EDURAN NAVIGATOR

Quarterly Market Review with an Outlook.

Zurich, 22.07.2019

“Yin & Yang”. After two quarters of notably down and up moves in markets some stage of balance calmed down things. Most likely not to last for too long.

Yet again central banks give support

The second quarter 2019 was marked by consolidation or, a slowdown in recovery. After two opposing quarters (correction in the 4th quarter of 2018 and rally in the 1st quarter of 2019), the stock markets (index levels) are by and large near the level of the end of the 3rd quarter of 2018. Broken down to individual stocks, however, there are striking differences: active stock selection can be worthwhile! Looking over the course of the quarter, the big indexes under the bottom line, in particular, rallied once again.

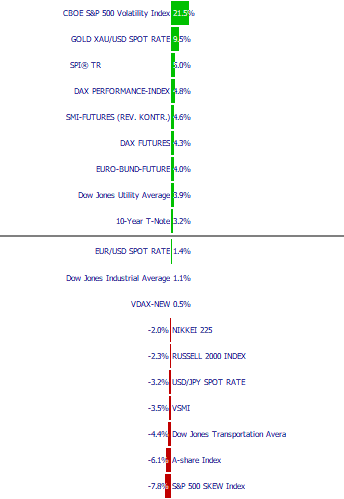

Markets overview Q2 2019

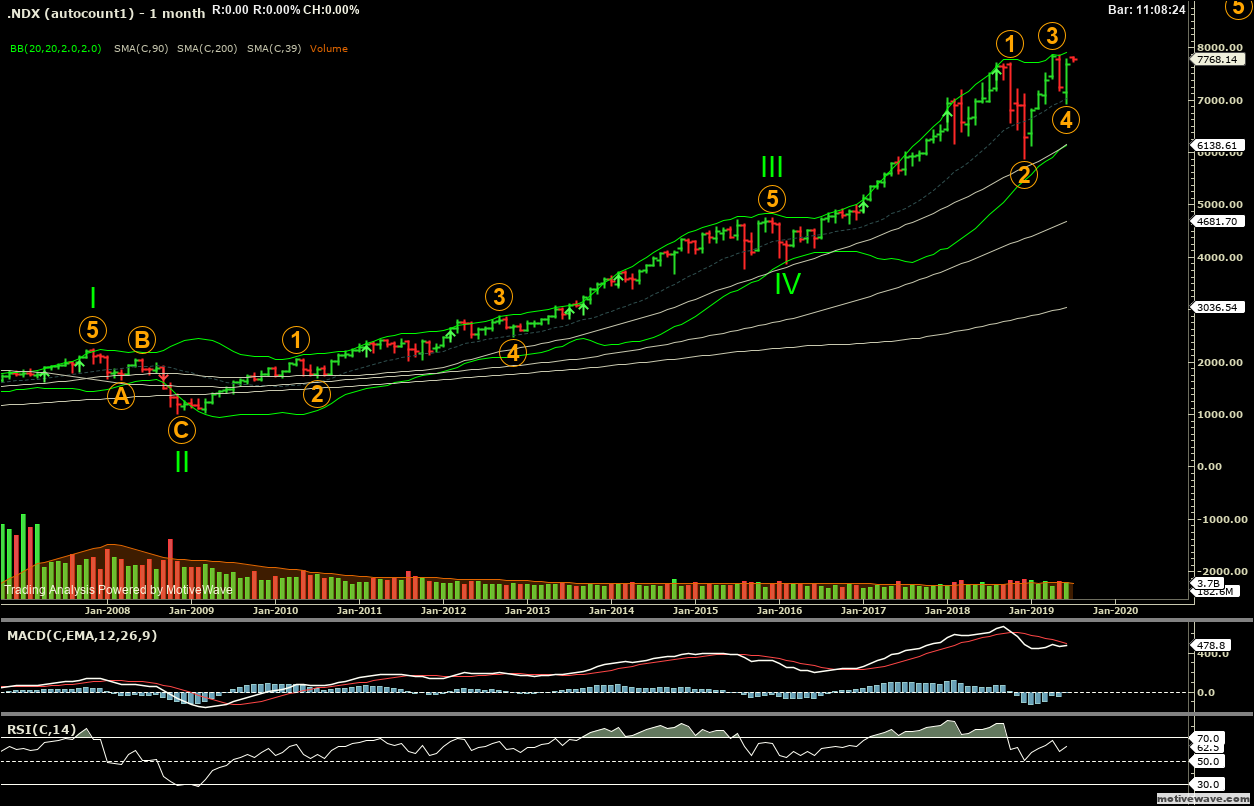

Broad stock indices or those with cycle-sensitive stocks suffered more than others. Asia, with its heavyweight China, took a correction above average (after a likewise strong 1st quarter). In terms of sectors, the quarter also ultimately painted a mixed picture (see separate section “Sectors” below). Also noteworthy is gold, which broke through the critical hurdle of $ 1350 / ounce. The VIX (the S&P 500’s volatility index) and the German VDAX ended the quarter above the 3-year average (the Swiss volatility index remains markedly below the 3-year average).

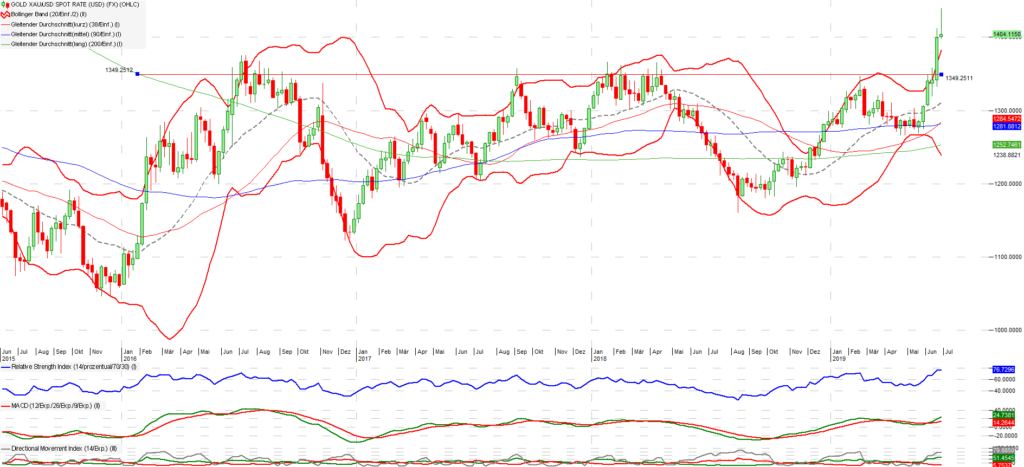

Gold breaking out and being bullish

Unlike in the two quarters before, the balance of power was relatively balanced, positions have been adjusted. The Bulls and Bears seem to have similarly strong arguments. On the one hand, there are the central banks, which have recently turned the script upside down and are refraining from further rate hikes, right down to markets preparing for interest rate cuts. The economy has lost momentum and seems to slow down. In the short term, growth could be fueled again, because in one year, the US presidential elections take place. It’s the economy, stupid! – President Trump knows that, too, and for instance could hand in a bit in reference to the tariff war with China for instance. At least, from this point of view, the trade war situation should not get worse until the US-election is over. Plus with lower interest rates, the economy could – via markets – gain new trajection to the upside again. The bears, on the other hand, see a progression of misery. Right now, it is feared that profit figures will disappoint or have disappointed; expectations have already been revised downwards. In the medium and long term, debt is putting pressure on growth (for those who don’t believe in MMT). If interest rates remain at a low level, it will do savers, future consumers and investments a disservice. Profits and incomes are unlikely to increase and bankruptcies will increase. Sooner or later, risk premiums would have to rise.

The central banks have the big task to find the optimal amount of money flow stimulus – and to communicate this optimally. If support is generous, the markets are expected to appreciate again. But it could also be, the Bears say, that we are already in recession and central banks, notably the dominant US central bank, is acting too late or too little. Looking at the leading indicators as well as the development of the most recent statistics in general, there is some evidence of temporary weakness. Effective numbers and sizes will be learned from the statistical offices, but only later, as is the nature of things.

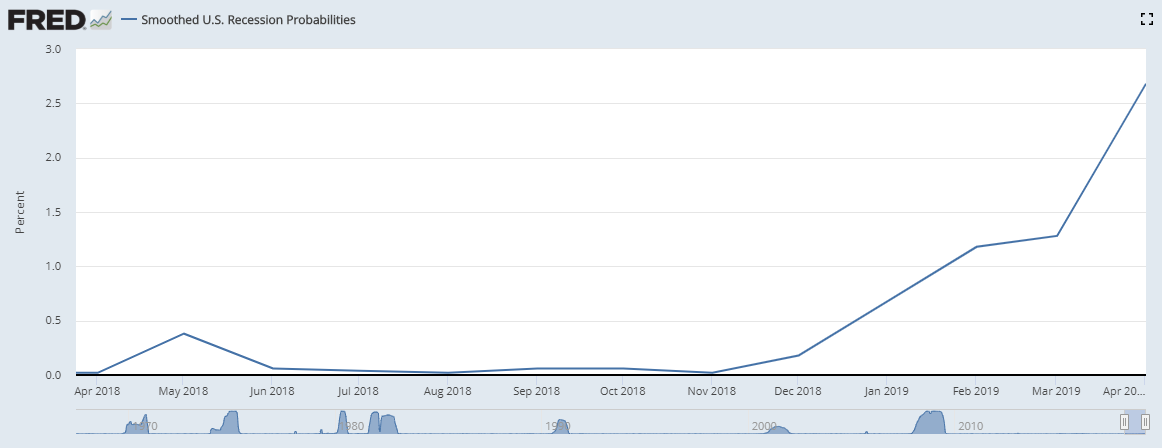

FED Recession Indicator

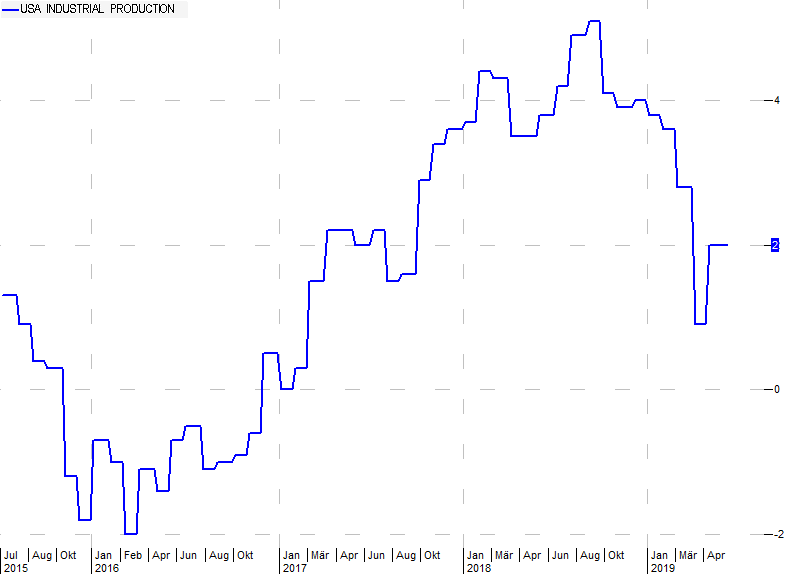

One of these leading indicators is the New York Fed index shown above. This index takes into account various factors such as the creation of new jobs, industrial production, the income situation, etc. (https://fred.stlouisfed.org/series/RECPROUSM156N). The weighty industrial production of the USA, for example, over the turn of the year has put an end to the previous increase for the time being.

U.S. industrial production

In the 4th quarter of 2019, markets were driven by fears of growth and in the first quarter of 2019 by the turnaround in interest rates; these two forces held steady in the second quarter and the adjustment of the position appears to be completed for the time being. The market has found its interim balance. With the outbreak of gold, the situation of interest rates, a possible relaxation – or not – in trade tariffs and a possible tightening in the various trouble spots worldwide, this may soon be different again.

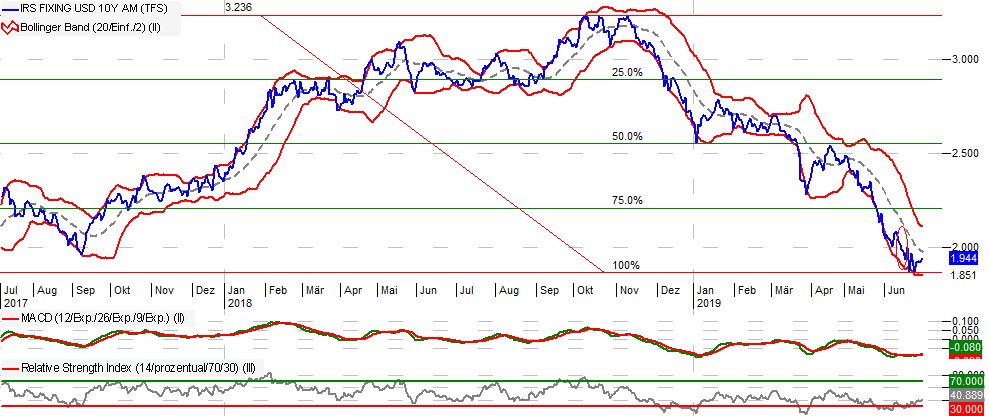

Interest rates

With the growing signs of a slowing economy, interest rates have consequently come under pressure. Readers of the Navigator recall the description in the fourth quarter of 2018, when interest rates collapsed along with burgeoning growth fears. Since then, there has been a dramatic downward movement that continued in this second quarter. Ten-year US Treasury yields have fallen below 2% this quarter – one feels sent back to the 2016 interest rate stone desert.

Yield of 10-year US-Treasuries

In other words, the “normalization” of interest rates announced by central banks – notably the US Fed – turns out to be a straw fire today. At least one tried to change it. After the ECB started to curb bond purchases in October and, according to the roadmap, wanted to start raising interest rates around one year later (in October 2019), a number of these are currently in question again. The striking difference in interest rates between the US and the EU seems more likely to be adjusted via a downward movement of US interest rates, rather than upward Euro interest rates (implications for USD FX). In regards of inflation, one could argue that when looking at capital markets, the issue of inflation seems to be off the table for the time being. The low interest rates or the inability to bring interest rates close to economic growth (EU) is more reminiscent of the situation in Japan and thus the specter of deflation.

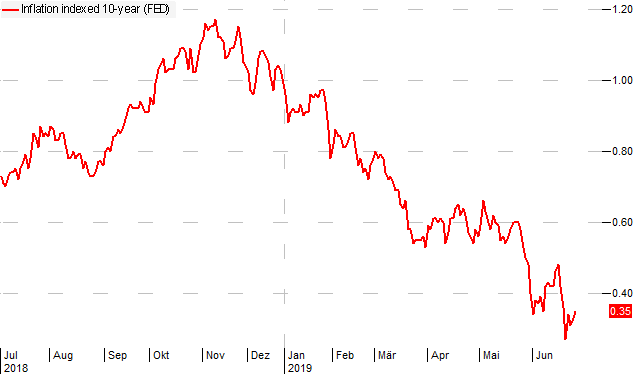

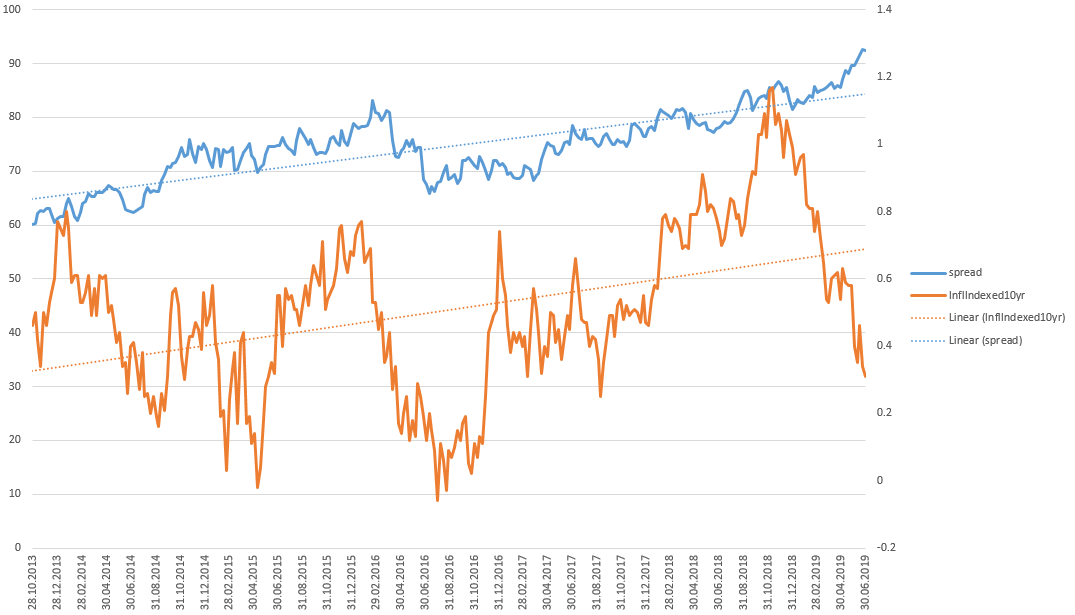

Inflation indexed 10-year

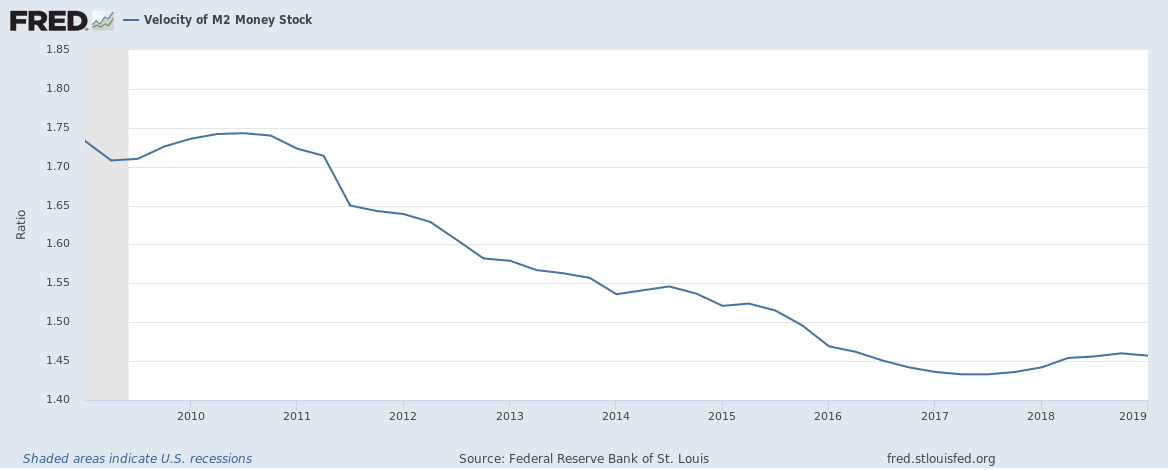

When talking about inflation, it makes sense find a definition of the term. For example, following the Austrian school, one can distinguish between monetary inflation, asset inflation, and consumer inflation. Only asset inflation has taken place so far. The monetary has been missing, that is, the desired size has not yet reached. Despite the record-high total assets of the central banks, the speed of circulation of the money (velocity of money) since the financial crisis of 2008/09 is close to the lows.

Velocity of money (M2 / U.S.)

Consumer inflation has increased slightly recently, at least in the US. Foods, for example, have experienced the strongest increase in 4 years. Commodities have come back slightly, probably due to the trade war / lower demand from China. With the recent slight shift in the trade-war to the resumption of negotiations, the likelihood that the price level will not rise much (if the trade tariffs were to remain or were to be developed, an increase in the medium and longer term would have been certain).

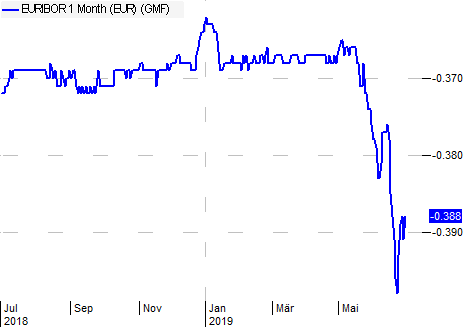

The big issue of inflation or deflation is likely to keep markets busy in the near future (fighting deflation foremost). The above-indicated rate of velocity of money should rise again when the banks are willing and able again to take more risks by lending – tricky with flat rate curve. Of course real life is pointing in the opposite direction: in 2018 European banks, for example, deposited a record EUR 7.5 billion with the ECB. Recently, for example, the Euribor (as well as the short-term forwards) has reached new lows.

Should the economic slowdown continue, however, this could lead to an increase in risk premiums. Due to the low interest rates, many companies (mainly in the US) were able to finance themselves well with a weak business performance and a low margin on the capital market. Also with economic slowdown, some are likely to run into trouble and bankruptcies will increase, which is supposed to increase risk premiums.

Euribor 1 Month (EUR)

Sectors / Companies

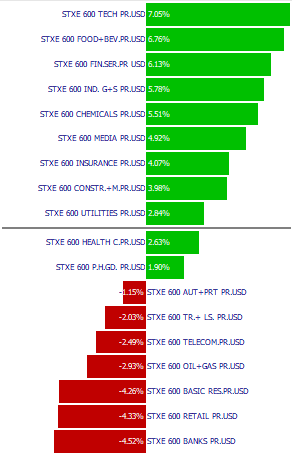

The sectors were handled differently. The majority gained, led by the technology sector.

The banks, once again, disappointed and have meanwhile marked lows on individual stocks (e.g. Deutsche Bank). Meanwhile a multiple year bear markets for banks which suffer from low interest rates as well as for some still from the aftermath of the financial crisis 2008/09. More to it, the market environment and pressure from disruptive technologies make it harder to maintain rich margins in operative business. Still, banks are important and we believe they belong, to some degree in a portfolio. Particularly when from a price point of view multiples look attractive. Of course sizing of position matters. Defensive stocks on the other hand, for a time, could float up to the top, due to the economic slowdown. Once again, the industrial sector was hit by a slowdown in growth, with the PMI falling just below the critical 50 mark again, most recently to 47.6 in June. The average value of the PMI in the 2nd quarter as low as last in the 1st quarter of 2013.

Swiss Perfomance Index Sectors overview for Q2 2019

The automotive industry, along with its suppliers, was able to increase some of the price, even if the business is sluggish or still carries relatively high risks. And it happens that prices are traded on the stock market. In this quarter, even the automotive suppliers that had been hit hard at the beginning of last year were able to bottom out in the second quarter, raising the prospect of stabilizing or higher prices.

Gold mines also grew in price strongly. With the rise in gold, as it typically goes, mines gained even more, for the time being the big and well-known names the most. Smaller and medium-sized names or stocks should catch up in a second round, should the price of gold continue to rise, especially those with a solid balance sheet.

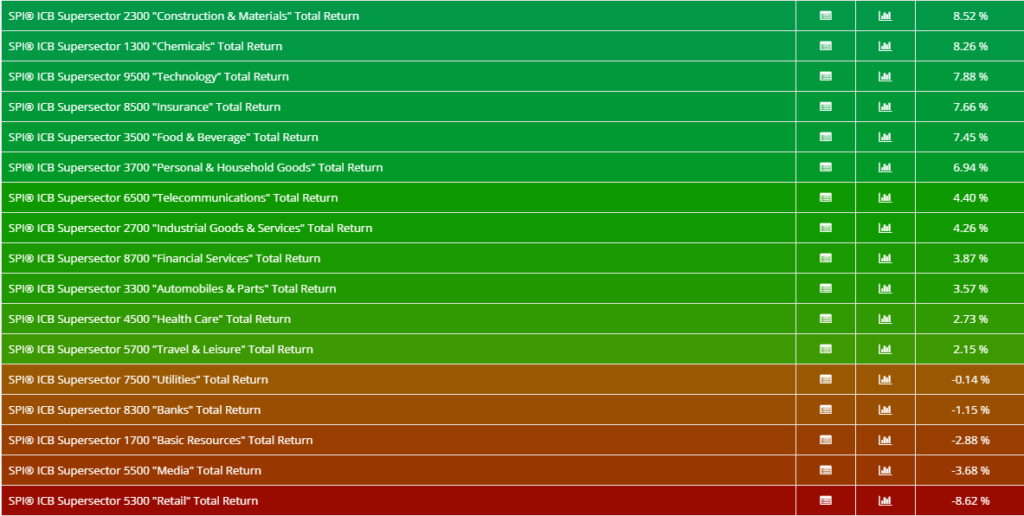

Charts

The upwards trend, over the course of the 2nd quarter, has remained intact and in the meantime, in May, even made a correction. There have been always dangers that the old lows could be undercut again. This has not proved to be the case so far, however.

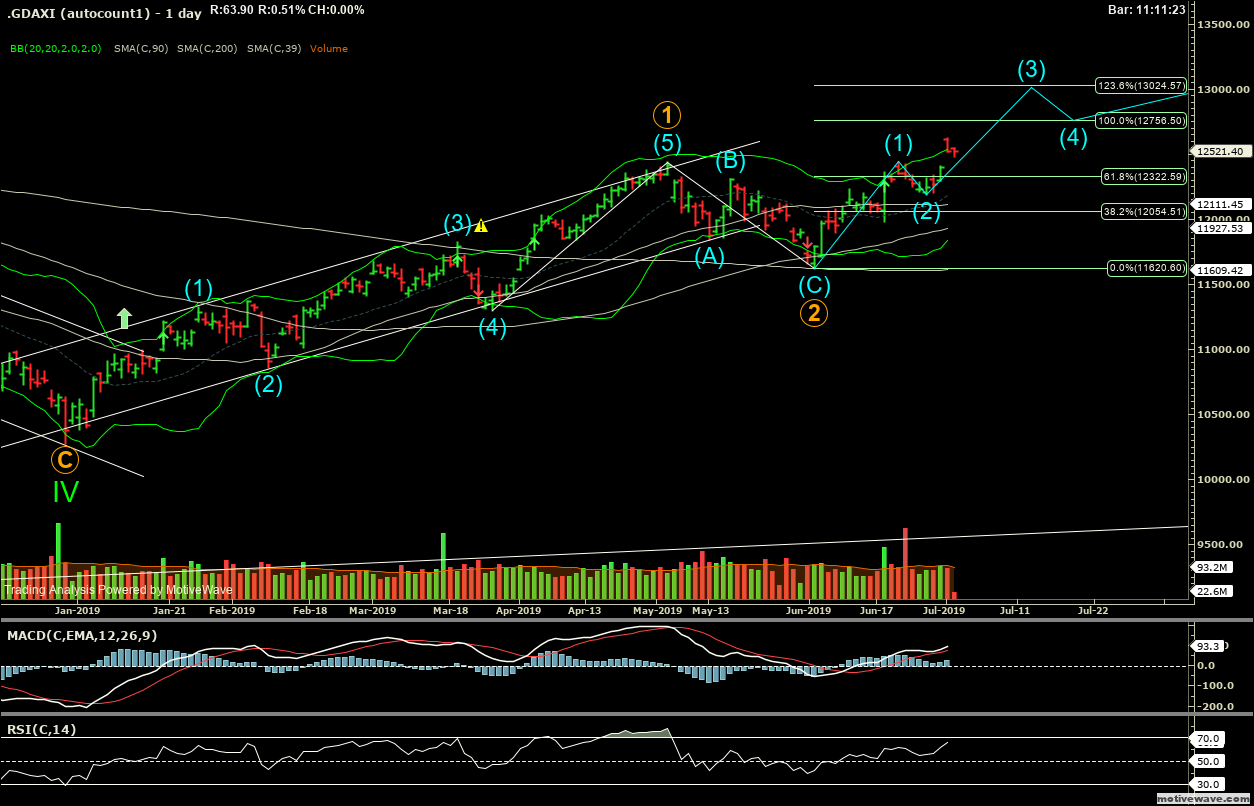

US markets – technically, and unlike the European stock markets – seem to be more advanced and in the final phase of the current uptrend. As an example: the technology stock exchange Nasdaq, which represents a part of the most capitalized US titles, is approaching the last leg up in the major uptrend (following this theory to follow, after a correction, with the last leg up in the major uptrend). All when looking at the chart only.

Gold came to a major technical breakout. Gold has been somewhat out of the focus of broad (investment) community for the past few years. With increasing stimulus and ever-increasing equity and asset valuations, well-known fund managers are increasingly announcing that they are investing in gold and gold mines. Now, maybe the next phase is to approach, where the general public is slowly coming back into the game. Price target USD 1600-1700, stop at 1350/1300.

With the outbreak of gold, the ratio of gold to silver also became interesting. For some observers, the ratio is an indicator of future inflation.

The breakout in gold happened almost simultaneously with the downside loss in the rising wedge pattern for USD. For the last couple of years, the dollar has been benefiting from the recovery in the US (Trump tax cuts), which has brought more funds back home. Against individual currencies, the USD currently tends to weakness. This is when looking at the chart. Looking at fundamentals, in particular at corporate debt, we find a record number of debt out there denominated in USD. When this is to be refinanced it could well put upwards pressure on the USD. So here, looking at both, one has to take it step by step and closely monitor the situation.

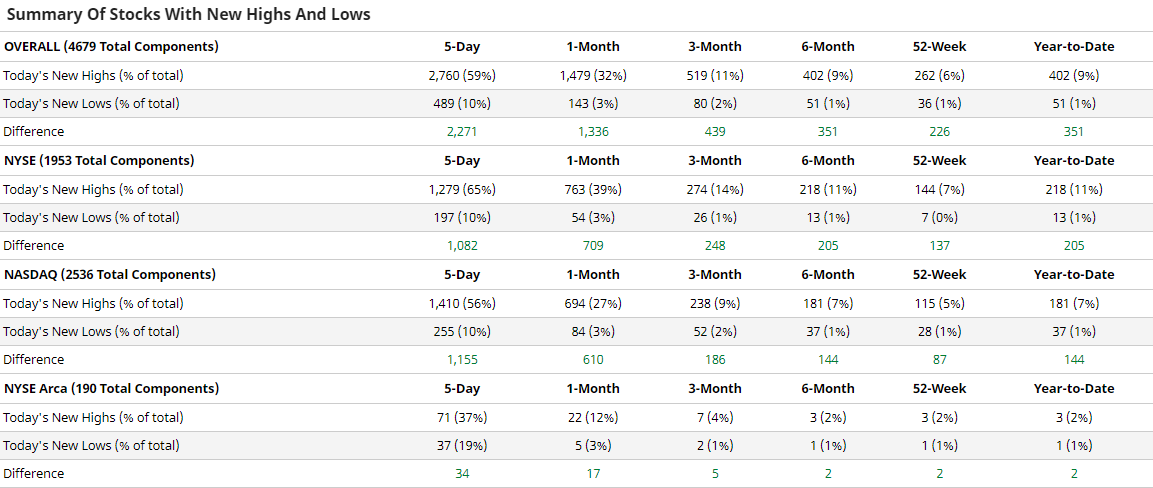

Momentum, measured by new highs, was able to increase at least in the US recently. Even in Europe, the losers of the last semester and year could catch something and avoid at least part of the lows.

Outlook

Markets, particularly equity markets, continue to be caught between the financial stimulus orchestrated by the central banks and the pressure to find a way out of it, and a weakened or slow-growing economy. If the economy weakens, it puts pressure on profits and, in response, central banks lower interest rates (or try to get money into circulation elsewhere). If the economy is running well or even so that even inflation rises (see Phillips curve with current low unemployment rate for instance), rising interest rates will depress valuations. It’s never easy and that said, also tricky in todays investing world. The challenge is, as generally stated, to be able to strike a balance between economic performance and “normalizing” interest rates. When talking about interest rates it becomes even more tricky since the yield curve has been highly influenced by central banks. One could even argue that the US-Fed for instance is not truly independent, having reacted to Presidents Trumps tax cuts and hence economy boost only when starting the journey of rising rates (which has been stopped by now and is on the way most likely to be reversed – as the tax stimulus is fading out too). Not enough, as at the same time there is a structural change of many parts of the economy going on. Technology as a driving factor will create new markets or market segments or simply turn business-processes on their heads. Growth titles can strategically provide a bright spot. It is important to identify sectors and – for the brave even single names – that benefit from such trends. Here too, one will be smarter in retrospect. Therefore, disciplined investing with strict risk management is recommended.

Returning to interest rate policy and central bank actions – probably the most important market driver these days and the backbone of the current bull market, it is expected that pressure on central banks will increase. President Trump wants lower interest rates, one hears. At best, however, interest rates return to levels where savers are not forgiven (interest rates in line with growth). As time progresses, the situation becomes more acute, but politics may postpone the decision for some time yet. MMT (modern monetary theory) is trying to make this tasty, but in our opinion, there is no perpetual motion machine, thanks to sophisticated policy – not even this time. In a worse case we are somewhere in a final stage of bubble building: debt has grown to high levels which asked for low rates (to sustain it) and furtheron to even be bought up by the public via central banks. Since on the interest rate side there is not much room left to help the situation next thing to do would be to weaken the currency (race to the bottom here too), where we see signs for this to continue (hence downwards pressure on US-yields too).

EDURAN AG

Leave a Reply