EDURAN NAVIGATOR

Quarterly Market review with outlook. First Quarter comes with overdue correction

Zurich, 30.03.2018

Many have waited long time for the market to correct itself and when it happened, it still came as a surprise.

Towards end of Januar into early February markets have lost roughly 10%. Strikingly there was very little liquidity which made most markets plummeting within a short period of time. In regards to sectors the defensive shares were among the ones which suffered the most, corresponding with a solid outlook re economy growth and hence higher rates on a bottom line. That said, what happened in January/February is still deemed to be a correction, i.e. the uptrend is still intact. On the other hand we doubt it is all over yet and expect one more leg down before markets move in an upward trajectory.

Interest rates

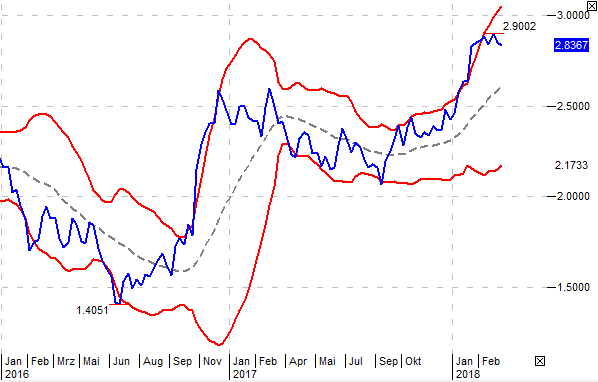

Interest rates have continued the trend of last quarter 2017 and moved above the critical level of 2.6% in the USD to 2.9%. A focus on inflation, or inflation to pick up soon, made many to reposition and hence asking for higher interest rates.

10 year treasury yield. Source: VWD/Eduran AG

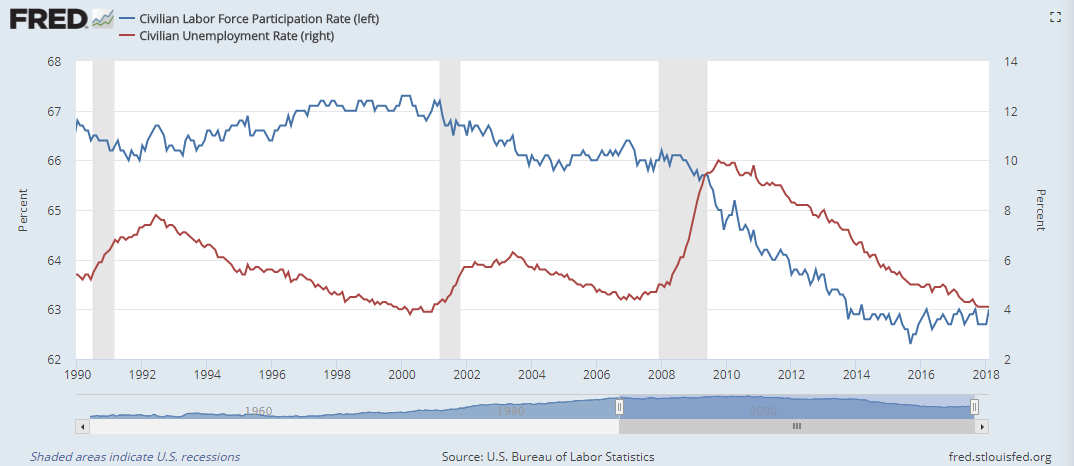

Wages in the U.S. have come in strongly with 2.6% for 2017 and 2.9% for January 2019 which has been the strongest increase since 2015. With unemployment rates low and for the U.S. for example being close to full employment levels a booming economy will cause wages to increase and hence higher inflation. Critics on the other hand believe wages are not likely to hike up much further because of a large number of potential workers which have been pushed out of the employment process post the financial crisis 2008/09. Measured by the labor force participation rate there is only roughly 63% of potential workes involved in the working or job finding process as opposed to 68% before the crisis. Also the payroll growth with an average of 200‘000 jobs per month for the time after the crises this is lower than what we saw for earlier decades (below 2% growth versus 2.6% for the 90‘2 and 3.1% for the 1980’s).

Unemployment rate vs labor participation rate. Source: St. Louis Fed / U.S. Bureau of Labor Statistics

With a solid economy an increasing number might come back and apply for a job which potentially limits salary inceases.

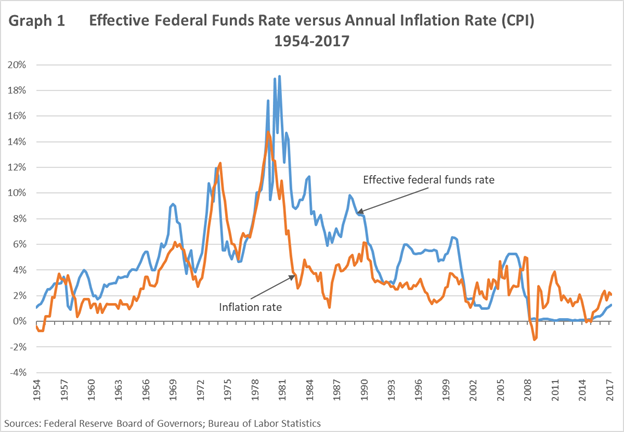

Inflation is still a very lackluster in Europe with 1.1% and far below targert number of 2%. In the U.S. at least it has reached a level of 2.1% for February after years of a averiging around 1.3%. History has shown that inflation can pick up quickly and at times with a out-of-controll nature of dynamics. Given the recent years of huge amounts of money printing many observers see a large potential for future inflation.

Fed Fund Rates versus US-CPI. Source: Federal Reserve Board of Governors; Bureau of Labor Statistics

Companies

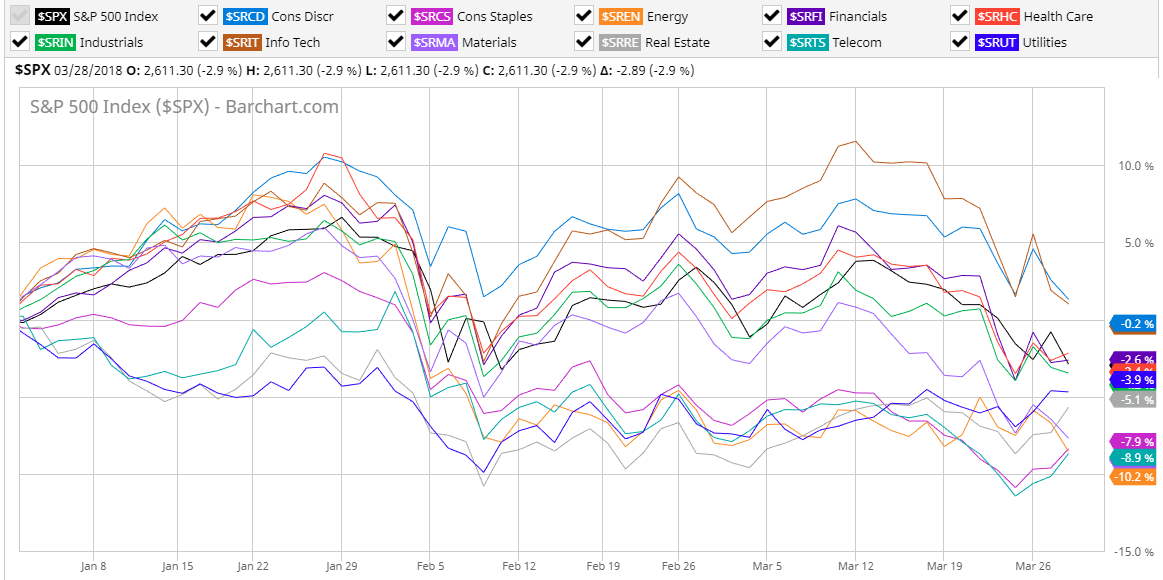

Growth in the global economy has put cyclical sectors in favor. Technology, cyclical consumption as well as financials have outperformed for the first quarter of this year. Defensive stocks on the other hand have given back territory and closed the quarter even with negative performance.

Stock markets sector price development. Source: S&P Index, Barchart.com

Market Technic

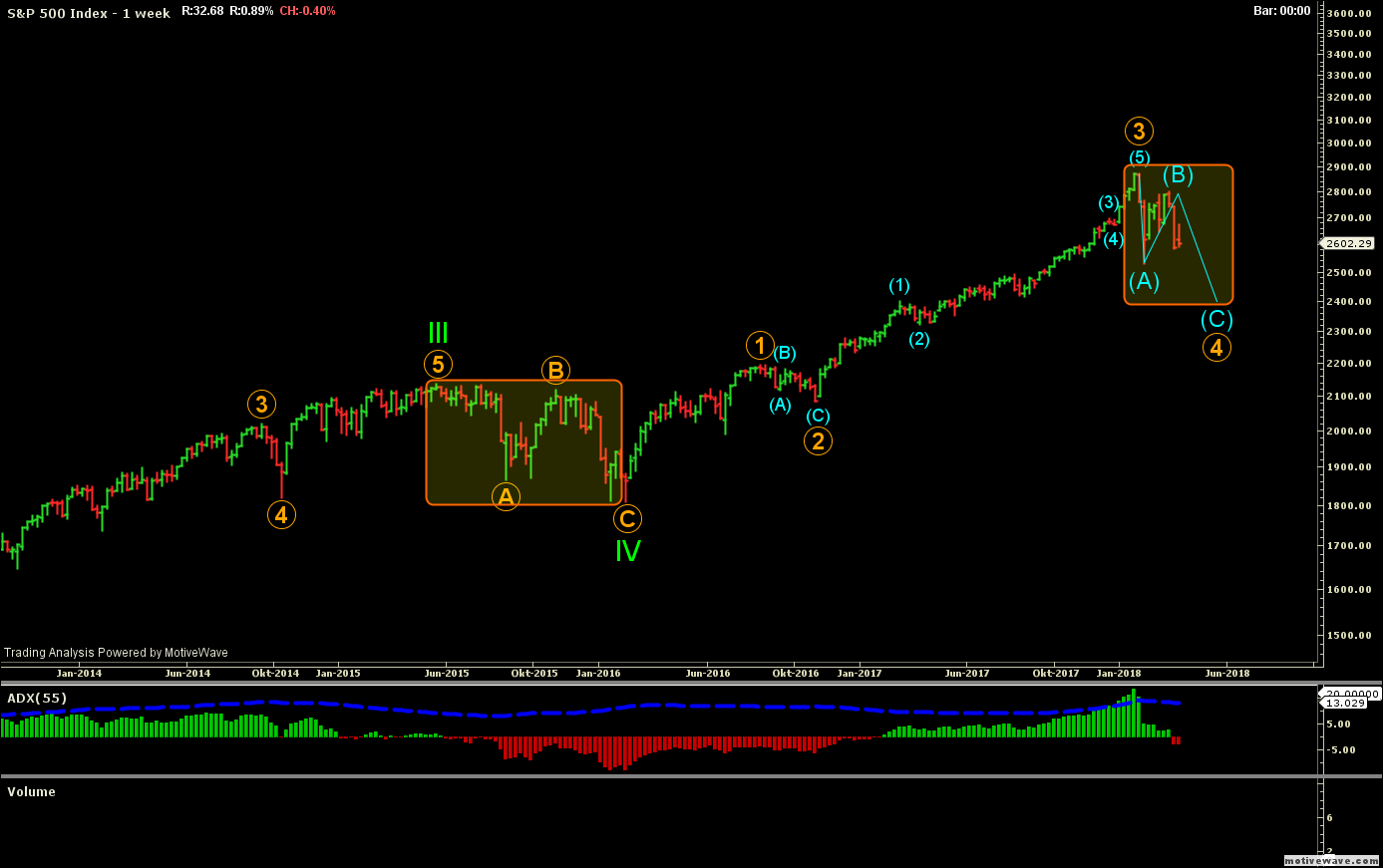

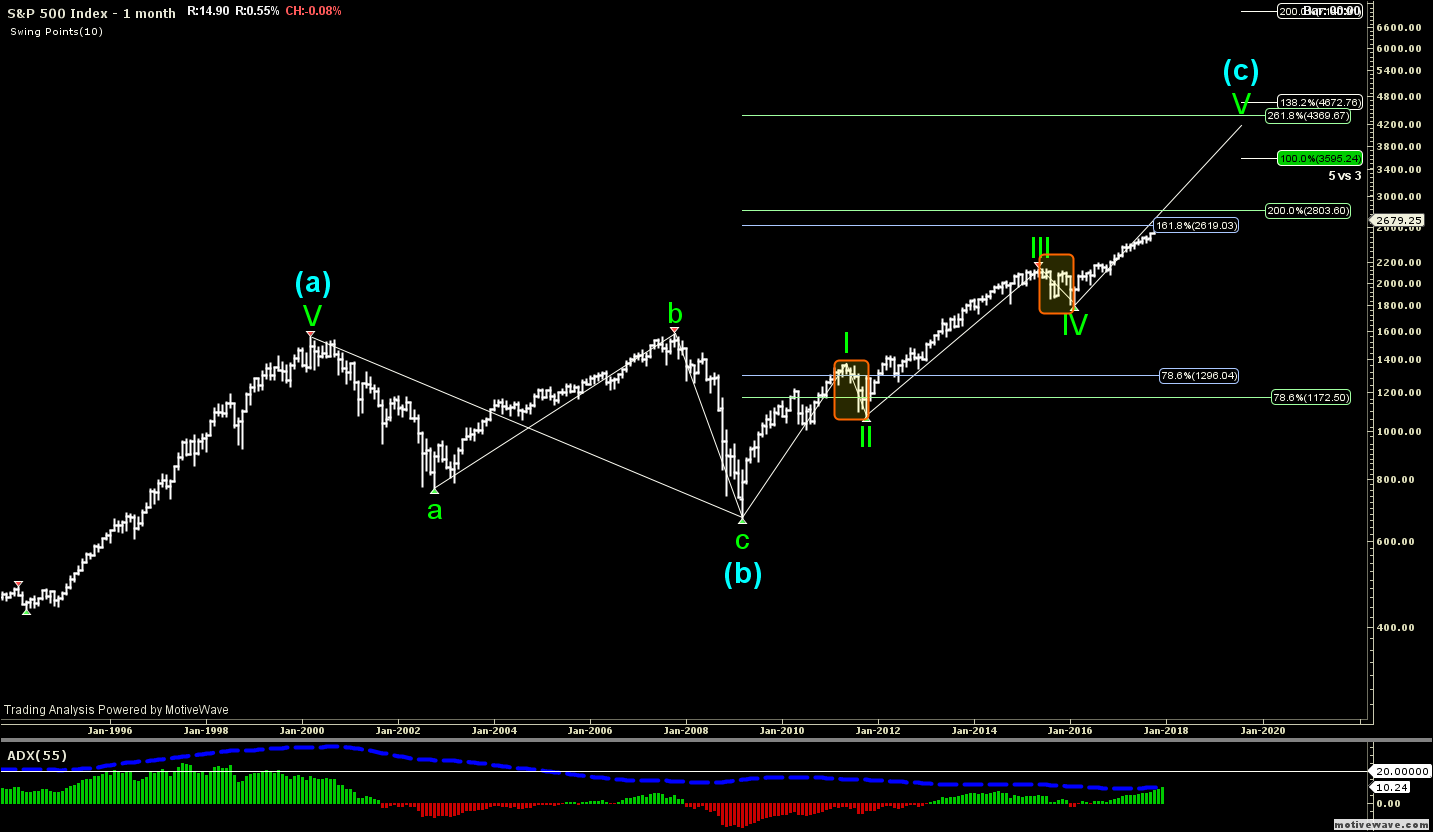

With the overlaying uptrend still being intact the market began to correct itself during the first Quarter 2018. We see a good chance for the market to take another leg down to complete the correction. The uptrend then is supposed to move on. That said however, as mentioned earlier, the uptrend itself as we see it is in its late stage and will correct at a later stage too.

S&P500 weekly chart. Source: motivewave / Eduran AG

S&P500 monthly chart prior to current correction, resistance 2600-2800. Source: motivewave /Eduran AG

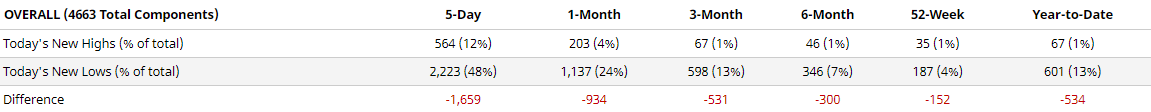

As for the past month and as one of the reasons why many have expected a correction for months the number of shares which post new highs is minor – in other words the uptrend has been pushed by a few stocks only. This trend has accelerated with even more stocks printing new lows during Q1 2018.

US overall, new highs lows (52 weeks). Source: barcharts.com

Outlook

The global economy overall seems to be in relative good shape when it comes to order books and capacity utilization. That said one always has to bear in mind that we are running on record low interest rates for most of the industrialized world and all of which was different when it comes to output which would be disastrous. Still there are many potential land mines on the way: central banks are just approaching the tricky part of their journey to unwind the lax monetary policy. Any lack of communication or unexpected action caused by centrals banks could lead to a financial crisis and hence cause damage to the real economy. Also geopolitical tensions have been building up over the most recent years. And last but not least total debt is higher than before the financial crisis 2008/09.

Governments to cut back debt might be wishful thinking – at least for the past the trend has been one way only and it is hard to imagine in democracies, as we have for most industrialized countries, people vote for someone to cut back spending. From this point of view, addressing things which can go wrong, we favor a diversified and conservative portfolio for the time being. It makes sense not to put all eggs in one basket. Happy Easter break!

Sincerley,

EDURAN AG

Leave a Reply