EDURAN NAVIGATOR

Quarterly Market review with outlook. Markets likely to correct but uptrend still intact.

Zurich, 24.08.2017

Markets have been relatively slow for the past quarter and mostly traded sideways in consolidation mode. Earlier in the year many have expected a downturn which obviously didn’t take place yet.

That said chances for a correction and hence lower entry points are still intact, in particular from a technical point of view.

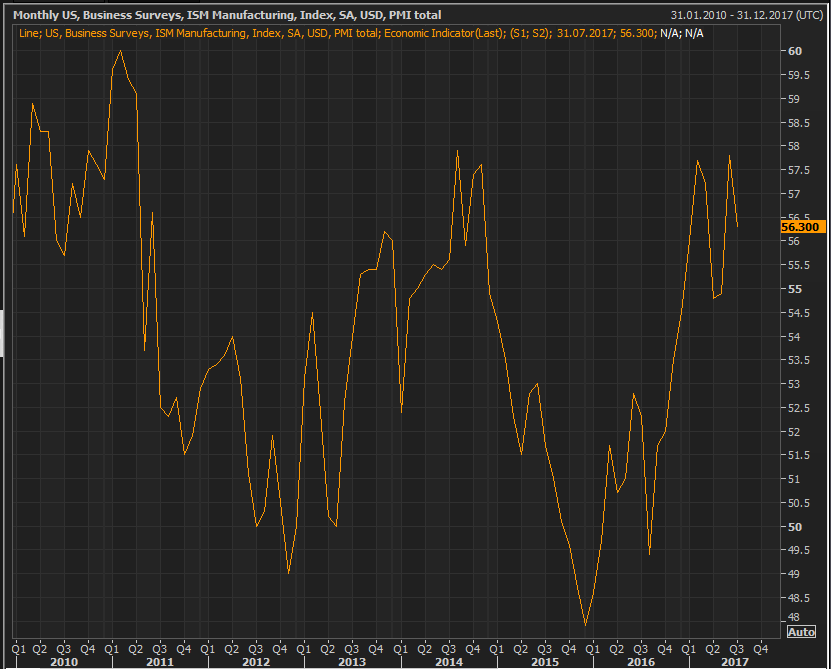

From a fundamental point of view most recent company earning reports have shown decent numbers with roughly 90% of reported companies 75% of them being above estimates and showing an average income growth of 10% (S&P index constituents). Also the economy looks promising with for example a strong PMI (purchasing managers index).

PMI-score above 50 indicates an expanding economy (Reuters/ISM Manufacturing).

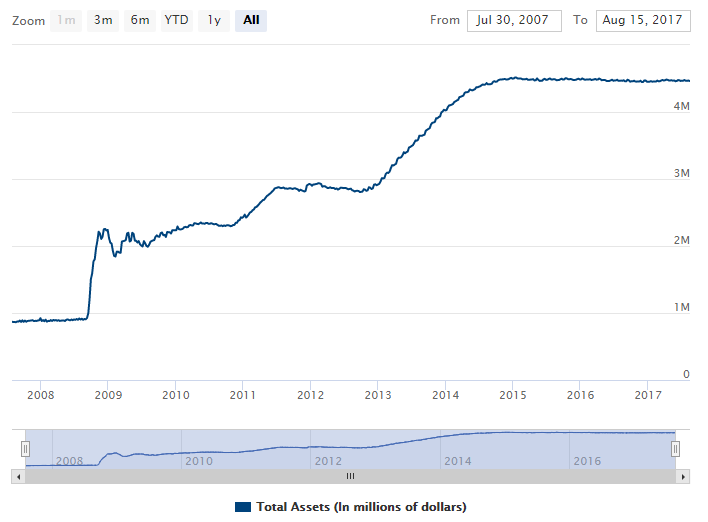

With an improving economy central banks are discussing the reduction of balance sheets with the US Fed already taken initial steps. For the past years, starting end of 2011 when the US Fed implemented quantitative easing, market valuation has gone up hand in hand with the increase of central banks balance sheet (S&P vs US Fed balance sheet).

The expansion of central banks balance sheets has pushed valuation of stocks (https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm).

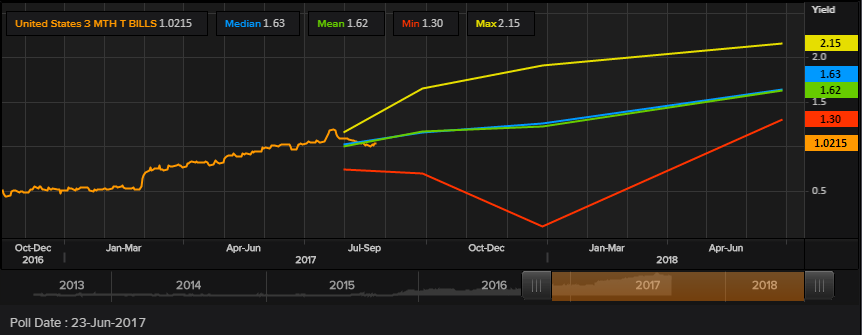

With the reversal of this policy and interest rates being „normalized“ by definition this will hurt stock market valuation. At best market it’s a goldilocks situation with still too low interest rates while the economy is expanding. Bottom line it is a tricky territory to explore for the coming months. A clear understanding and strategy helps to cope with it.

Recent polls show moderately higher future interest rates (Reuters).

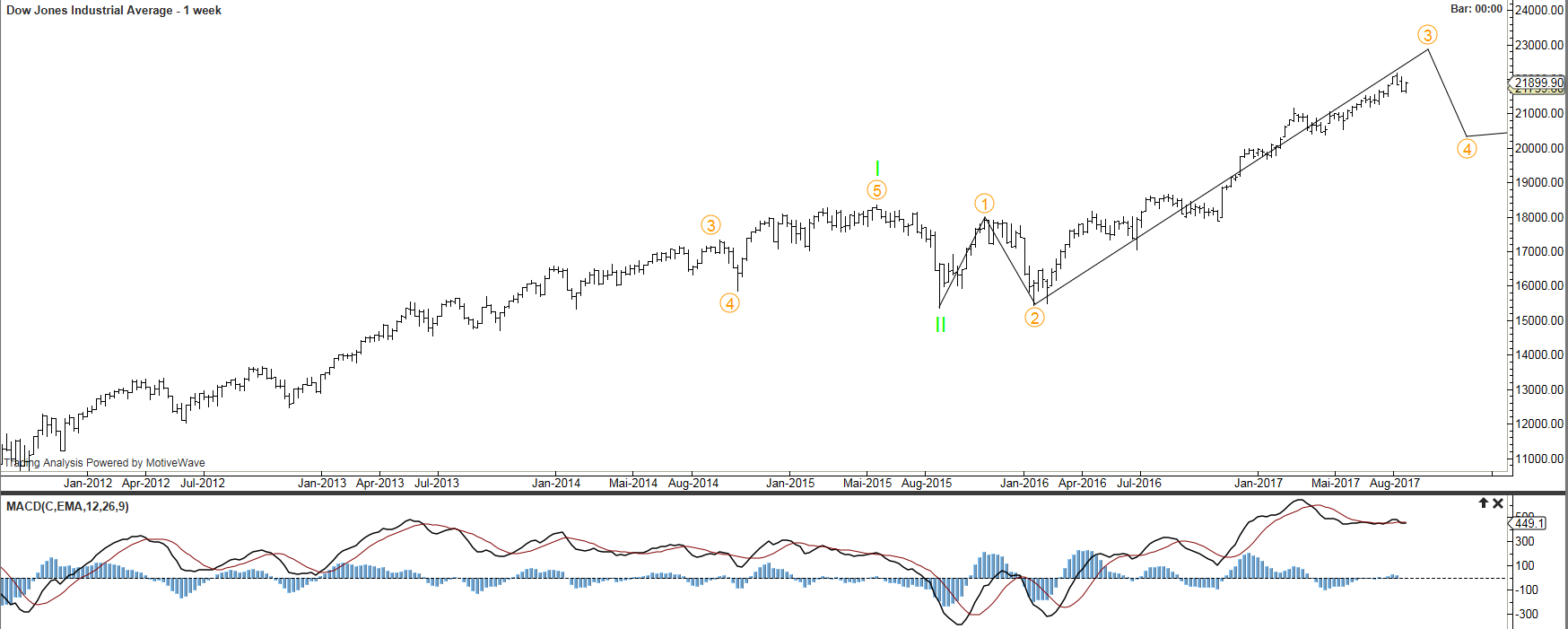

From a technical point of view stock markets are still in an uptrend, however, the trend has become weaker. An decreasing number of shares is supporting higher levels on an index level (negative divergence) is one indication and typically goes with seasoned uptrends and before a bear market starts.

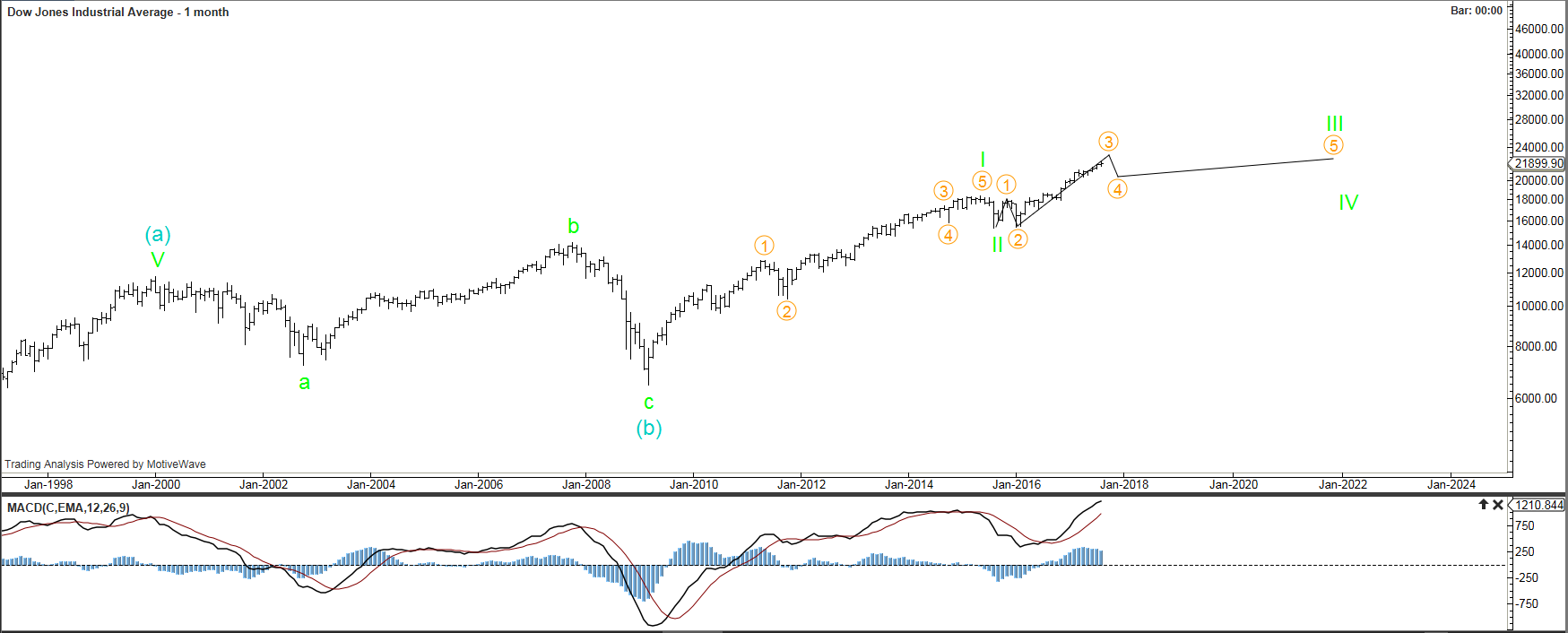

Charts indicate a chance of a correction any time soon but on the other hand the bull market is likely to remain intact for the coming few years.

Markets have seen a strong upturn and – according to elloitt wave theory – it is time for a consolidation or correction (EDURAN AG).

The monthly chart show a still intact bull market (EDURAN AG).

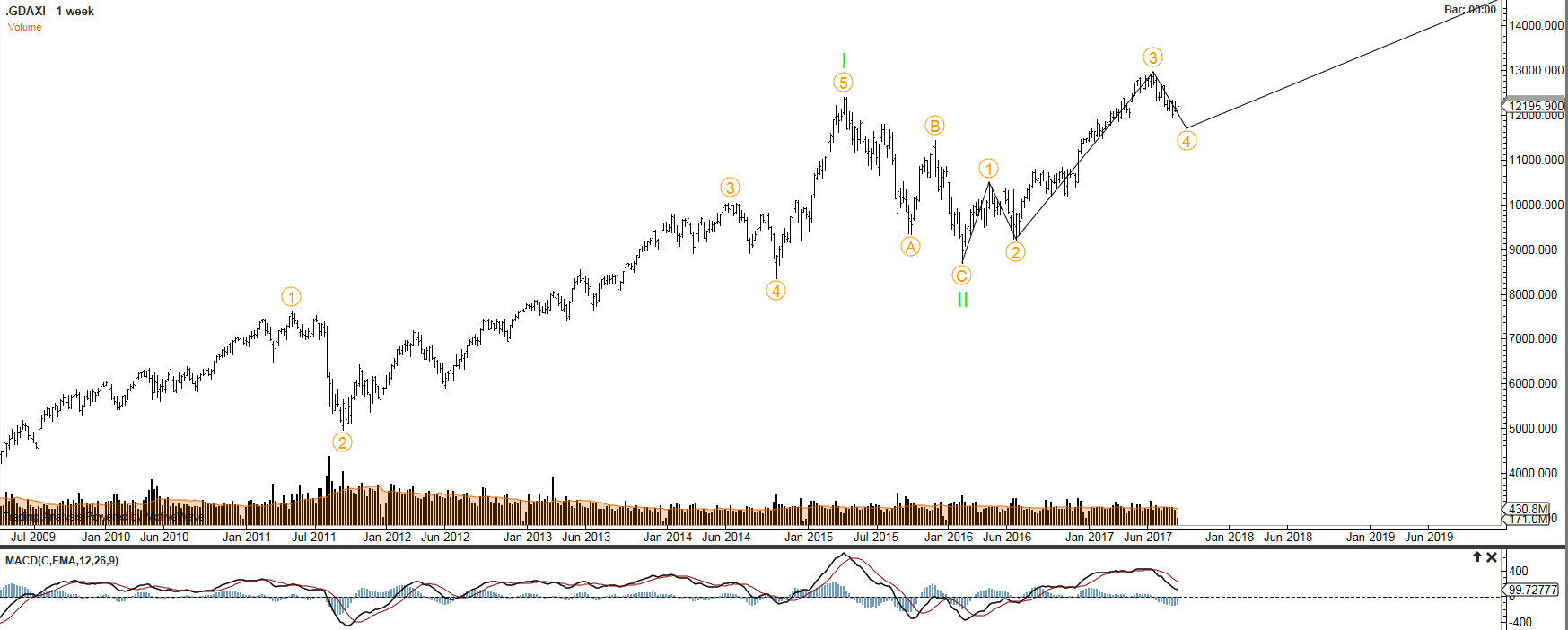

Europe has gained some traction and markets have seen decent inflow of money (see EUR vs. USD).

German stock market seems to be ready for a next move up after having consolidated for the past roughly two years (EDURAN AG).

Equity will remain asset class of choice for time being and still corrections should be looked at as an opportunity to add to positions. That said cash as a position makes sense and has the character of an option (to buy at lower levels). With slightly higher yields fixed income is back on the radar again (USD), Given the rich valuations the main target is clearly to protect capital and not to chase returns.

We wish you a great day!

Best regards

EDURAN AG

Leave a Reply