EDURAN NAVIGATOR

Quarterly Market Review with an Outlook.

Zurich, 28-Dec-2018

“Happy Holidays”. October started the quarter and lived up to its reputation. It came with a correction which went on for the rest of the year and left 2018 with no happy ending.

Yet another correction in an uptrend – so far

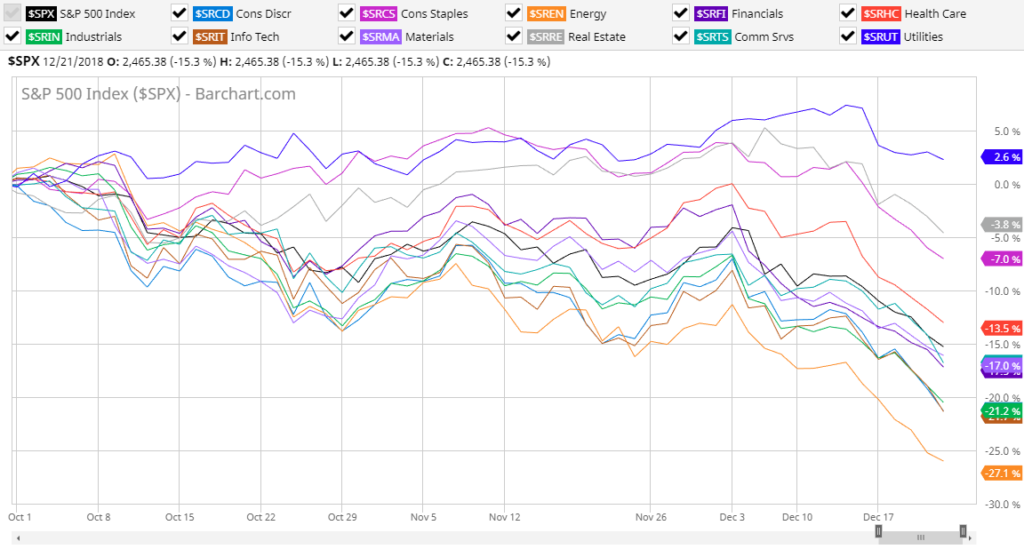

The main topic over the quarter was the constant pressure towards lower prices, the correction. After the relief off the lows encountered during the first quarter of 2018, the correction in the 4th quarter proved to be more severe. The only sector to pull through without serious losses were utilities.

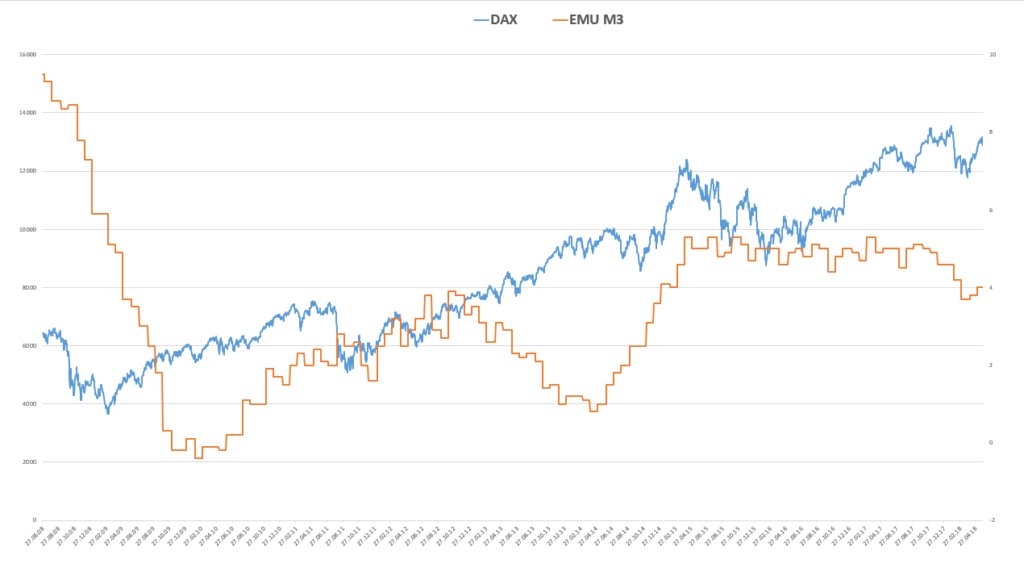

In our opinion, the main issue of this last quarter of the year was the increasing lack of liquidity – and of course high valuations that rendered a correction necessary. The reduction in bond purchases by the ECB (EUR 15 billion per month) which started at the end of October took the wind out of the financial markets’ sails. At the same time some American companies entered the blackout period during the month, thus putting share buyback programs on hold. The combination of the two factors tipped the balance and kicked off the downtrend for this last quarter of the year.

German DAX versus EURO money supply M3

The oil price also collapsed at the beginning of October, putting an end to its rise that had been in progress for the previous twelve months. The assumption had been that availability could decrease as a result of the American sanctions against Iran. However, the gap was filled from other sources such as Russia, the OPEC-states, and U.S.A. An outright plunge in prices commenced at the beginning of October, just before the sanction were to being put in place. This also affected prices of energy stocks. On the other hand, the unease in the stock exchanges pushed gold prices higher, giving a boost to mining stocks. This sector is likely to remain of interest, let alone the fact that most people have neglected it in recent years. Other capital-intensive sectors such as industrials or sectors dependent on the flow of credit (discretionary consumer spending) suffered losses, similar to Tech stocks, which were just running on high valuations.

In summary, we can say that the market has moved from what was until now a rather optimistic view to one that is rather more pessimistic – or even one that is more realistic.

WTI crude oil

Interest rates

At the beginning of October and in the first half of November it looked as though interest rates would break through to new heights, leaving behind the old resistance level of about 3.2% (10 year returns on US government bonds). In the meantime this turned out to rather be trap. Yields are back at levels of below 2.7%. Capital markets continue to anticipate no meaningful increasing in inflation yet. This is in spite of unemployment levels being at a 50-year low, something which should lead to increasing inflation according to models such as the Phillips curve (as described earlier in this publication).

The world and its economy is re-shaping or reorganising itself. The globalisation which has taken place over the last few decades seems to have come to a stop and a tri-polar world could emerge. The USA is repatriating its value-chain or establishing it in neighbouring countries which are within its direct sphere of influence. China is in the process of developing its own internal market and is moving away from being the production hall of the world. Europe is primarily busy with itself and trying to determine its own structure and role yet and hence most of the time is reacting to changes only rather than being a global shaper.

The uncertainties are also likely to continue in the New Year. Faced with the political and trade-related headwinds, markets will most likely remain all the more volatile.

If the ECB keeps its word, Europe and the Euro will follow what the USA has already done. Bond purchases will continue to reduce and interest rates possibly increase with effect from autumn 2019.

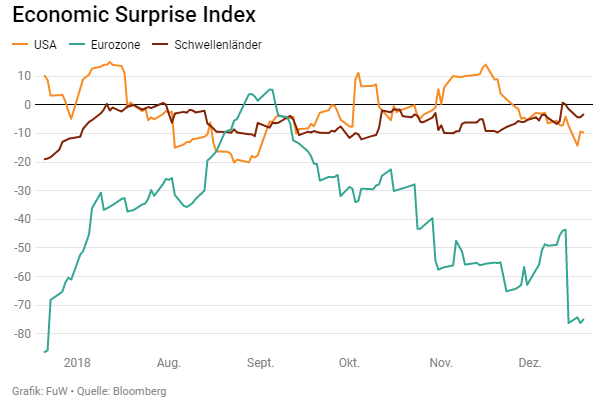

Economic Surprise Index and weaker than expected Eurozone

Indicators such as the PMI (Purchasing Managers’ Index) have softened, particularly in Europe where the index is at the lowest level it has been in the last 49 months. The Economic Surprise Index, too, which compares incoming data with analysts’ estimates, has fallen – in this case also more steeply for the Eurozone than for the USA. What still seemed to be so-called synchronised global growth at the beginning of the year no longer really exists. Whether Europe will follow the road map for a “normalisation” of interest rates will still have to be seen against the background of the above portents. Also, should markets correct further to some heavy degree, central banks will most like step in one more time – at this is what the US-Fed has addressed in the past when referring to the importance of finanical stability.

Companies / Sectors

As mentioned earlier in this report utilities were the exception which didn’t suffer a lot during the quarter. Lower capitalized stocks and growth stocks were among the major losers. Profit-taking after what were significant increases over recent months and lack of liquidity sometimes caused dramatic corrections. That said, Christmas time this year did not come with rich profits in stock investments, however, at least those who have kept liquid means could add to positions at lower levels.

S&P500 Index sectors

A whole range of well-known names are now on more attractive levels – or at least more realistic multiples. Leading sectors such as the chemical industry have already experienced a serious correction throughout the year and they could be first to see increases again. Due to the heavy sell off in some names there could likely be a sharp rebound take place any time soon and from a valuation point of view many names look attractive. From an investment point of view it makes sense to employ a first tranche of cash at such levels, even when markets go lower in the near future.

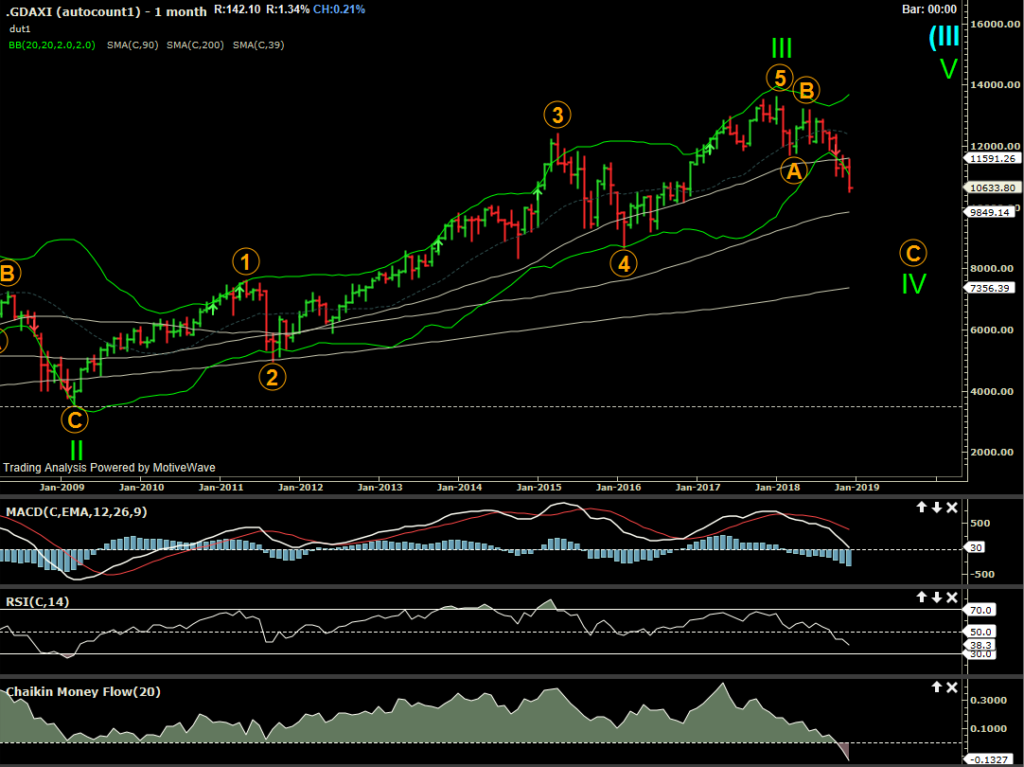

Technical aspects of the market

Although 2018 has proved to be the year of the correction, the overriding upwards trend still looks to be intact. However, some important support levels have been broken at first which makes it likely that the correction is not necessarily over yet. It remains to be seen whether this will take the form of a sharp downwards slide or rather a sideways movement of the market. We favour the latter one (triangle correction).

German DAX in correction mode

After the correction at the beginning of the year (end of January to the end of February), the markets were able to recover throughout the summer and for some markets even reach new highs (S&P500). In any case, the American markets were able to uncouple somewhat from the rest of the world while absorbing global liquidity which led to excessive price gains compared with other leading markets. That said, after a rather sharp correction throughout the 4th quarter there is a fair chance the US-markets in general will see inflows again at higher prices.

S&P500 where correction could be over soon

Outlook

With the end of the quarter, we can look back and review the past ten years to the financial crisis of 2008/2009. In September 2008, Lehman Brothers collapsed and the central banks moved into crisis mode, dropping interest rates to new lows or lowest levels ever. Based on the path trodden since the 2008/2009 crisis we anticipate that fundamentals such as growth and also central bank policies will not change so quickly in a meaningful way. Central banks have indicated that they will reduce their balance sheets and “normalize” interest rates. Indebtedness has increased further since then and the quality of growth is questionable which on the other hand makes it questionable if central bank truly can follow the path which they have announced.

As a tendency, with cheap money disappearing market forces become increasingly important again. Companies with weak balance sheets will find it harder to finance the business and share buy-back programmes will be fewer or more difficult to put in place – just to mention a few. Also with times of changes and uncertainty it is likely that volatility will increase which again, as a result, comes with higher risk premia in general. But all of this only to a certain extent, as if things became too dramatic the central bank is likely to intervene. Viewed in a historical perspective, interest rates are likely to remain at a low level and this in turn will support equities from a certain point onwards – particularly companies with a healthy balance sheet and undamaged growth prospects (even if it turned out that expectations would not be met each time). Last but not least, equities still offer a one of the best protection available for capital in such an enviroment for the medium and long term.

We wish you a Happy New Year!

Your EDURAN AG

Leave a Reply