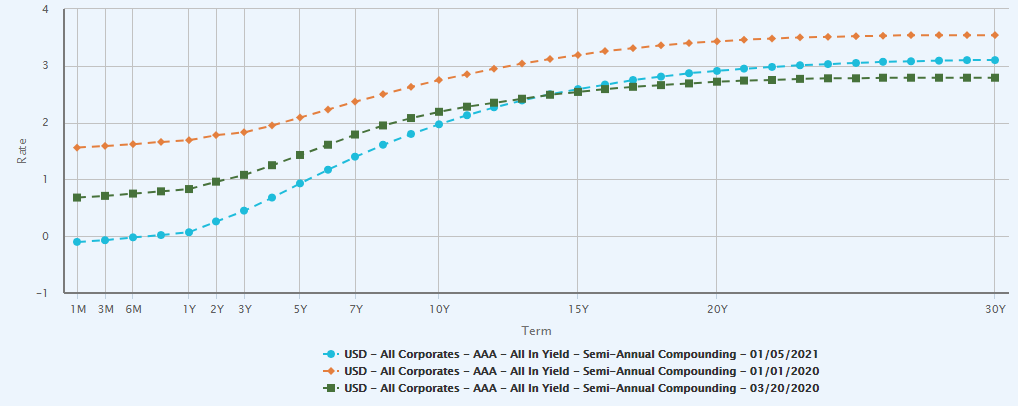

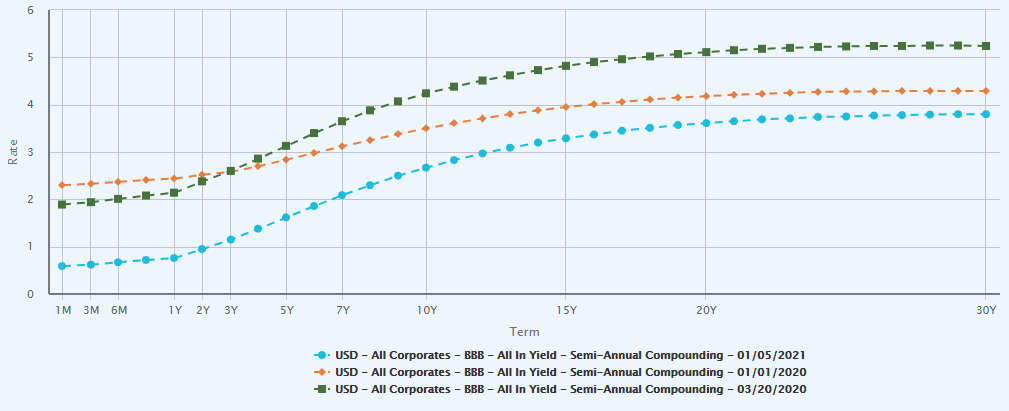

The yield curve has normalized compared with the situation in March and – with the exception of short-term interest rates – is not all too different to the curve we had a year ago. This is due to lower interest rates at the short end and slightly higher rates at the long end, producing a somewhat steeper yield curve.

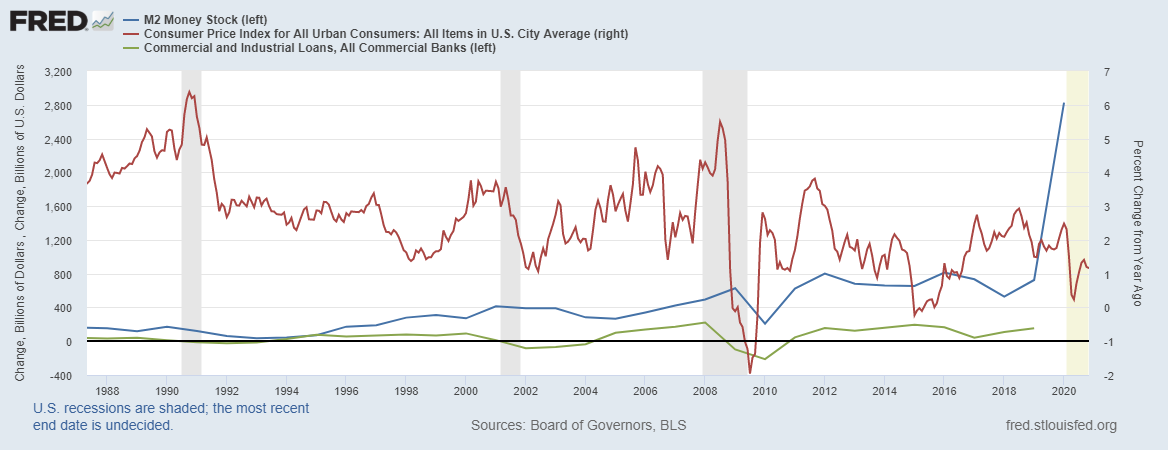

The direct payments made by governments to private households have revived the issue of inflation. The economy is also likely to benefit from catch-up effects when it reopens – which could push inflation up in the short term and has already been partially priced in by the market. On the other hand, deflationary trends are still emerging, and the question is whether the measures referred to earlier can put a stop to them. Low levels of economic growth are typically accompanied by more restrictive lending. This typically leads to a shorter supply of money – unless the central banks step in. At the latest since the recession seen at the start of the new millennium, we have not seen the M2 money supply recover to any considerable degree, let alone increase slightly, during recessions, precisely because the central banks step in to counteract the contraction. This activity was able to offset the shorter money supply and, as a result, deflation to some extent, but was too weak to actually trigger inflation. As described in the last Navigator report, central banks are not equipped with the right tools, and indeed it is not part of their mandate, to fuel inflation: this is something that needs commercial banks and demand for credit.

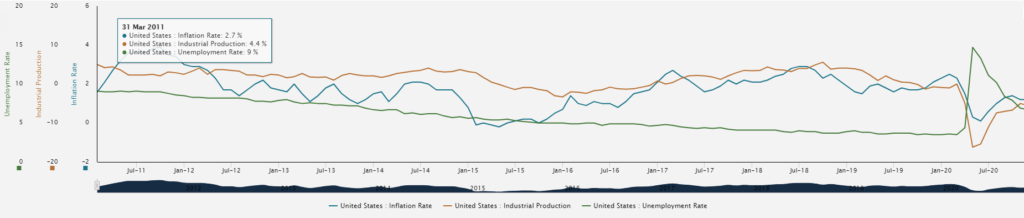

The virus has resulted in dramatic setbacks for economies across the globe. Industrial production in the US, for example, is currently on a par with the 2017 level. This raises the question as to whether the large-scale measures taken by the central banks are sufficient to withstand increased deflationary pressure. One new aspect is the fact that governments are granting loans directly, or at least guaranteeing them, feeding additional money into the economy. Fears of inflation are increasingly being voiced and can no longer be dismissed entirely due to the huge volume of money that has been made available.

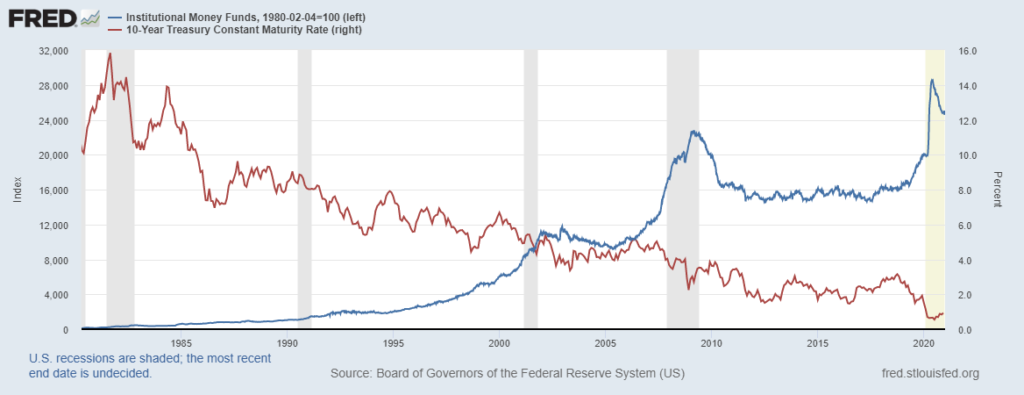

One could also, however, use the following line of argument: central bank asset purchases (by the US Fed in this example) mean that private buyers have fewer bonds available to them, resulting in higher bid prices. Institutional money funds recently lost deposits when interest rates slid to low levels. At the same time, interest rates have risen somewhat (when money managers are faced with fund outflows, they have to sell fixed-income investments, which in turn pushes yields up). As a result, rising interest rates may be more a technical matter than a sign of emerging inflation. The coming months will show which of the market forces, deflation/disinflation or inflation, will gain the upper hand.

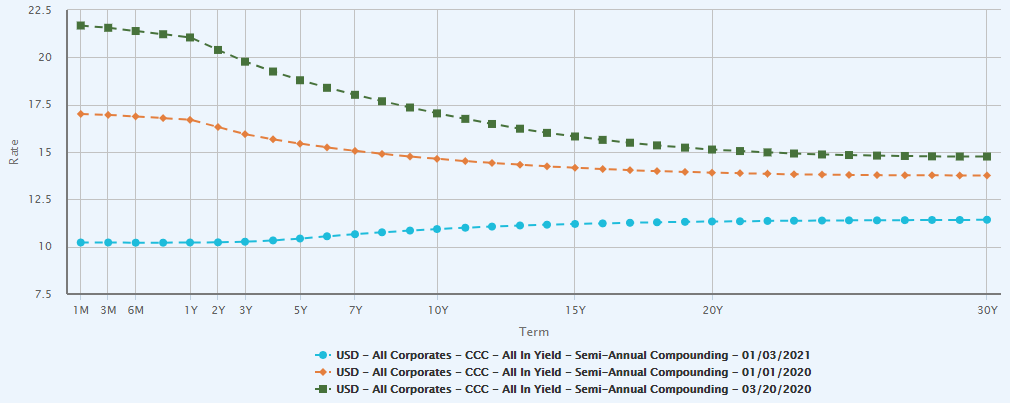

As far as corporate bonds are concerned, the markets have calmed down in general. Risk premiums, for example on CCC-rated bonds, made a strong recovery after the March stress period, and the hunt for yields also seems to be driving prices up (and, as a result, yields down) in a year-on-year comparison. As with government bonds, the yield curve for more solid AAA-rated bonds has been somewhat steeper.

Technical Market Analysis

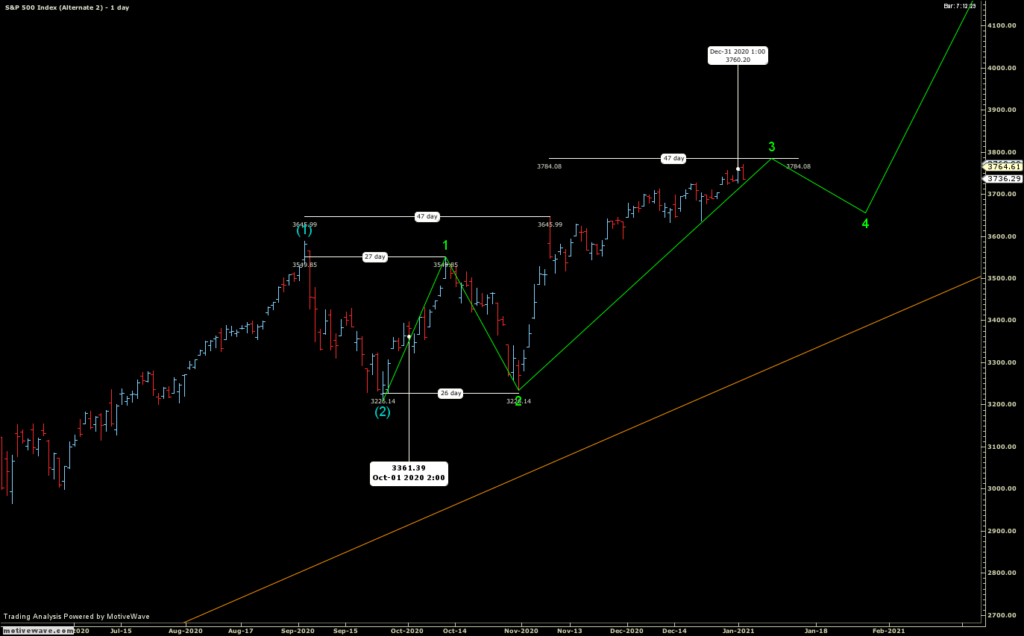

Depending on their geographic location, the markets were still not in the best shape before the start, or in the initial phase, of the fourth quarter (DAX). Thereafter, however, in early November or around the time of the US elections, the equity markets took new ground to the upside and were generally able to soar to levels marking new highs since the lows witnessed in March.

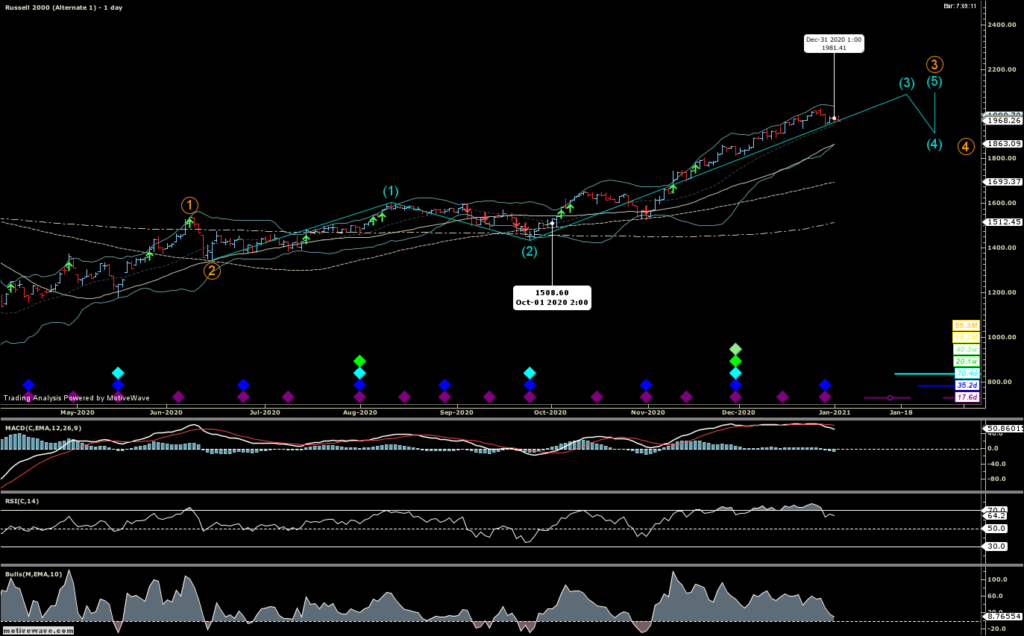

Technology stocks were still suffering a bit at the beginning of the fourth quarter and were unable to surpass the highs recorded at the beginning of September. In stark contrast, the broad-based Russel 2000 Index outstripped its previous high, reached back in late August 2018, in mid-November.

After more than two years of negative price performance, the Russel even went as far as to outperform the famous Nasdaq in the last quarter, continuing to outpace the Nasdaq in terms of positive price performance since its new high in mid-November. What is more, unlike the Nasdaq 100 Index, the Russel is not showing any negative trends.

When it comes to interest rates – looking at the price performance of 10-year US Treasuries – it is a bit of a “déjà vu” experience. In a similar development to that seen in September 2019, yields slid back to new lows after a temporary rise

Gold continued on its consolidation trajectory after reaching a high in August, a trend that was – possibly – completed by the end of November. This consolidation phase would have to be followed by another one to complete the trend.

One opinion says that there is such a thing as digital gold, too. In any case, the “gold standard” of cryptocurrencies, bitcoin, has certainly been making the headlines. Its value skyrocketed in the last quarter of the year. From a purely technical perspective, a consolidation phase is likely to follow soon (or may have already started. As we have already seen, overshooting to the upside is impossible to rule out).

Bitcoin’s market capitalization is still relatively small, which may well lead to more pronounced price swings (also potentially in an upward direction, as not many people own bitcoin at the moment, recent purchases have generally been made by renowned investors or companies, and very few investors are prepared to part ways with their bitcoin on the supply side => hodlers).

Bitcoin has certainly been catching up with gold. It remains to be seen whether the two can really be compared.

Outlook

The stock market path is, by its very nature, littered with stumbling blocks. If the driving forces behind prices are solid enough and the hiker is fit enough, stumbling blocks might, at most, be a bit unsettling and throw things off balance momentarily. You might trip, but you pick yourself up and continue. If the hiker is tired or, in stock market language, if the driving forces behind stock market prices are not solid enough, you might be in for a fall. The majority of the forces driving this stock market boom can be traced back to loose monetary policy and not necessarily to impressive economic growth, or growth in revenues or profit margins. It goes without saying that certain sectors of the economy, such as technology stocks, are also benefiting from a process of structural transformation. Even in this sector, however, prices have been driven by low interest rates. The cheap money available has allowed phenomena such as dividend payments financed by bonds (Apple) or by share buybacks instead of investments (various companies) to blossom. And then there is quite simply the flight of capital into high-risk investments such as equities in the hunt for returns.

As well as being full of stumbling blocks, the stock market path branches off in different directions every now and then. The coming months will show whether we are moving closer to this sort of junction. In addition to the fundamental question as to whether interest rates will bottom out or continue to fall, a number of specific events are on the horizon: a US Democratic victory in the Senate (Georgia runoff election) would give the Democrats the power to work towards a new brand of globalization. Whereas Trump resisted this process and was set on putting China, which emancipated itself from US dominance during Obama’s tenure, in its place, the beneficiaries of the old, familiar order should be able to regain a firmer footing. On the other hand, in the aftermath of the 2020 elections, the political landscape in the US could see permanent changes. With Biden/Harris specifically, but also elsewhere, government spending is also more likely to increase. What is more, the central banks will continue to buy up more bonds accordingly. This will see them squeeze private buyers out of the market, which could put pressure on yields. If interest rates rise (emerging inflation, increase in risk premiums), however, this would be beneficial for “value” stocks, which have lagged behind growth stocks in recent years. A steeper yield curve, at least, should give financial stocks a boost. Finally, however, it is important not to forget the economic shutdown and the fact that, with every week that passes, it will become more difficult for the economy to pick up speed again. Many people are no longer going to work and are currently still getting money from the government. It is difficult to predict which stumbling block will result in a fall. Ever since the financial crisis, the markets have always been able to bounce back thanks to the support provided. The challenge lies in bearing this in mind while still participating in the positive price performance.

“Be fearful when others are greedy, and greedy when others are fearful.” — Warren Buffett

EDURAN AG

Thomas Dubach

Leave a Reply