EDURAN NAVIGATOR

Quarterly Market review with outlook. First Quarter comes with overdue correction

Zurich, 28-Sep-2018

“Take a break”. The markets have continued their upwards trend across most sectors. However, some sectors and stocks have since noticeably corrected or have been taking a break.

The upwards trend continued

Markets continued the positive trend across most sectors. The MSCI World Index rose by around 5% during the quarter. This is primarily due to growth stocks, where, for example, the Nasdaq 100 saw a boost of around 7%. On the other hand, emerging markets suffered from a stronger USD which weighted on servicing the local debt taken in foreign currencies such as USD. These countries have more than tripled their debt in roughly the last 10 years (in industrialised nations, by contrast, debt grew by around 25%). Turkey also made headlines, seeing major capital outflows. The MSCI Emerging Markets has now lost around 4%.

MSCI emerging markets (ishares etf) in correction-mode.

Punitive tariffs remained a focus as a result of repeated new threats and countermeasures. We believe that the USA sees the whole thing as a means to an end and is ultimately targeting free-trade with comparable trading conditions for everyone. During this process to achieve a fairer global trade it wouldn’t be a surprise if there is increased uncertainty and unpleasant market reactions. However, our focus is more on interest rate development and as a consequence of this on the USD which is fundamental to markets.

Interest rates

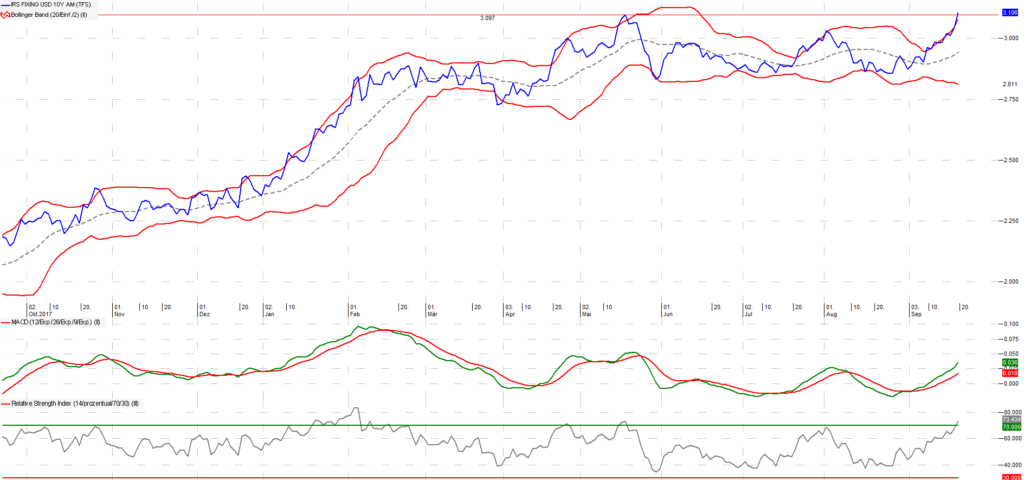

The Federal Reserve is using the opportunity and, in line with its announcements, made its third interest rate hike this year before the end of the quarter on 26 September. Another four hikes are expected to follow by the end of 2019. The Fed is skilfully making use of the opportunity because the ECB and the Bank of Japan are still providing enough liquidity that there will not be any bottlenecks in the USA either. Next year, the screw will then also be tightened in the Eurozone – the US should by then have virtually “normalised” its central bank rates already at 2.75-3%. Nothing has changed in the trend towards the yield curve flattening (USA). Even if everything or at least some things are to be different from the past this time – a flat yield curve sooner or later leads to an erosion of profit margins. If not the free economy itself, then the question is: what means should be used in future – including outside of interest-rate policy – to make the yield curve steep again. We probably won’t be able to comment on this until future Navigator reports.

The yields on 10-year US government bonds had another go at clearing the 3% hurdle towards the end of the quarter (at around 3.1% as resistance). The dice have not yet fallen in this respect. If you believe the capital markets, then interest rates are not likely to rise significantly further. From a technical point of view, however, the 3.3% threshold could lead to a possible adjustment of positions.

10-year-US-treasury-yield nibbling at resistance

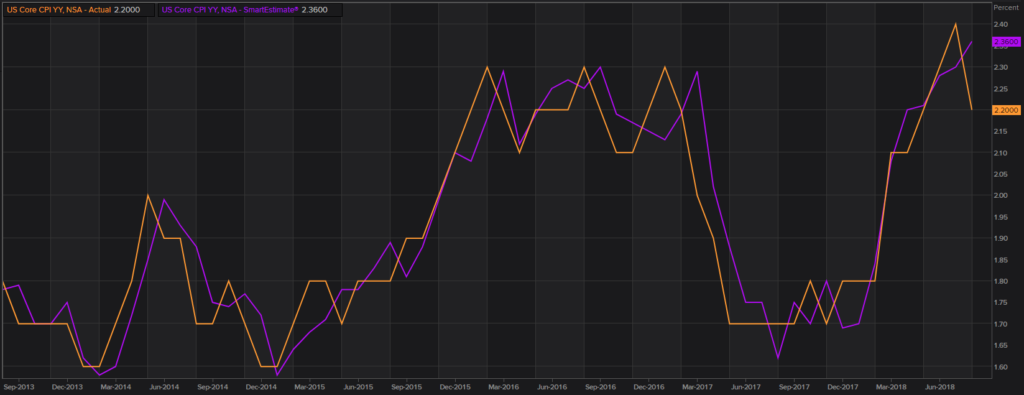

In the USA, inflation has gathered pace since 2015 and continued to do so in the past quarter, albeit at a somewhat flatter rate.

US inflation (reuters)

In Germany, inflation has been slightly more moderate recently.

Inflation Germany (reuters)

Companies / Sectors

Broken down by sector, health stocks were able to make up ground that they lost in the first half of the year. So were industrial and tech stocks. The latter caused talk because some of the well-known FAANG-stocks experienced major fluctuations. For example, Facebook dropped by around 19% on 26 July, the largest loss within one day ever recorded for a listed company. On the day before, the company had announced that earnings and sales growth were likely to be somewhat lower in the second half of the year.

Facebook earnings (reuters)

Netflix too, started a correction – or pause – with beginning of the third quarter. Yet other tech companies, such as Tesla for instance, also became a talking point when its CEO and major shareholder (19.7%) Elon Musk announced on Twitter on 7 August that he was considering taking the company private. The share fluctuated significantly over the course of the quarter. On 7 August, it came close to its all-time high of September 2017, only to find itself down by around 30% on 7 September and thus almost back down to the this year’s low, which it hit in April.

FAANG-stocks price developement over course of third quarter 2018 (reuters)

In Switzerland too, there were in some cases some rather significant corrections: around 1/5 of the equities in the SPI have corrected by 10% or more. This again includes companies that have revised their growth outlook slightly down. Or simply also those whose thin liquidity could not withstand profit-taking (see also the Spotlight post of 18 September 2018 in the blog). Some of them, e.g. Hochdorf, could soon bottom out.

Hochdorf-share already far in consolidation or correction mode, potentially finding ground soon.

Mining equities also to some extent tended to be on the solid side. We have also long had a focus on gold-mine shares, preferably those with a high level of debt. They could see good share price gains this quarter. Oil equities have also gained new interest.

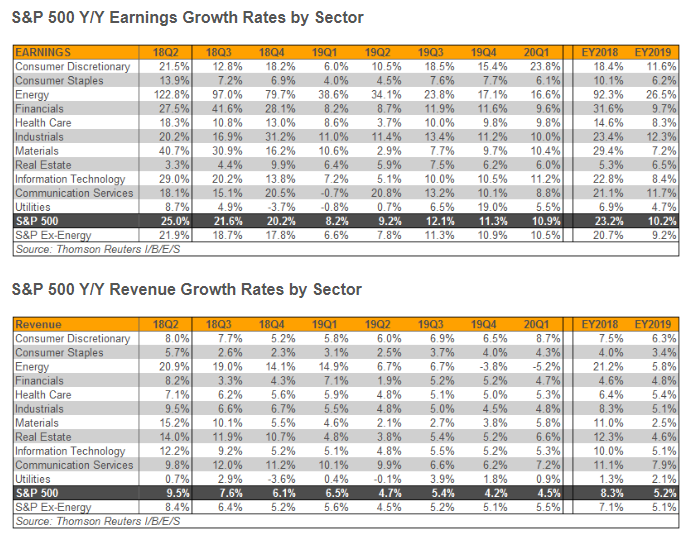

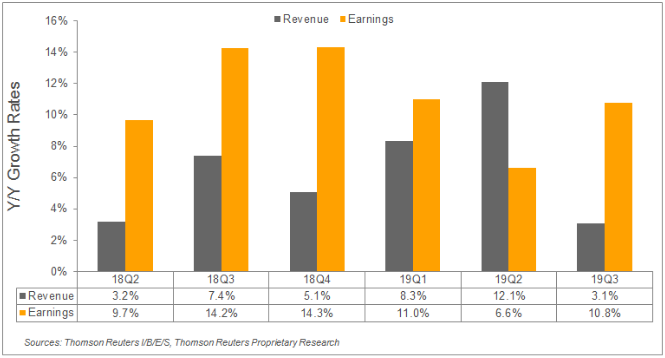

Generally, solid growth figures are needed for further share price gains, especially in an environment of rising interest rates. Expectations were and remain high. For the STOXX 600 index, the tendency is to expect somewhat lower earnings growth from next year, but higher sales growth rates for the first half of the year. It remains to be seen whether companies can deliver here. The air may become somewhat thinner here for some.

S&P 500 earning and sales growth by sector (reuters)

STOXX 600 earnings and sales growth (reuters)

Technical aspects of the market

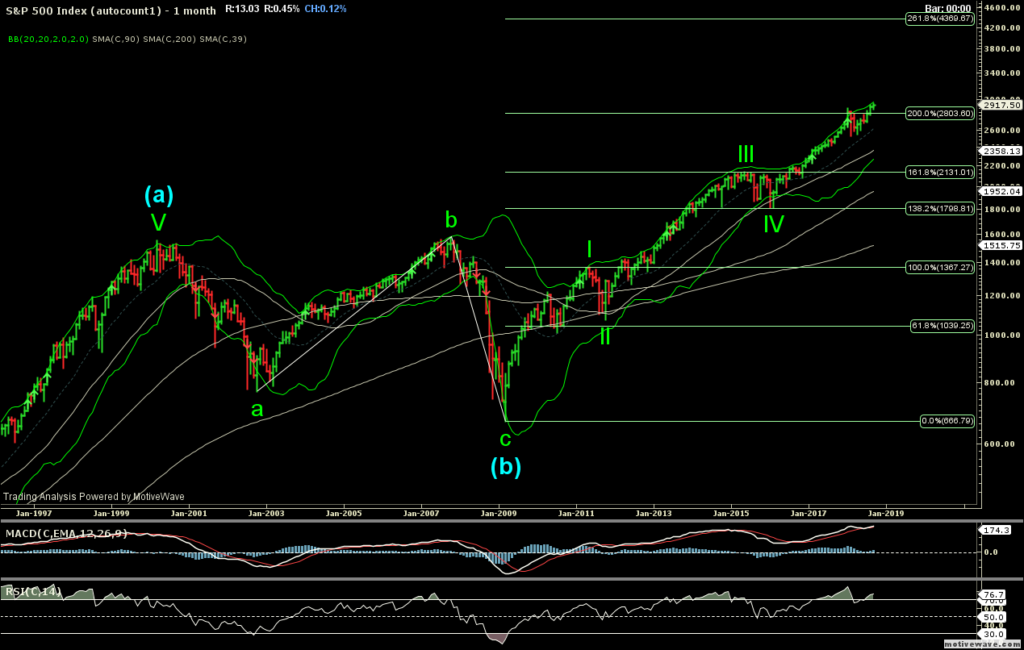

There is not much to report at the index level. The technical aspects of the market continue to show a still intact upwards trend, but one that is past its prime. The broad market has repeatedly gone through correction phases since the 2008/09 crisis, including a relatively small one in spring this year.

S&P 500 index having traded up, going forward a correction could happen at any time (market depth/thin air up here)

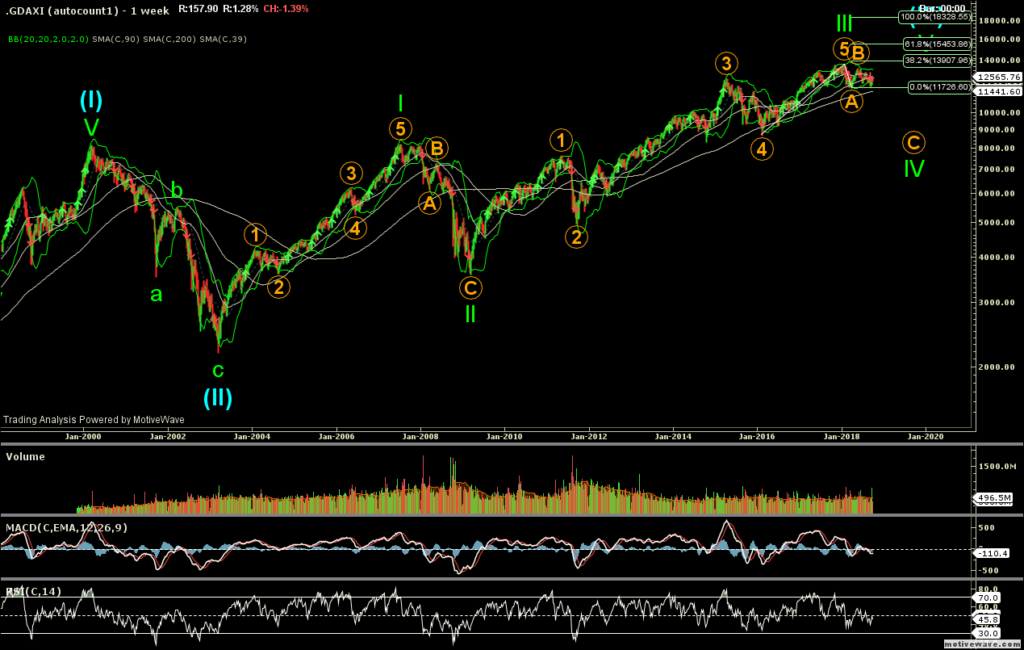

It should be noted that the regions experienced correction phases with different levels of intensity this year. The German share index still seems not to be quite out of the consolidation phase yet, whereas its American counterpart is already in the lift up to the next level.

DAX, still in correction mode – two scenarios: a head-shoulder break out towards lower levels or triangle correction which is in its final stage.

Individual sectors and stocks have in some cases seen significant corrections or are still in correction mode. From a technical point of view, there is room for an upwards move, including with the support of those stocks that will soon come out of the consolidation phase.

With the first quarter correction in the DAX it seemed the market is back to normal and is hiking up again. We have had our doubts and left it open for a second downward movement to happen yet. In fact, on June 21 the change point came with the new (interim) low of about 12,540. The next important zone of support is between just over 12,000 and 12,290, of which the most important one would be just over 11,700. It remains to be seen when the correction phase will reach its end. Chances are that with the end of June the market has found bottom.

Outlook

Fundamentally, with the current shape the markets are in, it is both possible that the upwards trend will continue or that we will soon drift into a bear market. In the first instance, we favour option 1. The US (S&P 500) already completed its correction in spring and has since reached a new all-time high. The German share index, by contrast, is probably still in a correction phase, which is likely to be over soon (also reports lower valuations than the US). The currencies are likely to tip the balance again (or show the flows) and herald the next movement in equity markets. Seen globally, however, we are coming close to the possible end. The question is whether this will be as early as 2019 or not until a couple of years later. The Federal Reserve already announced last Wednesday that it would react to turbulence in the market or a looming recession, i.e. by cutting interest rates. The risk premiums are likely to further increase overall, because rising interest rates mean more and more borrowers will begin to stumble and because it is increasingly difficult for companies to keep their profit figures going after years of cost cutting and share buybacks.

In line with tradition, we hope for a year-end rally (where people could also realise a bit of profit again). Until then, things could still happen, but we want to remain confident.

Your EDURAN AG

Leave a Reply