EDURAN NAVIGATOR

Quarterly Market Review with an Outlook.

Zurich, 7th April 2021

“A second crutch”. Markets are continuing on an upward trajectory. In contrast to the economy, which continues to struggle. Capacities are still underutilized; the job market is stagnant. The new US government has big plans and is supporting the economy with an unprecedented investment program. In addition to the relaxed fiscal policy, this serves as a second crutch for the faltering real economy.

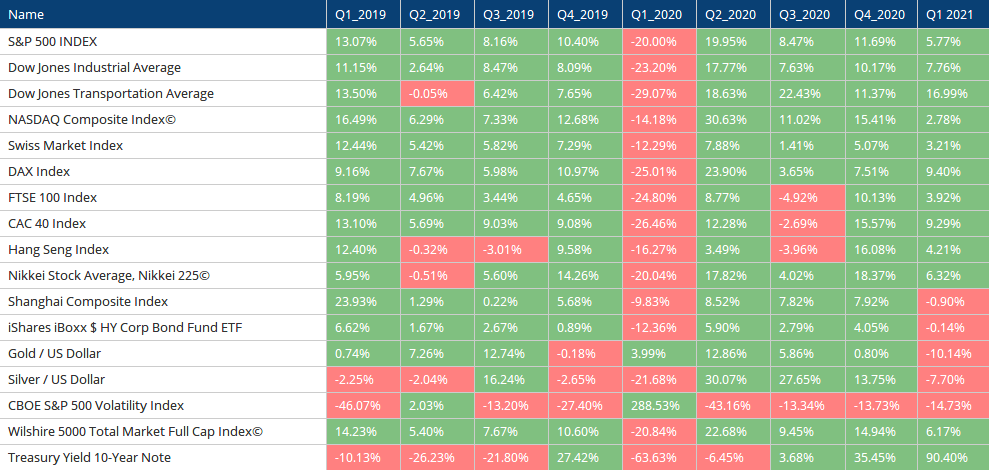

Market Review

The first quarter was still dominated by the virus. Many people started the new year feeling hopeful that the vaccine campaign would soon pave the way back to the “old normal”. As new mutations emerged, such as the COVID-19 variant from Brazil, and the vaccine rollout experienced delays, this hope began to fade somewhat. Sluggish Europe failed to secure enough of the vaccine in time and is lagging behind English-speaking countries in terms of vaccinations. Whereas last year, the Trump administration or UK Prime Minister Boris Johnson were labeled as chaotic or COVID-deniers, the US and the UK are now well ahead of the Europeans, who are currently still in lockdown and cannot attend sporting events in stadiums or enjoy a beer at the pub.

On the whole, stock exchanges remained relatively unchanged in the first part of the quarter before starting an upward swing towards the end of the quarter. While the mood at the start of the quarter was more cautious and many investors chose to hedge their positions, the US government’s announcements that they would be supporting the economy with massive stimulus packages was one of the main factors that reinvigorated the markets. Now we find ourselves in a situation in which, in addition to the low-interest policies of the central banks, the governments themselves are pumping massive amounts of additional money into the markets and now also into the real economy.

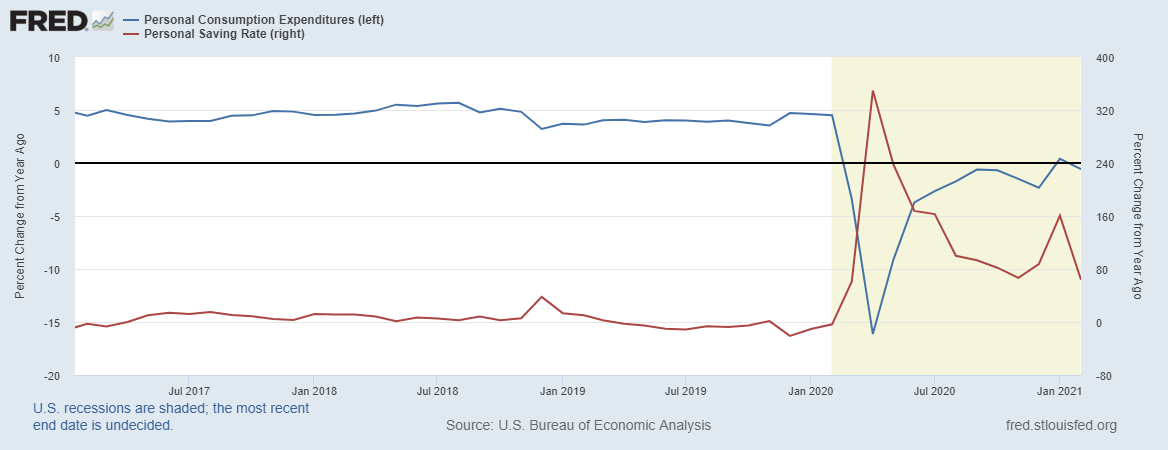

In terms of interest, investments came under pressure, meaning that yields have increased and are nearing pre-COVID levels. Furthermore, the interest curve has become steeper, indicating a new quality. The immense deficits and suppressed consumption or the savings that consumers have amassed during lockdown require an extra premium for longer-term investments due to the risk of a price increase. Calling it a fear of inflation would be a bit overblown, however the topic of inflation has come up. On the other hand, the purchases made by national banks already account for a large portion of the demand for bonds – for this reason, the market is relatively dried up in terms of existing demand (also due to regulations or simple investment guidelines) and thus yields are being pushed down.

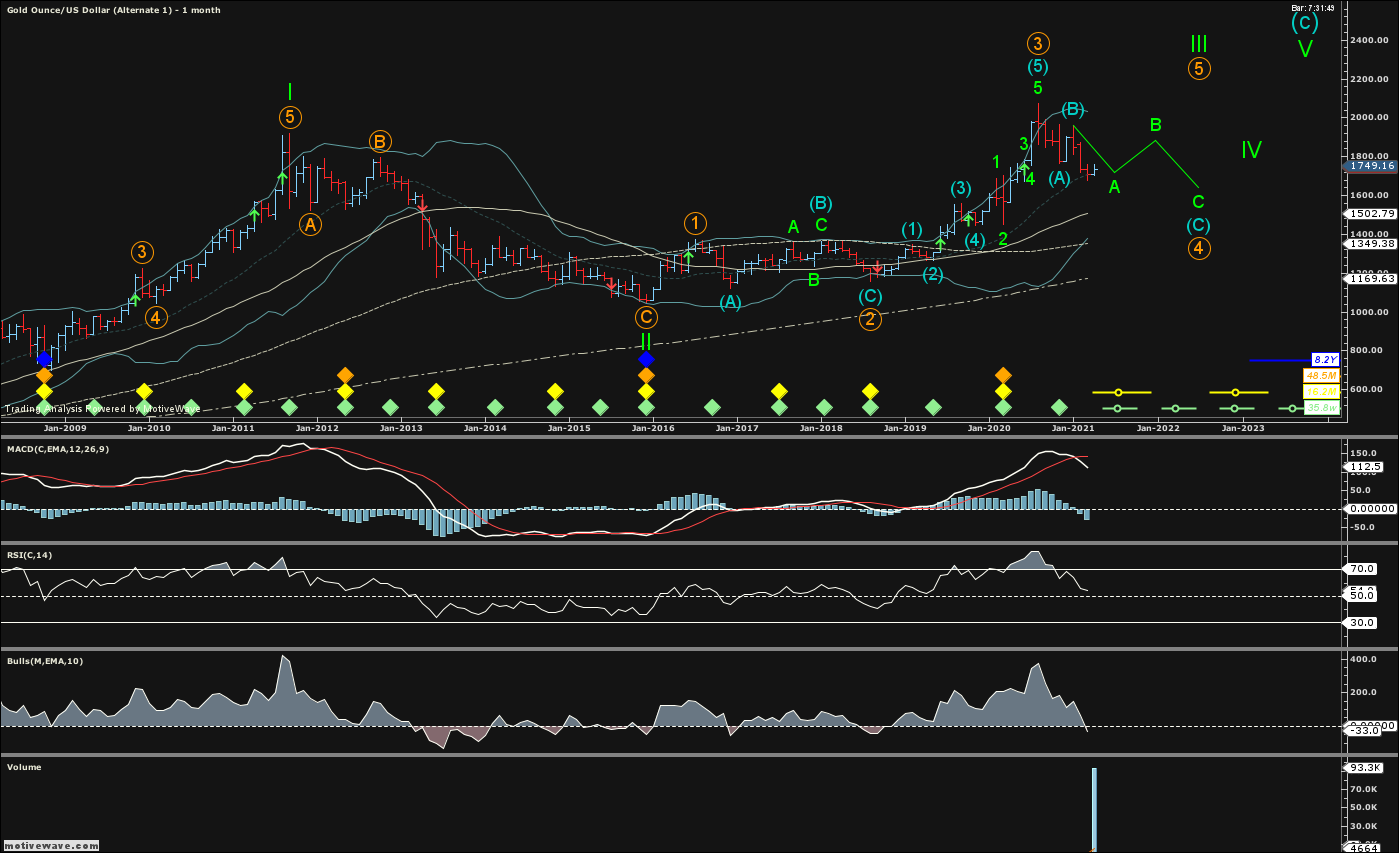

Gold continued on the consolidation trajectory that started in the last quarter of 2020. Commodities, on the other hand, were listed higher, which could also be due to discussions about possible inflation.

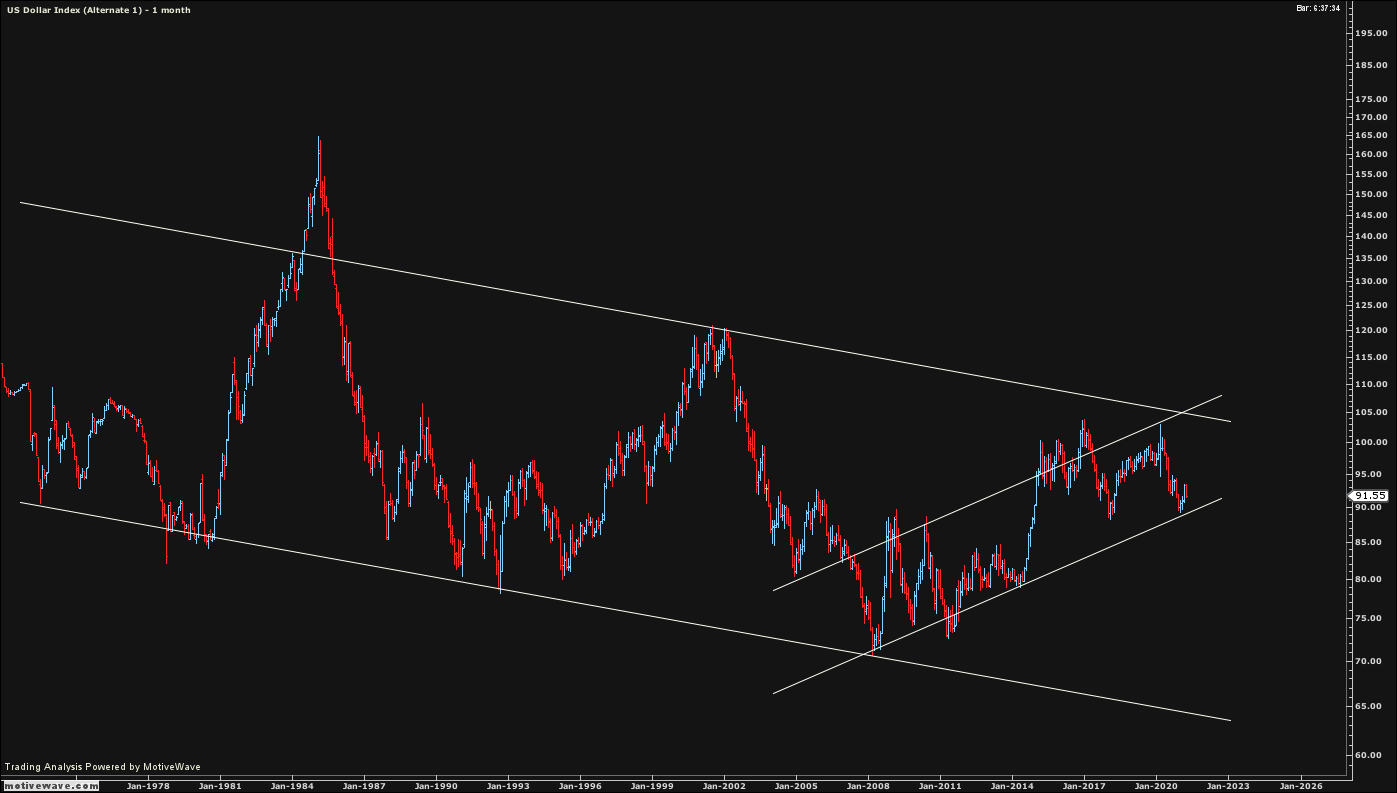

The US dollar has slowed, significantly compared to the JPY and CNY, which, in combination with the increasing US interest rates, raises questions about the state of the economy. Whereas in the constellation under President Trump, US dollars were increasingly spent “at home” – a pull back to the US, which, for example, made things difficult for foreign holders of debt in dollars – it remains unclear whether the demand for investment capital will increase significantly in scale in the US under President Biden.

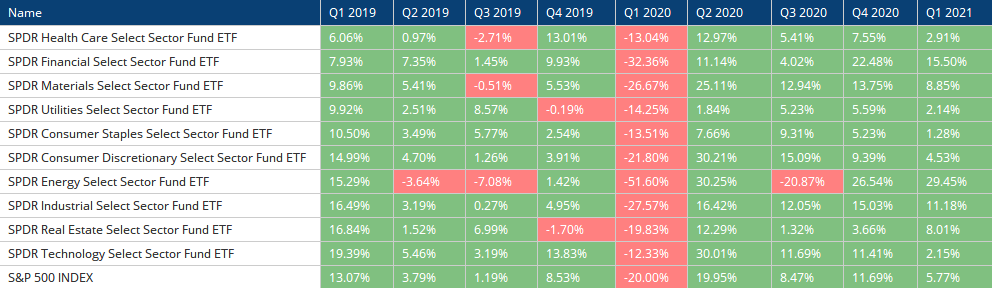

In terms of sectors, as in the previous quarter, the energy sector once again came out on top. The financial sector was also able to continue its growth from the previous quarter and may have continued to benefit from the steepening interest curve. Overall, all sectors closed out the quarter with higher ratings.

With the large-scale bailouts from central banks and governments, the markets are operating to some extent with two crutches. We are seeing less and less criticism of these kinds of bailouts. While it may not be urgent today, there is a growing danger of hubris on the horizon.

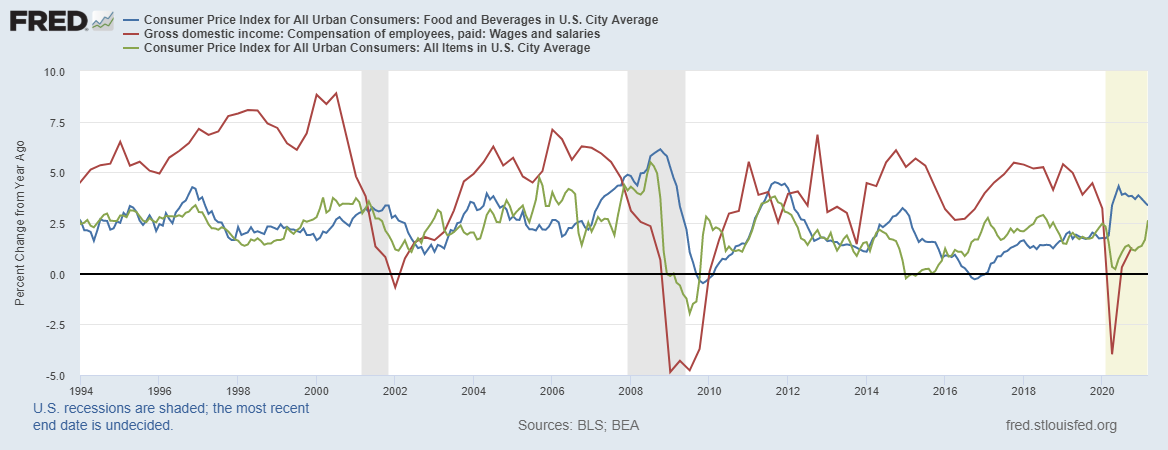

In Focus today

The question that many market players are asking right now is whether inflation is back. After years of deflationary tendencies, signs are pointing to a possible trend reversal. We felt that the deflationary forces that have shaped the events of the last nearly 30 years remain in effect. This includes globalization, for example, which has been resuscitated by President Biden and is pushing down wage growth in the Western world. Demographic trends and the shift towards automation may also play a role here. With the financial support of governments, however, capital is now being introduced directly into the real economy. This is a new quality that has never happened before with central bank funds (citizens cannot directly purchase anything with central bank reserves alone, as we have discussed here in the past). If a country (and the US of all countries) starts down this political path, it may be difficult to change course later on. A trend towards higher prices and higher interest rates is a real possibility – inflation could begin to take root.

Central banks have signaled their intention to keep base rates low for the foreseeable future. Even if they overshoot the target inflation (2%), this will not result in any interventions because higher inflation over the long term and a shift away from the zero threshold are desirable outcomes. Hence, according to the new definition:

On average, inflation should be somewhere within the target range, whereby measurements of over 2% may be tolerated.

This raises the question as to how central banks measure inflation. On various occasions, they have indicated, for example, that energy costs or food prices are to be viewed as transitory. This means that central banks could ignore these factors when determining inflation rates. There are many indications that wage growth could be the decisive factor. In addition to the price stability mandate, the Federal Reserve also has a mandate to achieve full employment. In short, the general understanding seems to be that inflation will move away from the currently low levels over the long term, and that this will only become convincing if wages increase as well.

Because inflation is also (and, some say, primarily) a psychological phenomenon, it will be that much more difficult to identify the turning point. In our view, a certain amount of reallocation in terms of investments could make sense if various cycles start to indicate a shift.

Because inflation is also (and, some say, primarily) a psychological phenomenon, it will be that much more difficult to identify the turning point. In our view, a certain amount of reallocation in terms of investments could make sense if various cycles start to indicate a shift.

Technical Market Analysis

In our view, the markets continue to find themselves on an upwards trajectory, even if they are in the final phase of this bull market. However, this final phase could last for quite a long time. As always, it is hard to predict when the trend reversal will come.

In its weekly chart, the DAX stock market index indicates a steep upward climb, even if it is in an area that is already slightly overbought.

Interest rate trends will be the decisive factor between now and the end of the year.

We have included a chart that depicts the yields of 10-year US government bonds compared to the price of gold in USD (inverse).

It will be interesting to see whether interest rates will continue to rise or if they will fall back into old trends. In some respects, the US dollar is faced with a similar question as to whether or not the long-term downward trend will continue or whether we are seeing a trend reversal (also in the index compared to the trade-weighted currencies). Ever since the 2008/2009 financial crisis, the US dollar has been able to detach itself from the immediate downward trend and currently finds itself at the top end of the superordinate trend.

The development of the gold rate tends to indicate that it will continue to consolidate, even if a countermovement upwards could occur in the short term. Silver, on the other hand, could appreciate in our view.

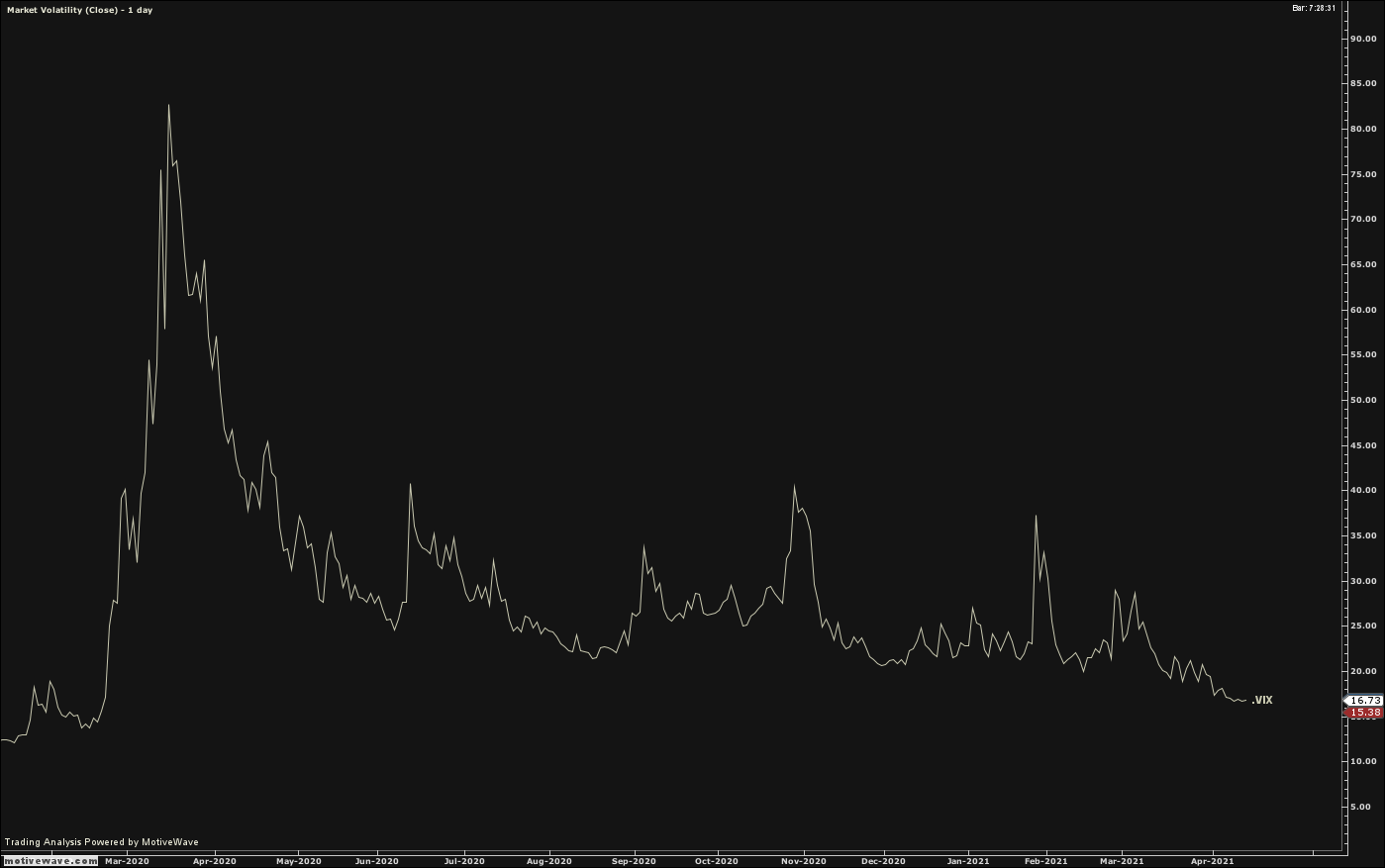

In line with market sentiment, the volatility index has in the meantime returned to low levels, however there is still potential for it to drop further.

Bitcoin has certainly been catching up with gold. It remains to be seen whether the two can really be compared.

Outlook

The coming quarter promises an environment that practically could not be better. At least for markets. Interest rates are still low (enough), governments are offering support where they can, vaccination campaigns are picking up speed, and the population is tired of COVID, which increases the pressure to lift lockdowns or ease restrictions, even in the face of rising infection rates.

The groundwork has essentially been laid for economic recovery. It is questionable whether the economy will return to the “old normal” and therefore whether growth will once again slow. It is difficult to see better perspectives for the middle class in the near future. The fact that governments want to keep spending money come hell or high water will not be sufficient on its own over the medium term. Quite the opposite. Interest rates would continue to rise, although to a limited extent as the result of national bank acquisitions. Volatility would likely return and make all of our lives more difficult. But this will not necessarily happen in the next quarter. The markets could continue on their current path for quite a while. With two crutches – one being the central bank, and one now being fiscal policy.

Investors can still make provisions given the fact that the world is becoming increasingly fragile. In addition to a certain level of diversification, there are also investments that promise a trend reversal and appear to be advantageous. It will also be interesting to see how the gold rate and commodities develop. In the event of increasing inflation, both could gain ground or at least retain their value. In terms of stocks, we expect that more defensive securities will continue the race to catch up with growth stocks. And this after the former had been in a correction cycle since around 2018 that likely have ended in summer of last year.

“Inflation is taxation without legislation.” Milton Friedman

EDURAN AG

Thomas Dubach

Leave a Reply