EDURAN NAVIGATOR

Quarterly Market review with outlook. First Quarter comes with overdue correction

Zurich, 02.07.2018

“What goes down must go up”. The rise in the stock market is getting long in the tooth; but this year’s period of weakness has not yet halted the present upwards trend in its tracks.

Recovery in the 2nd quarter

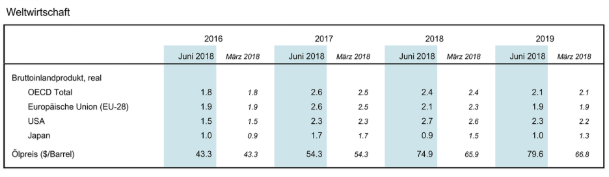

Markets have recovered from their 1st quarter lows. On the other hand they lack the vigour or traction to be able to regain the old highs for most broad markets. There are exceptions, for example the Nasdaq 100, where technology stocks proved capable of sustaining a strong rally. On the other hand, the Shanghai 100 has only seen one direction since the beginning of the year: downwards. Generally speaking, fundamentals remain very much unchanged. The global economy is in good health even if growth should prove to be somewhat less strong during the second half of the year, slowing down a bit after a period of robust expansion. The latest events in world trade are having a braking effect, with punitive tariffs affecting certain industries and companies . China is suffering as the trade barriers have come at a time when the Chinese economy is already experiencing a slight setback to its growth. Exports to the USA account for about 3% of Chinese GDP, and the punitive tariffs could cost up to 0.5% of this. Some people are saying that a trade war is already in progress. But perhaps something quite different is on the way, since the objective, as President Trump has also announced, is fair world trade and tariffs which are as low as possible for everyone. The intention of the temporary escalation is intended to make China to treat everyone equally. Companies in the USA have clearly benefited from the tailwind after the tax reductions and the business-friendly policies. Europe, and particularly the German car industry, is also concerned about the growth of protectionist measures.

Global economies growth (ETH Zurich/Swiss Economic Institute)

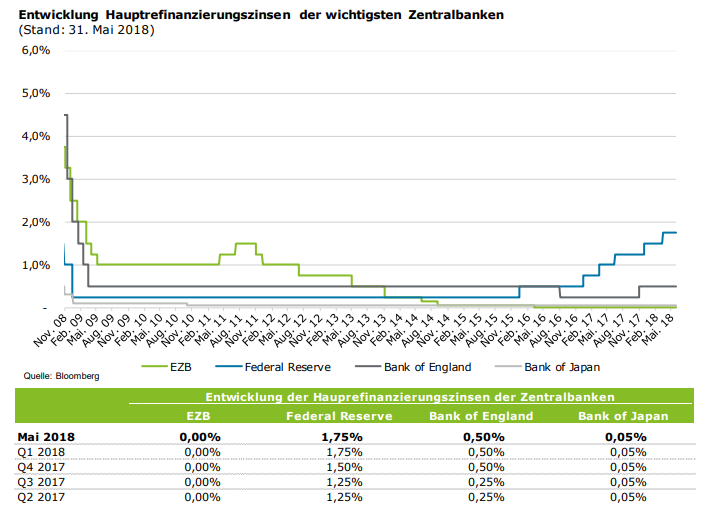

Interest rates

As far as interest rates are concerned, all eyes still are on America’s Fed. The movement is clearly towards further increased interest rates so long as the economy is steady, and in particular so long as stock markets perform reasonably well. Central banks and particularly the Fed are at pains to prevent any potential crisis which spreads from the financial markets. As the American economy is in good shape, the Fed is furthest along the track towards increasing or normalising interest levels. The US dollar has already gained ground but this could in turn cause problems in the emerging markets. But whether much attention will be paid to the emerging countries is questionable. On the other hand, the ECB is sticking to its previous position and stated at its latest meeting that it was safe to assume that the key lending rate “would remain at its current level at least until summer 2019 and, in any case as long as is necessary to ensure that movements in inflation consistently match our current expectations”.

Key central bank interest rate over time (Bloomberg)

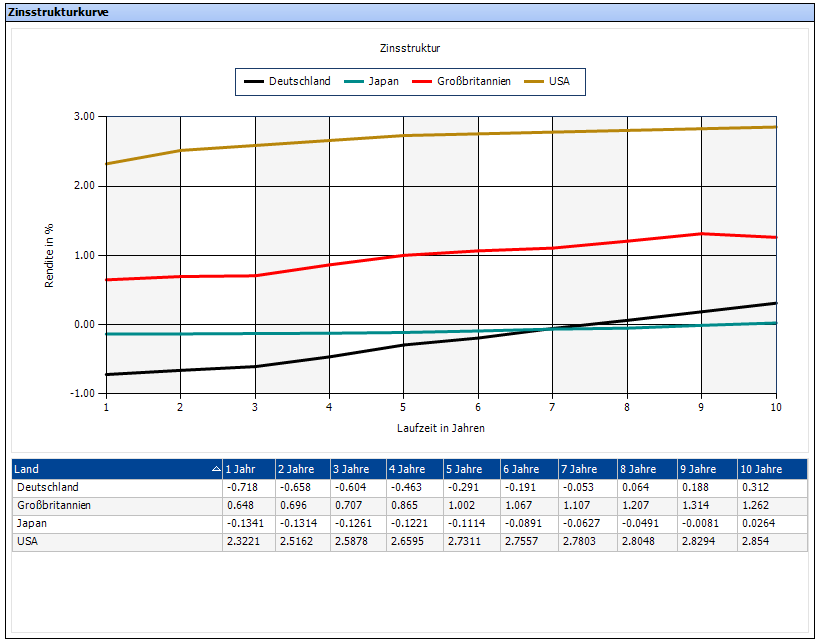

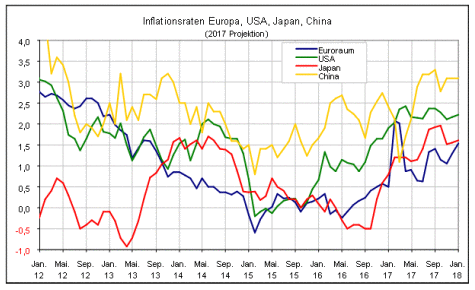

Thus changes in inflation will continue to be at the heart of things in the future. As a result of expectations of increased inflation, bond yields and net yields have increased everywhere in the world. Combined with improvements in the economic situation, this is not surprising. In this connection, all eyes are on the USA where the economic cycle is more advanced.

Interest rate yield curves (source: VWD)

Until now, inflation figures have been consistently lower than central bank expectations. We have to wait and see when and whether this will change. Inflation may well increase even if only slightly (increasing wages, low unemployment rates, etc. are favouring improvements in the income/price ratio). There are also those who are forecasting that inflation will get out of control because of the extremely loose monetary policy, but they are somewhat fewer in number than a few years ago. As we have mentioned in earlier editions of this review, little or nothing in the markets currently points towards a marked risk of inflation. Interest rates and the interest curve at the long end are moving at a similar, flat level.

Inflation over time

Companies

Given increasing interest rates and movements in inflation which are being very closely watched, some investors are thinking about switching their investments from one sector to another.

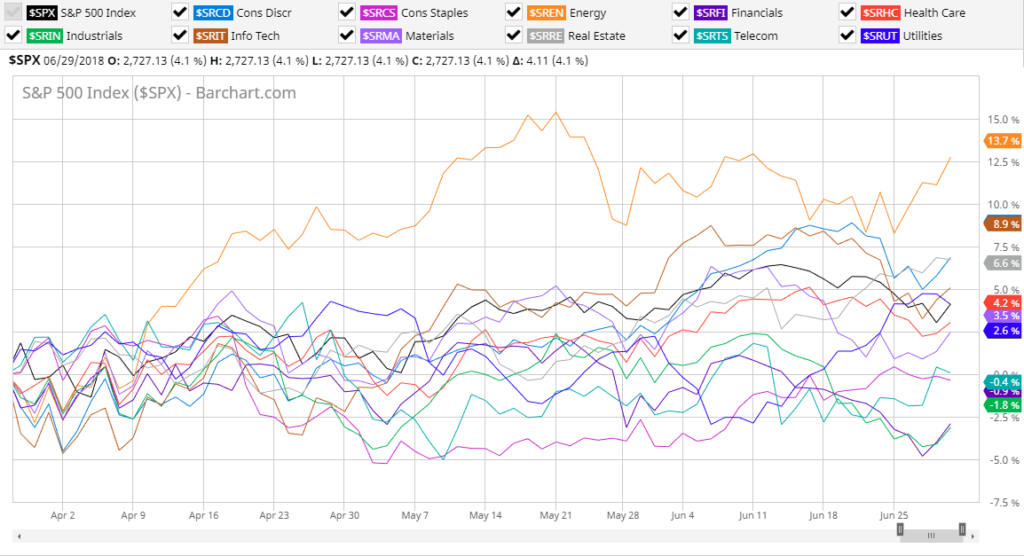

Equity market sectors (source: barcharts.com)

Just as in the first quarter, consumer goods and cyclical stocks generally increased. After a brief but sharp correction, technology stocks marked up gains. The momentum for technology stocks increased strongly once again towards the end of the quarter. The same goes for energy stocks, which have been benefiting from the increasing oil price for about a year. In recent years, this sector has taken a severe beating and there have been adjustments on the supply side.

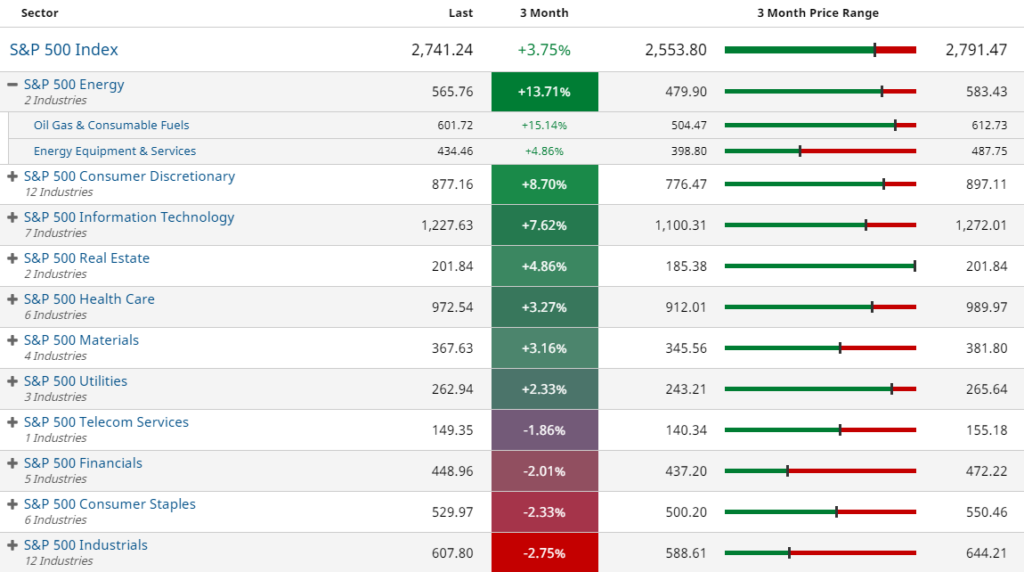

Equity sectors, focus energy (source: barcharts.com)

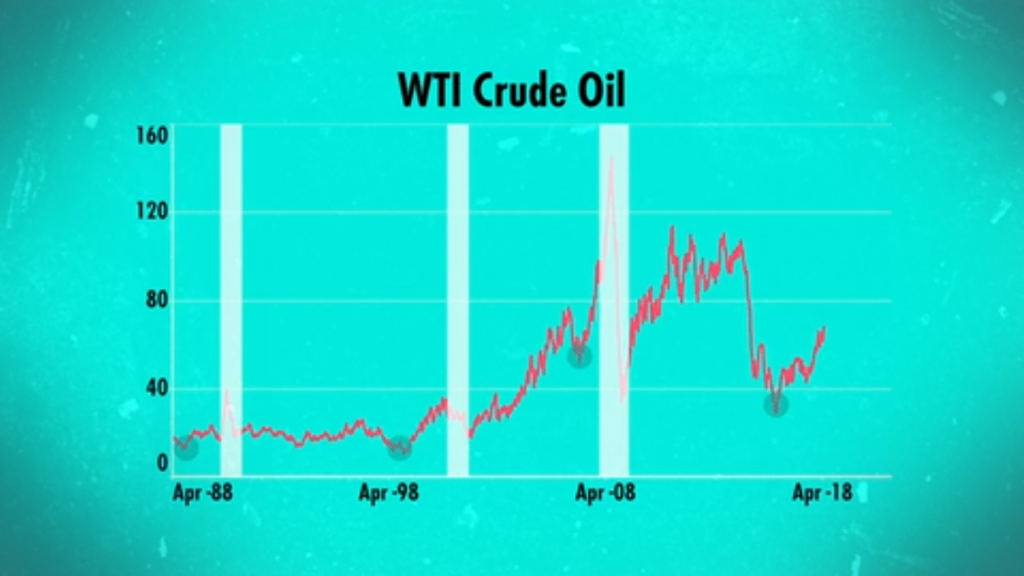

The industry can live with an oil price over USD 60 since the start of the year and some investors have rediscovered this sector after avoiding it for months on end. But many people doubt whether the price can consistently remain at this attractive level. In addition, a study shows that in the past, whenever crude oil significantly increased in price after a short-term rock-bottom low, the economy cooled off around one to two years later.

Crude oil and recessions

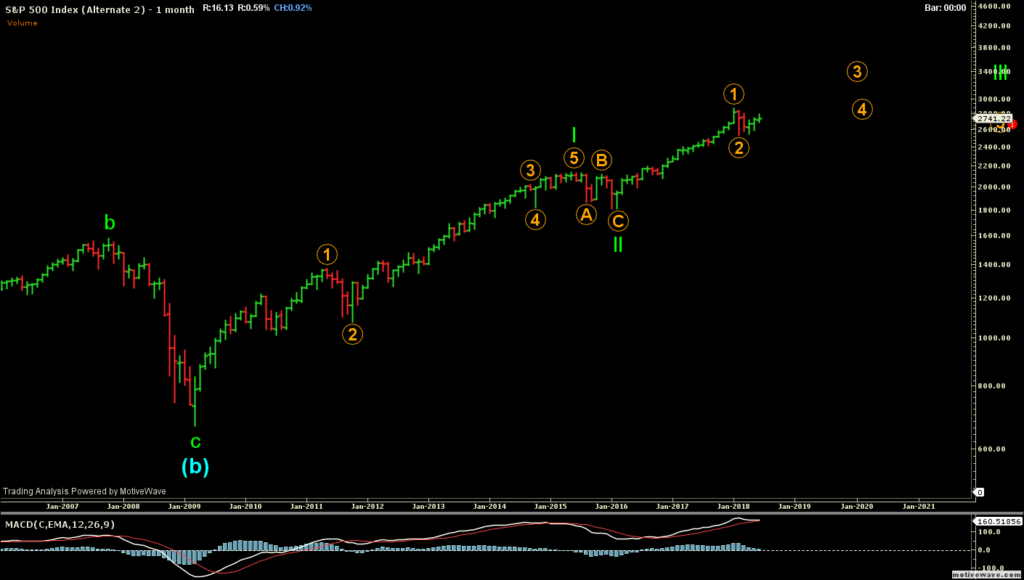

Technical aspects of the market

Most of the markets once again entered into a period of correction towards the end of the second quarter. It is difficult to avoid the impression that the markets are at a crossroads. Viewed from where we stand, there is a good chance that the upwards trend will pick up speed again. Whether the correction is already at an end will only become clear in the coming weeks or months. If the markets should break through the assumed support level, a downward momentum may well take hold. Aside from the technical aspects of the market, the pattern with continuing unattractive alternatives for investments (low interest rates) continues to be in favour of equities.

S&P 500 Index monthly

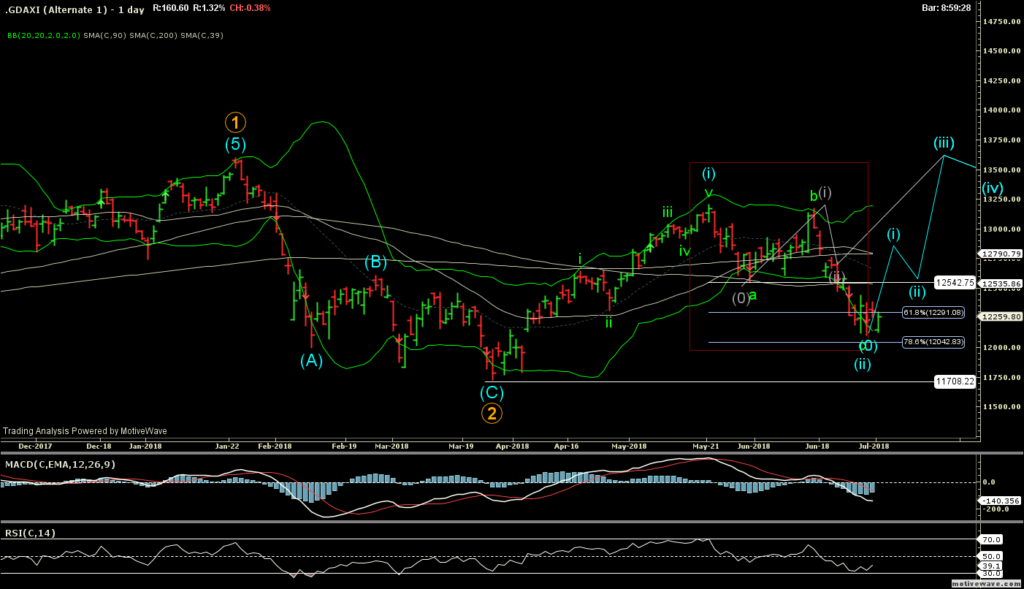

With the first quarter correction in the DAX it seemed the market is back to normal and is hiking up again. We have had our doubts and left it open for a second downward movement to happen yet. In fact, on June 21 the change point came with the new (interim) low of about 12,540. The next important zone of support is between just over 12,000 and 12,290, of which the most important one would be just over 11,700. It remains to be seen when the correction phase will reach its end. Chances are that with the end of June the market has found bottom.

DAX Index daily

Outlook

The markets were slightly nervous again following the latest correction. The high valuations and the often rather sparse liquidity are also contributing to this nervousness. However, it is evident from the options premiums and credit spreads that the large volumes of liquid funds currently available and in search of returns have until now prevented an escalation of the risk premiums. Some breathing space is being slowly provided by the upward movement of interest rates. Central banks plan to leave the markets to their own devices – but to watch them with care. Yet the general opinion is that this policy will only be pursued while things are going well: If they take a turn for the worse, central banks will revert to their old ways and intervene in support of the markets. The Fed has a new Chairman in the form of Jerome Powell and statistics tell us that for the first six months stock markets react unfavourably to a new Chairman. From this viewpoint, the current correction fits the scenario well. No noteworthy differences in policy can be seen. The term of office of Mario Draghi, the ECB Chairman, ends in October 2019. We will certainly be reading plenty about his potential successors. Overall we are expecting an increase in volatility and, along with the structural evolution which is already in progress, our attention over the medium term is directed at these topics.

Sincerley,

EDURAN AG

Leave a Reply