EDURAN NAVIGATOR

Quarterly Market Review with an Outlook.

Zurich, 11.10.2019

“Illusion vs. reality”. Today’s low interest rate environment suggests sufficient market liquidity – and yet there have been shortages. Risk premiums are likely to be rising.

Market Review

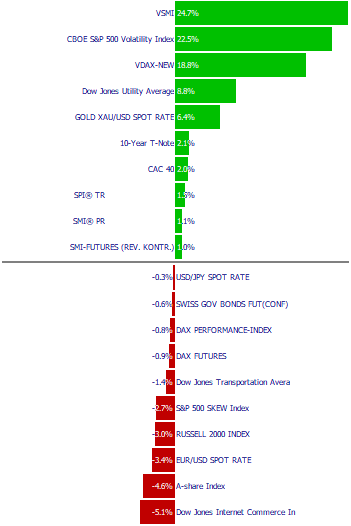

To a certain extent, the third quarter was dominated by a vacuum between the still sluggish growth outlook and the countervailing effects of lower interest rates. Even though analysts had corrected their corporate earnings forecasts downwards in the course of the year, around 75% of companies were able to meet or exceed their targets. For the coming year, analysts are again expecting profits to grow by around 10% (US). As the chart below shows, most major stock markets are virtually unchanged. On the interest rate side, there has been widespread coverage of the change in leadership at the ECB, where Christiane Lagarde has already announced that she will likely deliver more, rather than less, stimulus. Markets have generally moved sideways, albeit in a very broad range, which at times rattled investors’ nerves (and put a dent in their bank accounts).

Overview on markets for Q3 2019

As the previous report suggested, the gold price has technically broken out and rallied throughout the quarter, while consolidating somewhat towards the end of September. The macroeconomic outlook continues to support at least a modicum of exposure to gold. Towards the end of the quarter, small and mid-cap stocks were able to recover some ground for the first time in months. Like the rest of the market, they generally bottomed out during the slump in August. In contrast with the previous quarter, volatility has been markedly on the rise. The risk premiums for bonds increased during the slump in August, while bond prices generally rose over the quarter (due to lower interest rates).

Market Insight

Earnings growth

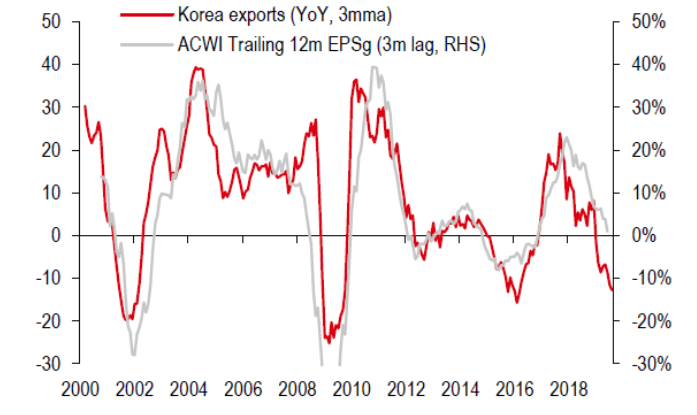

As regards earnings growth, analysts are currently assessing whether there will be a broader economic downturn, or if we are simply witnessing a slowdown in growth similar to the one in 2015, so that companies will soon report greater profits again. There are currently signals and indicators supporting either of these scenarios (although we see in tendency the first one becoming more convincing). South Korea’s open and export-oriented economy has previously served as a reliable early indicator of global growth trends. Recently, South Korean exports have slowed down, which would typically be followed by a period of weaker corporate earnings.

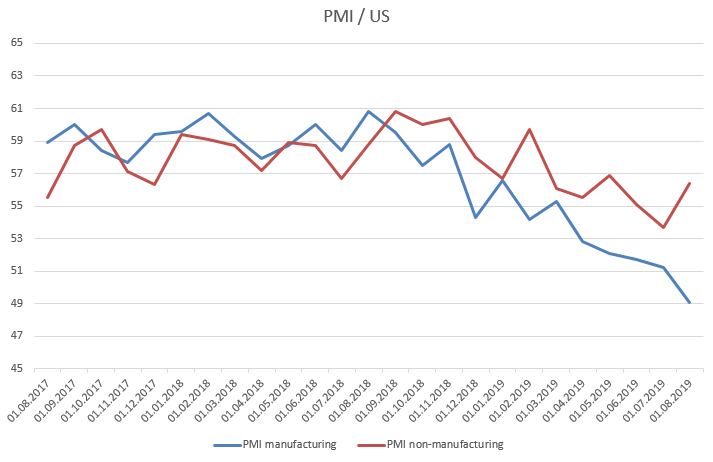

In most major economies, purchasing managers’ indices have also been down, and in the world’s largest economy (US) the PMI fell below the critical level of 50 points at the beginning of the third quarter. On the other hand, there are early indicators that the automotive sector appears to be recovering. For September sales have picked up vs August and on a yoy-basis August was up vs August 2018. For the total 4th quarter however forecasts still see a reduction in sales compared to 2018. Also in May China introduced a new law which asks for “National 3”-level cars to change it into the next generation until end of 2020. On a net basis this would be about roughly 20Mio cars to be sold. A more stable or improving car industry could be key to the overall industry since its downturn expanded into neighbouring industry secotors. This would support the second thesis – namely a short slump rather than a broad or deep recession – as the cause of the current slowdown in growth.

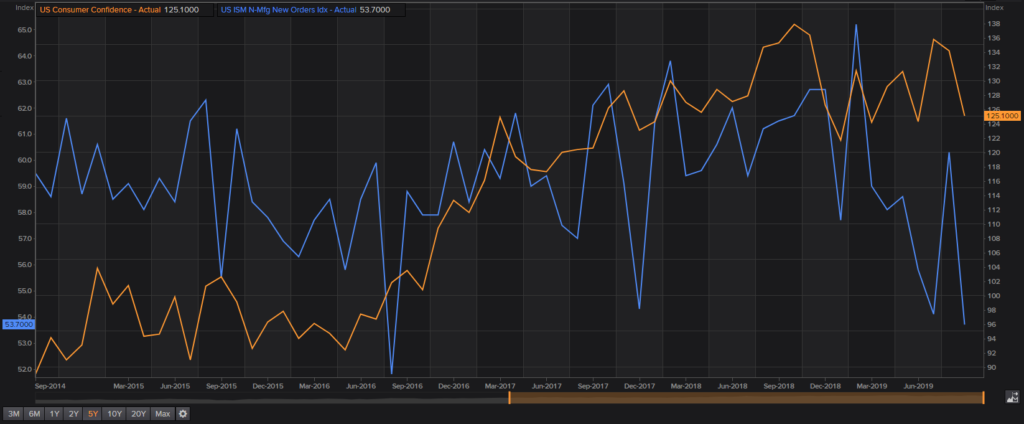

The slowdown of the industrial sector that has so far not affected consumer spending, which remains strong. It should be added, however, that consumer sentiment generally exhibits a delayed response to slowing industrial growth. Recently first industrial companies have contacted the governmental programms to bring financial support if production will be cut any time soon (reduced working hours).

Consumer Confidence Index vs PMI (US ISM new orders)

Yet another important factor in terms of growth is – of course – China. After almost 3 decades, the Chinese engine seems to have come to a at least slowdown. The Central Committee has already announced to switch from being the worlds production site and to develop and strengthen the Chinese domestic market. Growth rates of 8 or 10% are likely to be history, the official 6% to be questioned too. Hardly nobody knows how strong the effective growth in reality is. On top, one can assume that China is even more in the debt trap than the West (of the USD 3trillion reserve most likely 2 are not very liquid and the banks and economy is in need, some talks, of close to USD 2trillion). Following the global financial crisis of 08/09, the government supported the economy with massive amounts of money, then again in 2015 plus in the following years. The banks are very weakly capitalised (assumption 2%) and increasingly dependent on external lenders (shadow banking system and USD borrowing via Hong Kong). US trade policy is hitting China at an inopportune time. China could stumble more and more, which would hit export-oriented nations such as Germany and thus the earnings prospects of companies much harder.

Central Bank Stimulus

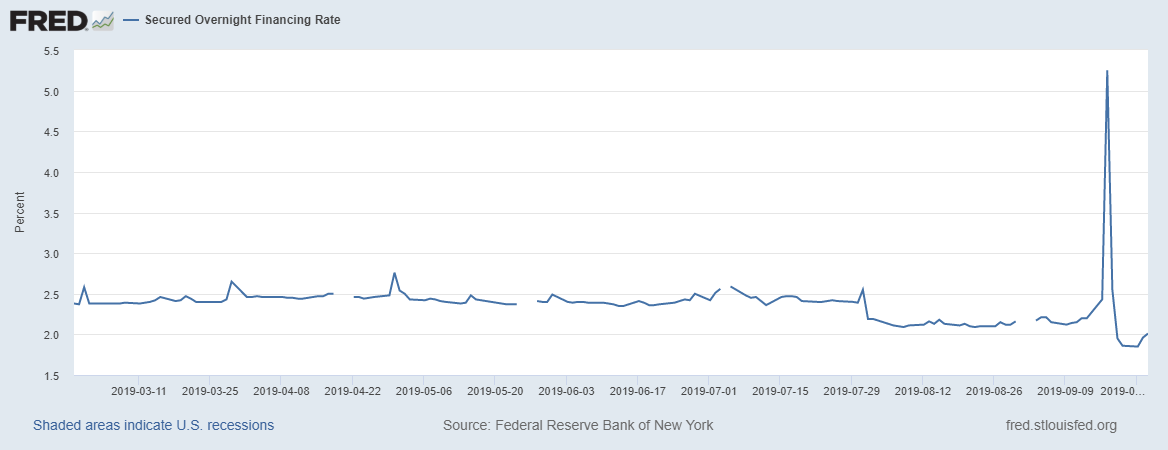

On the other hand, low interest rates have provided some economic stimulus, as mentioned above. Analysts are also discussing – and evaluating – whether central banks should resume or expand their purchases of securities (variously known as quantitative easing or by other names). This has given stock markets a boost. The extra liquidity that central bank stimulus creates tends to flow into value investments such as equities, real estate or even art, less so or not at all into the real economy. In addition, interbank rates (repo) jumped to around 10% on September 17/18, instead of their expected levels of 2-2.25% (the Fed fund rates at the time, which now stand at 1.75-2%). We consider this to be a crucial issue, which concerns the heart of financial markets where the liquidity of banks should be assured. This suggests that the US Federal Reserve does not (always) have liquidity under control. In the wake of this realisation, risk premiums could rise (and they already have) because not everyone is able to access the ample liquidity that is available at the anticipated interest rates, meaning that some market participants could get into trouble, even if central banks inject more money. This illustrates that conventional monetary policy is at the end of its wits. The change of leadership at the ECB, where former IMF chairwoman (and French government minister) Christine Lagarde is set to take over, thus comes at the right time. Based on what she said during her first press conference, it can be assumed that the ECB’s current policy is set to be expanded, with even more purchases of securities, if need be including shares, and additional “creative” measures (e.g. MMT). So far, this is uncharted territory, but it has given rise to some fears, for example that a currency reform is imminent.

Despite the generous monetary policy, there was a liquidity shortage on the interbank market in the night of 17th September. The repo rate has jumped to up to 10%, where it would be considered that the banks could finance themselves close to or within the target range of the Fed fund rates (old 2-2.25%, new (18 Sept) 1.75-2%). It seems that not everyone can finance themselves at the proposed interest rates. The risk premiums should rise (there seems to be a problem with the collateral/collateral). As a consequence, a steeper yield curve is expected, where longer-term rates are likely to rise relative to short-term rates.

Yields

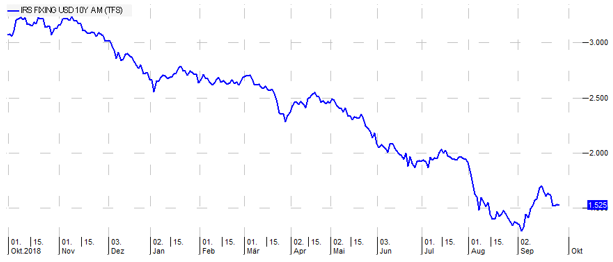

Yields continue to be under pressure, and 10-year US yields came close to their July 2016 lows at the beginning of September. However, September marked a turnaround as yields again started to rise. In other words, the US dollar yield curve has become somewhat steeper (bear steepener). In Europe, the interest rates/yields on German 10-year government bonds also initially came under pressure but then rose again in September.

10-year yield US-Treasuries

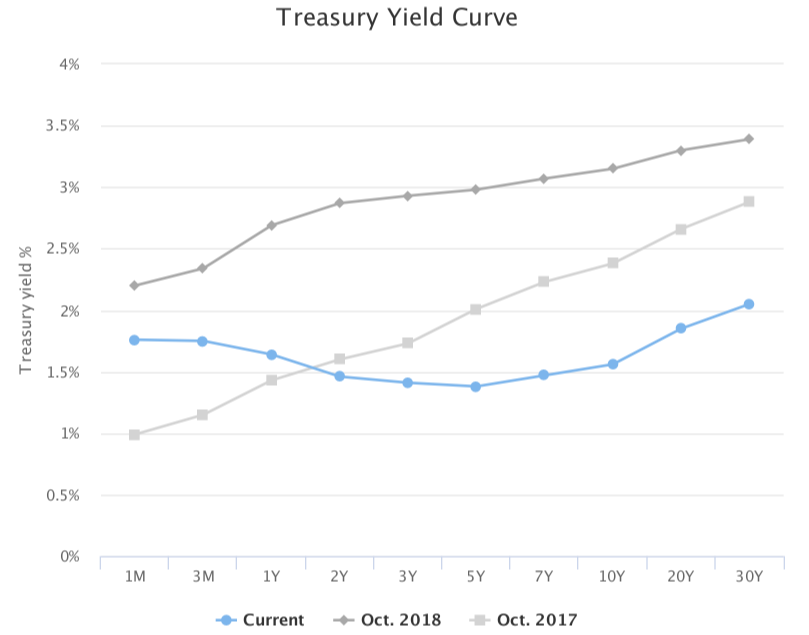

As reported earlier in the Navigator, the yield curves – above all those of the lead economy in the USA – have flattened out. The spread (difference) between short-term interest rates and longer-term interest rates has slipped into negative territory (the 3-month rate vs. the 10-year Treasury yield), which historically has led to a recession (since 1973 there has been a recession within two years). However, there has not been such courageous intervention by central banks in history.

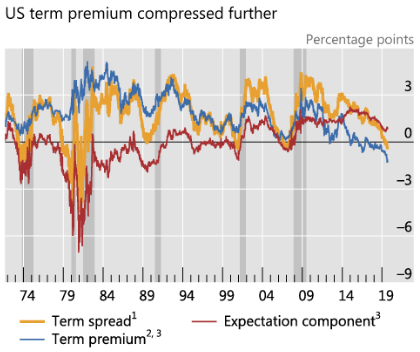

That said, it is worthwhile considering the term premium: In fact, the recent reversal of the US Treasury curve coincided with exceptionally high pressure on term premiums. US Treasury forward premiums have been declining since the Great Financial Crisis, probably due to demand pressure from price-inelastic buyers such as central banks, pension funds and life insurers. The current combination of a negative term premium and a weakening monetary policy stance is also unusual, as a tighter monetary policy stance has been in place in recent episodes.

In view of such complications, it might make sense to examine other indicators of recession risk. In addition to the 10y-3m term spreads, the literature has identified several other measures that may indicate an imminent economic slowdown. For example, a low short-term forward spread or a stretched surplus bond premium, which all add up to a certain probability of recession risk.

Sectors

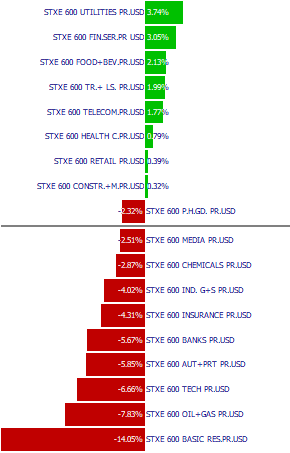

Among the different sectors, utilities performed best, followed by financial service providers. Banks, on the other hand, saw a weaker performance and closed the quarter (slightly) down across the sector. However, there is some hope that banks have started to bottom out and will soon enter a small recovery – but this remains to be seen. In general, defensive, non-cyclical sectors have rallied, which makes sense at a time when recession is imminent. On the other hand, cyclical industries, especially the automotive sector, remained under pressure (as did downstream industries). In September, towards the end of the quarter, they also saw a small recovery.

Sector Overview Q3 2019

In regards to gold/gold mines, the quarter began with an upswing and then to consolidate at a higher level. With the shift towards lower interest rates in the USD, demand for the precious metal is likely to remain intact. Technically, gold soon could take another step up. Also silver is ready to “boost”, especially as the relatively low historical gold-silver ratio (Navigator 2nd quarter). After the surprise attack on the largest refinery of the Saudis, the price of oil rose sharply, correcting immediately in the direction of previous levels after the Saudi Arabian Ministry of Energy had injected existing oil reserves. A temporary stay in the $57-62 range is likely, with a breakout likely to initiate a new trend.

Technical Market Analysis / Charts

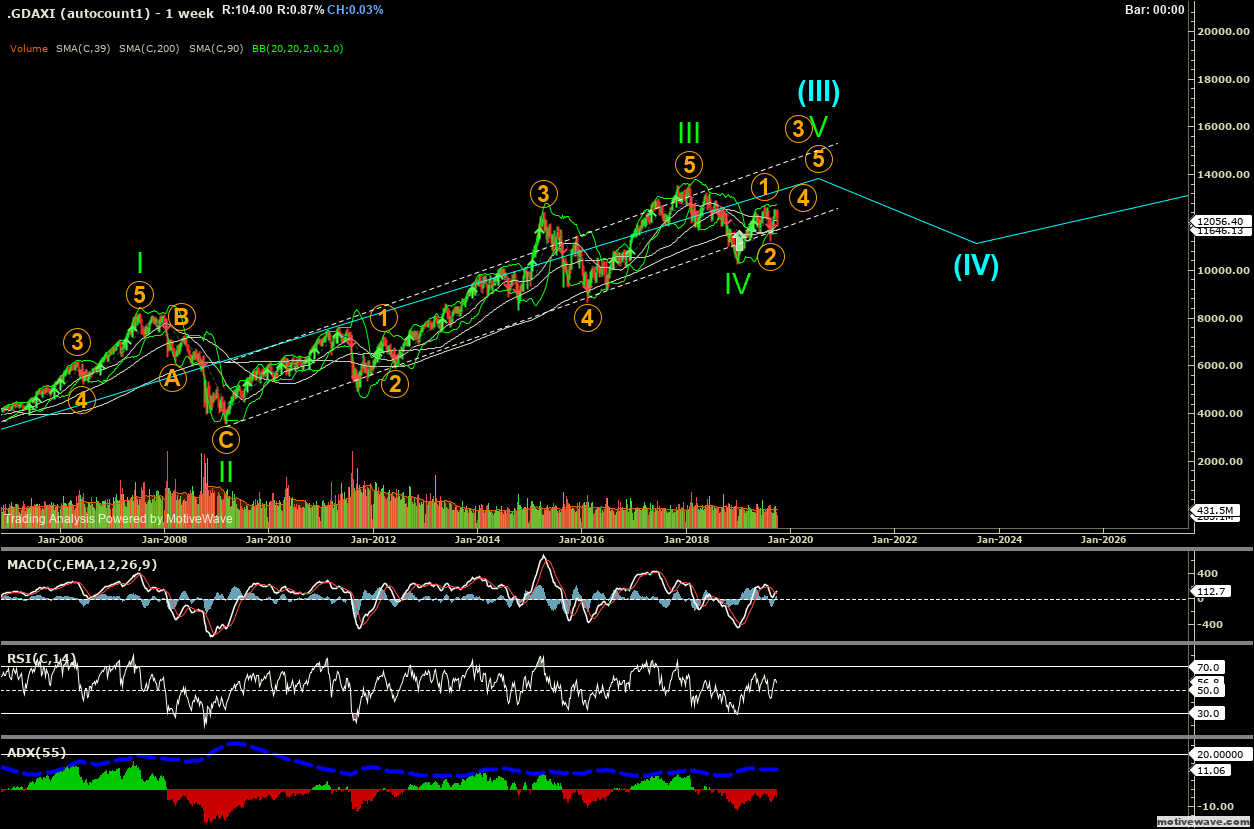

As we outlined in the last quarter, at the beginning of 2019, markets emerged from the correction that began earlier in 2018 and accelerated in the fourth quarter, and this upward trend is currently continuing. The positive scenario thus appears to have prevailed. The alternative scenario – which may yet materialise – would be a longer sideways movement with new lows but no actual upward breakout for some time (ending diagonal). However, even in the positive scenario, there is relatively little room for upward movement, and a further, possibly larger, correction is already expected for 2020.

Dax weekly chart

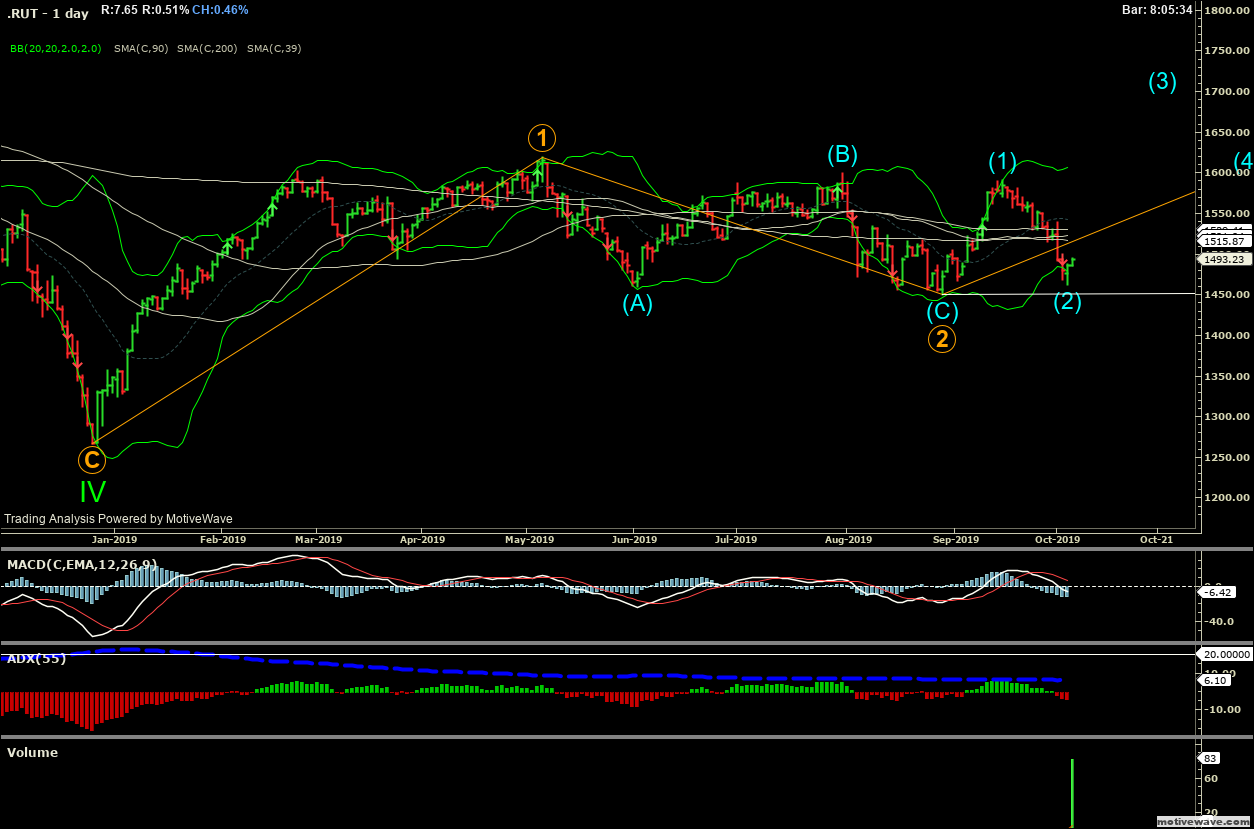

The outlook for the US continues to be somewhat different, with a more advanced upward trend. This also applies to the major indices of blue chips heavy-weights. Meanwhile, the broader Russel 2000 index is still lagging behind, but it may make up some ground in the near future (from a purely technical point of view). What is important, however, is that it won’t drop below 1450 points.

Russel 2000 daily chart

Along with the breakout in gold, the price ratio of gold to silver is also significant. Some observers regard this ratio as an indicator of future inflation.

Outlook

In the short term, indicators of market turmoil prevail. Given the widespread uncertainty, it may well be that a correction will occur in the fourth quarter or in the first half of 2020. In our view, the main problem is China: much is being said and written about the Chinese economy, but only very limited and rudimentary official data is available. The government still puts the growth rate at 6%, but according to official sources wages have hardly risen, if at all, which makes little sense. For analysts with a dedicated focus on China, the country poses a huge problem due its levels of debt – in essence, growth has been bought on credit. With an average of only 2%, the banks’ capital reserves are spread very thin, and they have recently had to borrow more US dollars via Hong Kong. The central bank still has large reserves of USD 3 trillion, but only about a third of these are liquid. The trade dispute with the US also comes at an extremely unfavourable time, as growth is likely already sluggish. Devaluing the currency would be counterproductive as it would put further strain on Chinese companies, whose debt is often denominated in US dollars.

As the Chinese economic engine sputters, Western markets are also faltering, and it remains to be seen whether this represents a momentary lull or a full-blown recession. As the thesis stated above has shown, a recession is in the cards. However, the downturn will not necessarily go hand in hand with the kind of stock market crash that we saw 10 years ago.

In the longer term, the outlook for stocks remains favourable, especially compared to other assets such as bonds. Gold continues to play a welcome stabilising role.

Yours sincerely,

EDURAN AG

Leave a Reply